November started with a bang. While most traders slept, crypto whales quietly added millions to their positions across three specific tokens.

These aren’t random picks. The whale activity shows clear patterns: privacy tech, decentralized trading, and meme coin infrastructure. Plus, the timing matters. Early-month accumulation often signals where smart money expects gains before year-end.

Let’s break down what whales are buying and why their bets might pay off.

Railgun Whales Added $220K in 24 Hours

Privacy tokens rarely get this kind of attention. But Railgun (RAIL) just saw whale wallets explode by 30% overnight.

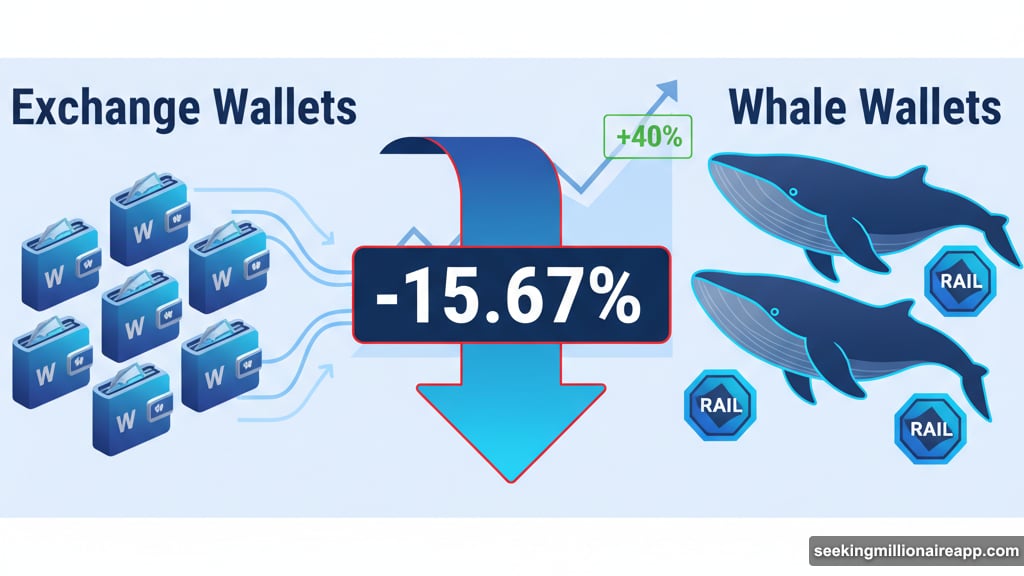

The numbers tell the story. Whales went from holding 185,000 RAIL to 242,500 RAIL in a single day. That’s 56,000 tokens worth roughly $220,000 at current prices. Meanwhile, the price itself jumped over 40% during the same period.

Here’s what makes this interesting. Exchange reserves dropped 15.67% at the same time. So tokens are leaving exchanges, not entering them. That means whales are buying to hold, not to flip.

Smart money wallets — addresses known for consistently profitable trades — also increased their RAIL stacks by 8.17%. When both whales and proven traders move together, markets tend to follow.

