Year-end usually sees big wallets cash out and sit tight. Lower liquidity, profit-taking pressure, and holiday downtime make December the month when smart money steps aside.

But not this December. Three altcoins are seeing the opposite pattern. Whales are buying while everyone else sells.

Chainlink Whales Added $8.5 Million in 30 Days

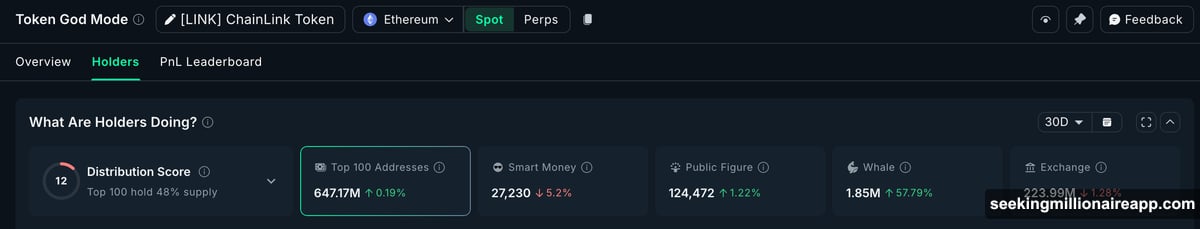

Chainlink caught serious whale attention over the past month. Big wallets increased their LINK holdings by 57.79%. That equals roughly 680,000 LINK tokens worth about $8.5 million at current prices.

Meanwhile, LINK dropped 7.5% during that same period. Smart money wallets actually reduced exposure by 5.2%. So whales are buying into weakness while smaller traders exit.

One whale alone pulled 366,364 LINK from Binance recently. That wallet now holds 695,783 LINK worth $8.52 million. These aren’t random buys. They’re calculated positions built during a correction.

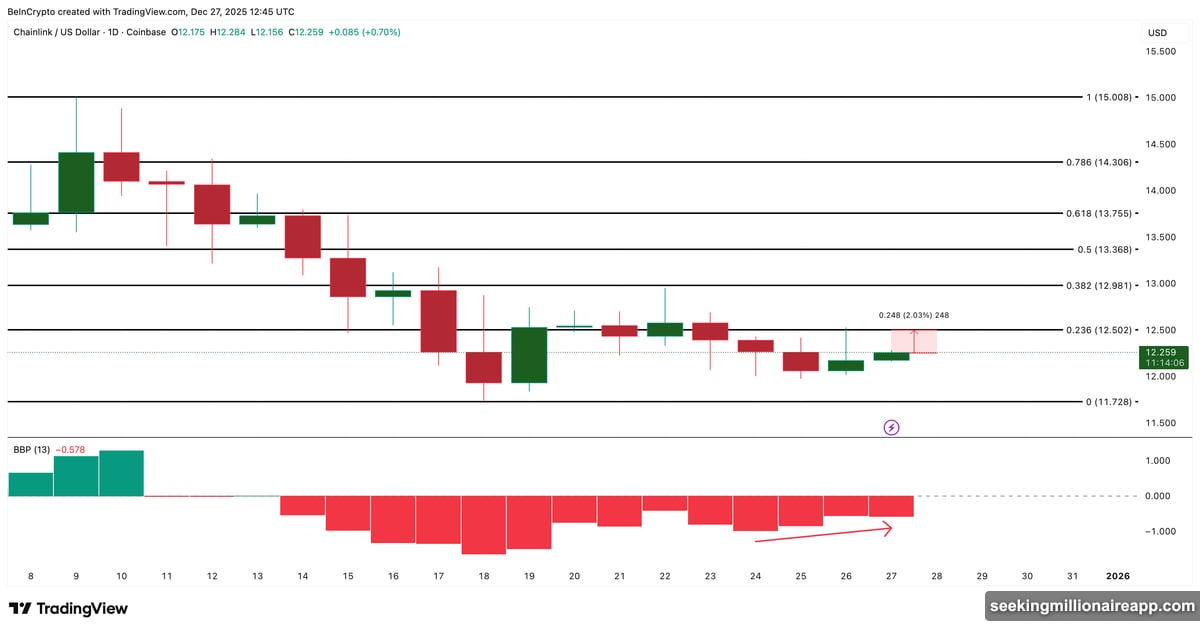

The Bull Bear Power indicator shows red bars shrinking since December 24. That means bearish pressure is fading. Plus, LINK is testing a critical short-term level near $12.50.

