Big money is moving. While retail traders watch Bitcoin, crypto whales quietly accumulated three specific altcoins throughout January 2026.

On-chain data reveals the purchases. Large wallet holders added millions of tokens across ASTER, CHZ, and AXS. Plus, these aren’t random buys. Each token shows distinct accumulation patterns that suggest whales expect significant upside in February.

Let’s examine what the smart money is betting on.

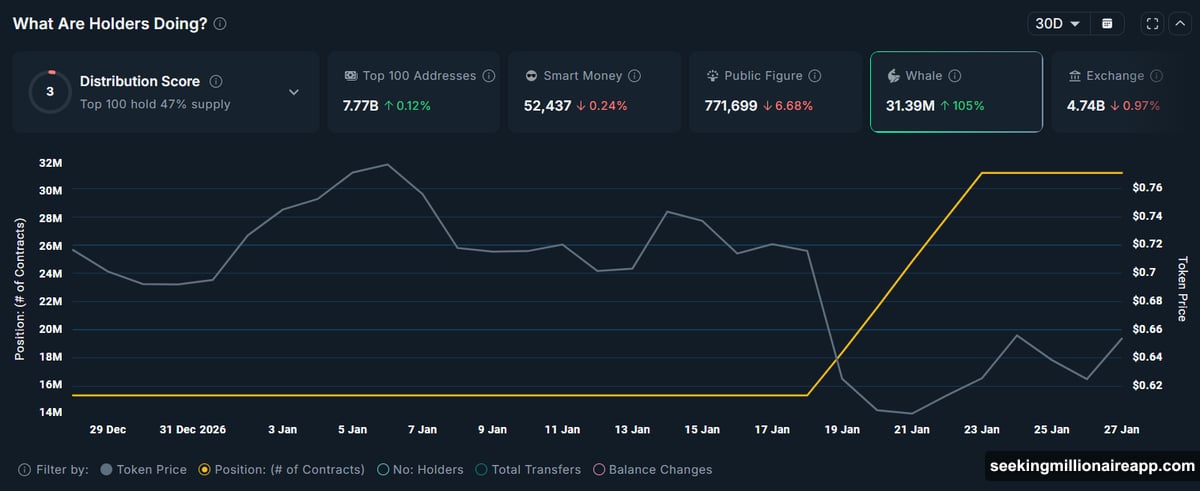

ASTER Whales Bought 15 Million Tokens During the Dip

Large holders love buying what others fear. ASTER proved that perfectly.

Addresses holding over $1 million in ASTER accumulated roughly 15 million tokens last month. That happened while price dropped steadily since mid-November 2025. Most traders sold. Whales bought.

Now ASTER trades near $0.65. The downtrend reflects weak sentiment across the broader market. But whale behavior tells a different story. Large holders rarely accumulate aggressively unless they see value others miss.

The technical setup supports a rebound. If whale buying continues, ASTER could target $0.71 near term. A broader market recovery might push it toward $1.00. That’s a 54% gain from current levels.

However, risks remain real. Whales sometimes misjudge timing. If they stop buying or reverse course, ASTER could slide toward $0.57 or lower. Watch wallet activity closely. The moment whales shift to selling, the bullish thesis breaks.

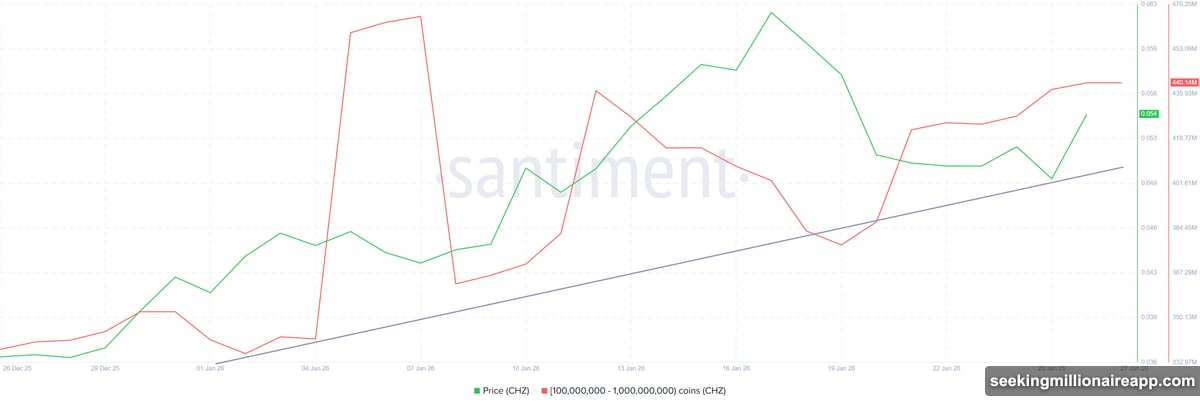

CHZ Rally Followed $5 Million Whale Accumulation

Whales don’t just buy dips. Sometimes they push assets higher while accumulating.

CHZ shows exactly that pattern. Addresses holding 100 million to 1 billion tokens added over 100 million CHZ last month. That’s roughly $5 million in fresh whale capital. Meanwhile, price rallied 30% and now sits near $0.054.

The correlation matters. Strong whale support often sustains uptrends longer than technical indicators suggest. If accumulation persists, CHZ could reach $0.066 medium term. An extension toward $0.080 becomes possible if broader markets cooperate.

But momentum cuts both ways. Whales bought low. Now they’re sitting on solid gains. Profit-taking could start anytime. If large holders sell, expect quick downside pressure toward $0.045 or $0.041 support levels.

The key signal? Watch for continued inflows to whale wallets. As long as they keep buying, the rally has legs.

AXS Exploded 213% as Whales Added $15 Million

Some whale plays work immediately. AXS delivered exactly that.

The token surged roughly 213% since early January 2026. That moved price from under $1 to around $2.55. The rally caught most traders off guard. Whales saw it coming.

Large addresses holding 100,000 to 1 million AXS accumulated over 6 million tokens last month. That represents $15 million in whale buying. The timing aligned perfectly with the price explosion.

Now AXS leads altcoin performance charts. Continued whale support could push price toward $3.00 short term. A move to $4.00 becomes realistic if the gaming sector strengthens alongside broader crypto recovery.

Yet risk escalated alongside returns. Whales who bought under $1 now face tempting profits. A shift toward selling would reverse momentum fast. Break below $2.00 support could trigger cascading sells toward $1.30 or lower.

The question facing AXS holders is simple. Will whales hold for bigger gains? Or lock profits after a 200%+ move? February will answer that.

Why These Three Tokens Matter

Whale accumulation signals conviction. Large holders deploy millions based on research retail traders rarely conduct.

ASTER whales bought through a downtrend. That takes confidence in fundamentals over short-term price action. CHZ whales supported a rally with steady buying. That suggests they expect continuation. AXS whales captured massive gains but kept accumulating. That implies they see more upside ahead.

Still, whale activity isn’t infallible. Large holders sometimes exit positions as quickly as they entered. The tokens that whales are buying today could become the ones they dump tomorrow if market conditions shift.

Monitor wallet flows closely. Sustained accumulation supports bullish scenarios. Distribution patterns signal time to exit. The data tells the story before price confirms it.

Smart money moved first. Now retail has a choice. Follow the whales or wait for confirmation? February will reveal who chose correctly.