The market just wiped out $1.38 billion in long positions. Most traders got crushed. But a handful of crypto whales are doing something unexpected.

They’re opening massive long positions right into the crash. These aren’t amateur moves. We’re talking about traders with proven track records and millions in profits making bold contrarian bets.

So what do they know that everyone else doesn’t?

The Carnage Hit Everyone

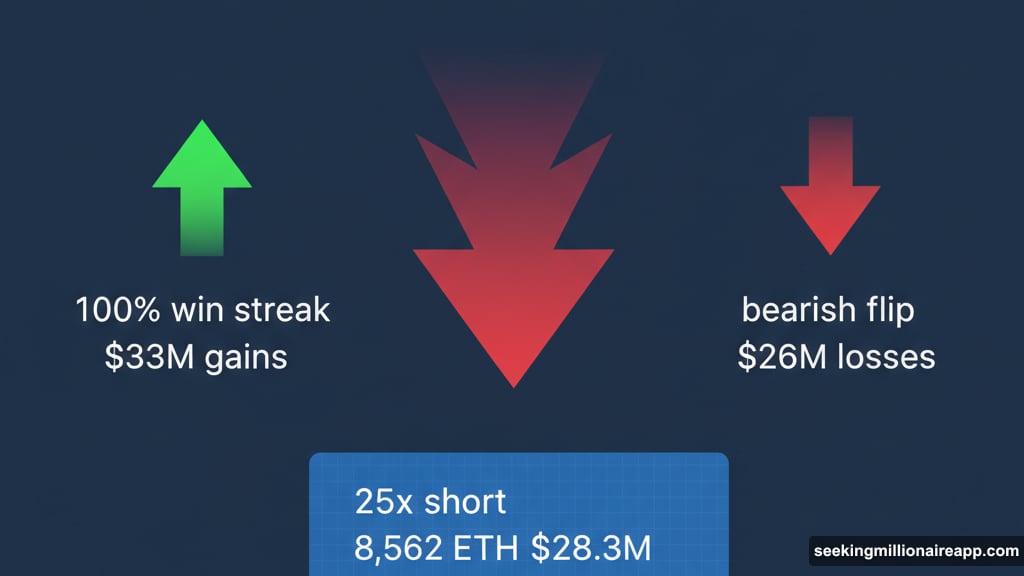

Even the pros took losses this time around. Trader 0xc2a3 had a perfect 100% win streak. Then the market turned.

He closed all Bitcoin longs and dumped portions of Ethereum and Solana at steep losses. His portfolio swung from $33 million in gains to $26 million in losses. That’s a $59 million reversal in value.

But here’s where it gets interesting. After losing $44.67 million on longs, 0xc2a3 flipped completely bearish. He opened a 25x short position on 8,562 ETH worth $28.3 million, according to Lookonchain data.

Meanwhile, another prominent trader called “Machi Big Brother” got fully liquidated. His account balance crashed to just $1,718.

These weren’t small retail traders making rookie mistakes. These were experienced operators who still got caught in the downdraft.

Three Whales Made Contrarian Moves

While most traders licked their wounds, three major players did the opposite. They went long.

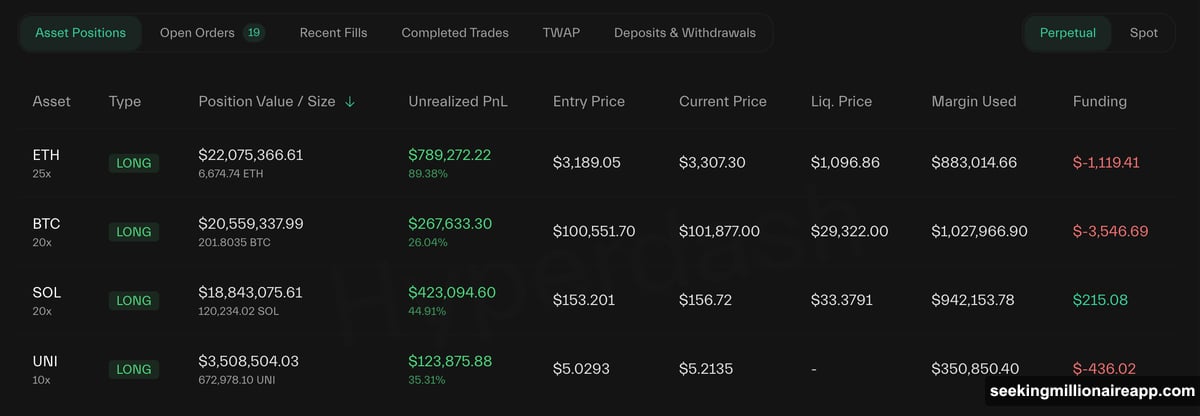

First up is trader “0x9263.” This whale closed 20 profitable trades since October and generated $23.7 million in profit. Then he closed all shorts and opened long positions in Bitcoin, Ethereum, Solana, and Uniswap.

