Big money’s getting nervous. Hundreds of millions in Bitcoin, Ethereum, and altcoins just moved to exchanges as the crypto market shed weekend gains.

The market cap slid to $3.59 trillion in early Asian trading Monday. Meanwhile, whale wallets shuffled massive positions. Some took profits. Others doubled down on risky bets. The mixed signals suggest uncertainty among crypto’s biggest players.

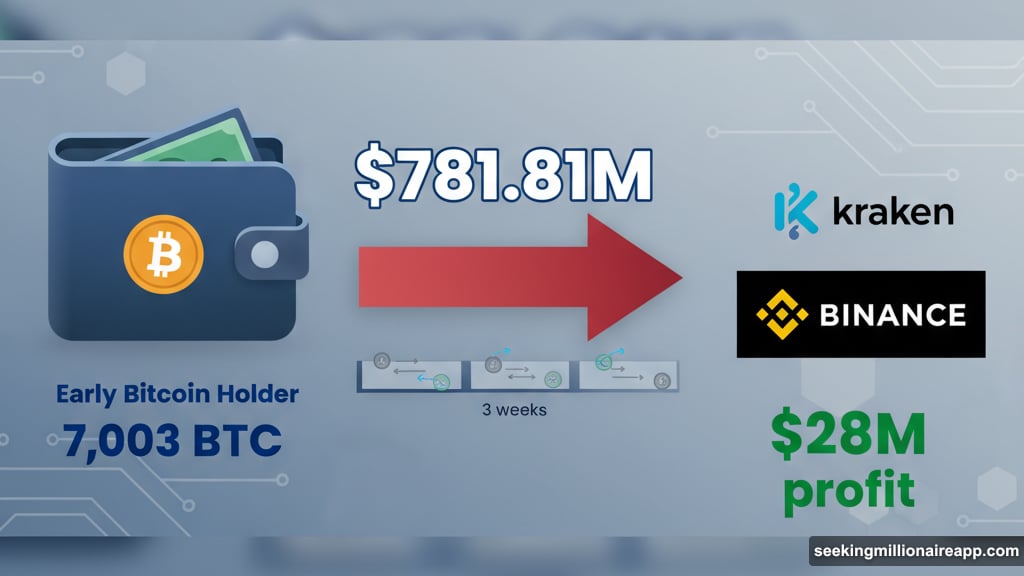

Bitcoin OG Cashes Out $780 Million

One early Bitcoin holder moved hard. Over three weeks, they deposited 7,003 BTC worth $781.81 million to exchanges.

The latest transfer? 500 BTC, valued at $55.28 million, hit Kraken on Monday. That’s serious profit-taking from someone who likely bought Bitcoin years ago at much lower prices.

Plus, another whale deposited 351 BTC into Binance. They originally withdrew 361 BTC three to four years ago when it cost $11.63 million. Now they cashed out for $39.6 million. That’s roughly $28 million in profit.

These moves signal confidence is shaky. When OG holders exit positions this large, it often means they see rough waters ahead.

Ethereum Whales Play Both Sides

Ethereum saw wild swings in whale behavior. One trader withdrew 20,021 ETH from Binance, worth about $78.15 million.

But here’s the twist. This same whale borrowed $262 million in ETH using $700 million USDC as collateral. Why? To short Ethereum at $4,032 two weeks ago.

Analyst EmberCN notes the short position likely earned them $12 million. ETH now trades at $3,850, so the bet paid off. Yet pulling funds suggests they’re closing positions or preparing for volatility.

Meanwhile, another whale reduced leverage by selling 2,500 ETH for $9.67 million. They bought at $4,197 and took an $820,000 loss on the sale. Still, they hold 13,504.56 ETH as collateral on Aave. That’s playing defense while staying exposed.

Altcoin Bets Get Aggressive

Beyond major coins, whales made notable moves in smaller assets. Binance founder Changpeng Zhao personally bought $2 million in ASTER tokens on November 2.

That announcement sparked whale activity. One holder pulled 5.8 million ASTER worth $5.58 million from Binance. Over six days, they withdrew 6.8 million ASTER totaling $6.66 million.

But not everyone’s bullish on ASTER. Two whales, identified as 0xbadb and 0x9eec, opened massive short positions. The shorts currently sit in profit. One’s up $5.9 million, the other $1.4 million.

GHOST tokens also attracted attention. Three wallets bought 2.26 million GHOST over the weekend. A Solana whale inactive for 10 months grabbed 1.12 million GHOST. That’s serious conviction after sitting out for nearly a year.

Leveraged Longs Push All-In

Some whales are betting big despite market weakness. Trader 0xc2a3 maintains a perfect win rate and keeps adding to long positions.

Current holdings? 39,000 ETH worth $151 million, 1,070 BTC valued at $118 million, and 569,050 SOL totaling $105 million. They also placed limit orders for 40,000 SOL at $184, worth another $7.36 million.

That’s extreme bullishness. Trader 0x8d0E went even harder. They transferred 10 million USDC to Hyperliquid and opened a 20x leveraged long on 140,366 SOL. Position size? Roughly $26.14 million.

Then there’s gambler 0x9e4f. They opened a 25x short on 7,368.8 ETH worth $28.2 million at an entry price of $3,900.81. Liquidation price sits at $3,953.3. One wrong move and they’re wiped out.

What These Moves Actually Mean

Whale activity reveals split sentiment. Long-term holders are taking profits after years of gains. That’s rational but signals lack of confidence in near-term upside.

Simultaneously, leveraged traders are making all-or-nothing bets. High leverage in both directions means someone’s getting liquidated soon. The question is who.

Mixed strategies like this typically appear during market transitions. Either we’re setting up for another leg up, or whales are positioning for a deeper correction. The defensive plays suggest many expect volatility ahead.

Crypto markets feed on momentum. When big players start hedging or closing positions, retail often follows. So these whale moves could accelerate the current pullback or set the stage for a bounce if shorts get squeezed.

Watch how Bitcoin holds $110,000 and Ethereum handles $3,800. Those levels matter. Break below and whales might dump more. Hold and we could see those leveraged longs pay off.