A daily close above $12.50 changes the setup. Above that, LINK faces barriers at $12.98, then $13.75. Breaking past $15.00 would confirm the return to bullish territory.

But here’s the catch. Smart money leaving while whales accumulate suggests this won’t pop immediately. Instead, whales appear to be positioning for a move in early 2026 rather than a quick bounce.

Until LINK reclaims $12.50 with conviction, expect range-bound trading. And if it drops below $11.72, the whale thesis breaks down entirely.

Lido Whales Bought $2.28 Million in One Week

Lido DAO saw aggressive whale buying over the past seven days. Whale balances jumped 30.34%. That means they added about 4.07 million LDO worth roughly $2.28 million.

This happened while LDO gained 4.2% during the same week. So whales aren’t bottom-fishing here. They’re buying into strength.

Arthur Hayes made one of the most notable moves. He accumulated 1.85 million LDO worth around $1.03 million directly from Binance. Public figure wallets followed similar patterns.

However, smart money shows a different picture. Their balances dropped 7.75% over the same period. Exchange balances also fell 1.49%. That suggests retail might be withdrawing tokens rather than actively selling, but it also means the big boys aren’t all aligned yet.

LDO currently trades in a clear range between $0.59 and $0.49. The On-Balance Volume indicator broke its downtrend on December 23, right when whale inflows picked up. That timing matters.

For the bullish case to work, LDO needs a daily close above $0.59. That level broke on December 14 but hasn’t been reclaimed since. Above it, the next targets sit at $0.76 and then $0.92.

The disconnect between whale buying and smart money selling means this setup might take time to play out. Early 2026 looks more likely than an immediate breakout. And if LDO loses $0.49, the current thesis fails completely.

Aster Whales Added $320,000 in 24 Hours

Aster represents the shortest accumulation window on this list. But the signal still stands out.

Over the past 24 hours, whales added 2.37% to their existing holdings. That equals roughly 455,000 ASTER tokens worth a bit over $320,000 at current prices near $0.71.

The addition isn’t massive in dollar terms. But ASTER dropped more than 30% over the past month. So whales stepping in now suggests they see value where others saw panic.

Price action backs this up. ASTER fell sharply from about $1.40 on November 19 and found support near $0.65. That floor has held through December despite heavy selling pressure.

The Wyckoff Volume indicator shows red and yellow bars fading since December 15. Those bars represent seller dominance. When they shrink, it means sellers are losing control.

If whales are right, the recovery starts with a push toward $0.83. That requires about a 16% move from current levels. Breaking above $0.83 opens the door to $1.03, and then potentially $1.24 if market conditions improve.

But $0.65 remains the critical support. A clean break below that level invalidates the entire setup and puts ASTER at risk of new local lows heading into year-end volatility.

What This Pattern Means

Three different accumulation windows. Three different price structures. But one common theme: big wallets are positioning while retail exits.

Chainlink sees 30-day accumulation into weakness. Lido gets 7-day whale support into strength. Aster just caught 24-hour interest after a brutal month-long drop.

None of these setups scream immediate breakout. Smart money remains cautious across all three. Exchange flows show mixed signals. Volume patterns suggest more consolidation ahead.

But that’s exactly when whales build positions. Not when everyone’s excited. When sentiment is cold and liquidity is thin.

The play here isn’t to ape in blindly. It’s to watch these levels closely as we move into January 2026. If these whales are right, early positioning beats chasing pumps later.