His current unrealized profit sits around $1.6 million. Plus, his win rate stands at 73.73%. That’s not beginner’s luck. That’s someone who reads market conditions well.

Next comes the “Anti-CZ Whale.” Yesterday, this trader’s unrealized short profits hit $36 million. He was crushing it shorting ASTER, DOGE, ETH, XRP, and PEPE. Earlier in October, he made $18.5 million from shorts alone.

But now? Complete reversal. He switched from shorting Ethereum to opening a $109 million long position. His current positions include 130,566 DOGE ($21,000) long, 32,802 ETH ($109 million) long, and several remaining shorts in ASTER and PEPE.

Finally, there’s “Bitcoin OG.” He just deposited another $20 million USDC to expand Bitcoin and Ethereum longs. However, both positions currently show a combined unrealized loss exceeding $3.5 million.

So these whales are putting real money where their conviction lies. And they’re not all winning yet.

What Could They Be Seeing?

These traders don’t make random bets. Their track records prove they understand market dynamics better than most. So why go long now?

Several factors might be driving these contrarian plays. Market sentiment reached extreme fear levels. When everyone expects further downside, sometimes that’s when the bounce happens.

Moreover, these whales likely spotted technical support levels or on-chain indicators suggesting oversold conditions. They trade with sophisticated analytics most retail traders can’t access.

Plus, they have the capital to weather short-term volatility. If they’re wrong initially, they can hold positions or average down. Most leveraged traders who got liquidated didn’t have that luxury.

But there’s another angle. These whales might be betting on renewed volatility rather than immediate recovery. Extreme market conditions create trading opportunities in both directions. If volatility spikes, their positions could profit even without sustained uptrend.

The Leverage Trap Versus Strategic Positioning

The gap between liquidated traders and repositioning whales reveals something crucial about crypto markets. Leverage magnifies both gains and losses.

Those $1.38 billion in liquidations came primarily from overleveraged positions. When the market moved against them, forced selling accelerated the decline. That created a cascade effect where one liquidation triggered the next.

Whales opening new longs likely use lower leverage or no leverage at all. They can afford to ride out temporary drawdowns. That gives them a massive advantage when timing entries during panic selling.

Furthermore, these contrarian moves might influence other large traders. When respected whales flip bullish, it can shift sentiment among their peers. We might be seeing the early stages of that shift now.

However, timing matters enormously. If these whales entered too early, they could face additional drawdowns before any recovery materializes. The “Bitcoin OG” trader’s $3.5 million unrealized loss shows that risk clearly.

Two Scenarios Play Out From Here

Either these whales timed a generational bottom, or they’re betting on volatility and prepared to manage positions actively.

In the first scenario, the market found support and begins recovering. Early long positions from here would generate substantial profits. The whales who flipped bullish become heroes who bought the dip while others panicked.

In the second scenario, the market continues grinding lower or stays range-bound. Those whales manage positions dynamically, possibly adding to longs at lower levels or exiting partially if needed. Their edge comes from superior risk management, not perfect timing.

What’s clear is that these aren’t emotional decisions. These traders have systems, analytics, and conviction behind their moves. They’re not hoping for recovery. They’re calculating probabilities and positioning accordingly.

The extreme gap between mass liquidations and whale repositioning showcases why most retail traders lose in crypto derivatives. They lack the capital reserves, analytics tools, and emotional discipline to survive high-leverage environments.

These whales aren’t smarter necessarily. But they have resources and experience that create fundamentally different outcomes. When retail traders get liquidated, whales see buying opportunities. When fear peaks, they position for the next cycle.

Whether they’re right this time remains to be seen. But their willingness to go against the crowd while others capitulate says something about market structure and professional versus amateur approaches to crypto trading.