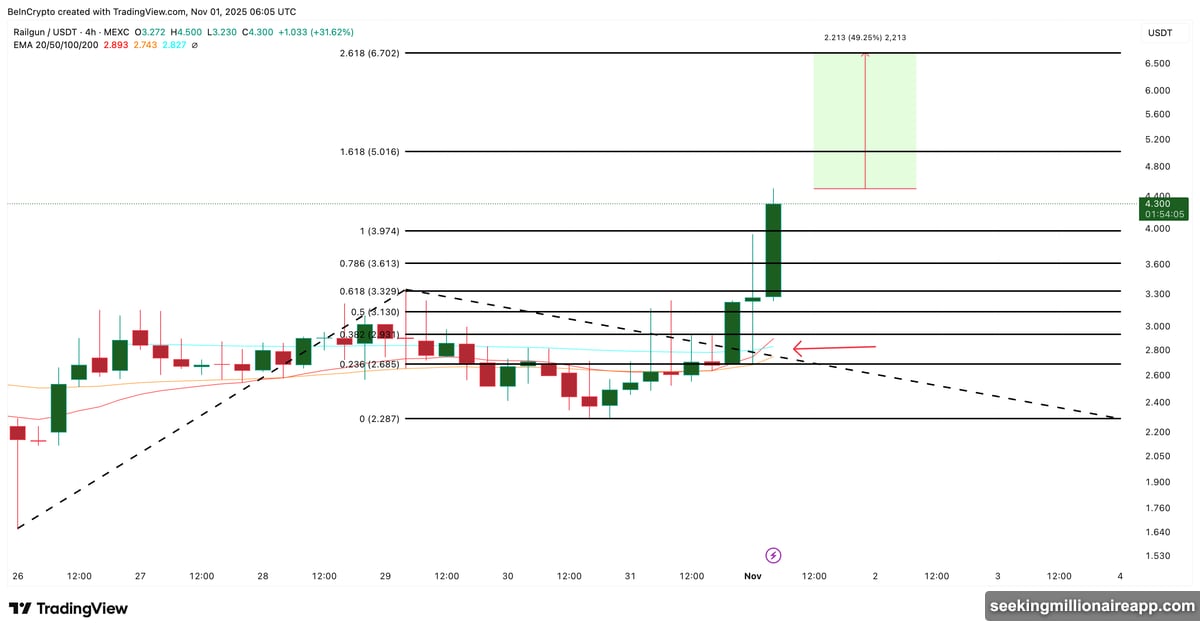

The technical setup supports the whale thesis. On the 4-hour chart, the 20-period moving average just crossed above the 50-period average. That’s a bullish signal showing short-term momentum shifting upward.

If the 50-period average crosses above the 100-period next, RAIL could target $5.01, then $6.79. However, support sits at $3.97 and $3.32. Those levels would likely hold during any pullback.

Below $2.28, this entire setup falls apart. For now, whales seem convinced Railgun has room to run.

Aster Whales Grabbed $2.3M Worth Before Breakout

Decentralized exchanges don’t usually see whale accumulation this aggressive. Yet Aster (ASTER) just registered a 12% jump in whale holdings overnight.

Aster runs on BNB Chain and offers both spot and perpetual trading across multiple blockchains. After weeks of quiet activity, whales suddenly added 2.33 million tokens worth about $2.3 million.

Even the top 100 addresses — the biggest whales — saw modest increases. That confirms accumulation isn’t just happening at one level. Both large and mid-sized wallets are positioning.

The price action makes this accumulation even more telling. ASTER is trading inside a pennant pattern on the 4-hour chart. These tight consolidation zones often appear right before strong directional moves.

A close above $1.06 would confirm a breakout. From there, the next targets sit at $1.09 and $1.22 if momentum builds. But a drop below $0.94 would invalidate the setup and open the door to $0.85.

Whales appear to be betting on the upside. They’re accumulating near the breakout zone rather than waiting for confirmation. That front-running behavior often precedes sharp rallies.

ASTER is up 7% in 24 hours despite being down 10% for the week. So whales might be catching the bottom of a reversal rather than chasing strength.

Pump.fun Whales Added $8M Over Seven Days

While Railgun and Aster saw 24-hour whale activity, Pump.fun (PUMP) has been accumulating for a full week straight.

Pump.fun is a Solana-based platform that lets users create and launch meme coins easily. It’s become a hub for small-cap traders chasing quick rotations and social buzz.

Over the past seven days, whale balances rose 11.84%, lifting their total stash to 17.13 billion PUMP. That’s an addition of 1.81 billion tokens worth close to $8.1 million. Plus, exchange balances dropped during the same period, showing tokens are being moved to cold storage.

PUMP is up 10% over the week and nearly 5% in the last 24 hours. So whales have been buying into strength, not panic selling or catching a falling knife.

The 12-hour chart shows a flag-and-pole pattern forming. This setup typically signals a pause before the next leg of a rally continues in the same direction.

The token has tested both the upper and lower flag trendlines multiple times. That’s normal for a volatile new asset consolidating after a strong move.

A break above $0.0049 would confirm the breakout. Short-term targets sit at $0.0053 and $0.0061. Based on the pole’s height, a full breakout could push PUMP toward $0.0078, marking a 60% potential gain.

If momentum stays strong, even the previous all-time high of $0.0088 could come back into play. A move beyond $0.0095 would mark a new record.

Whales appear to be front-running the breakout. They’re adding exposure now while the market waits for technical confirmation. That’s a classic smart-money strategy.

Below $0.0041, this bullish setup loses validity. Until then, the whale bets look solid.

The Pattern Whale Bets Reveal

Three different sectors. Three different timeframes. Yet the whale behavior looks remarkably similar.

First, accumulation is happening near technical breakout zones. Whales aren’t chasing extended rallies. They’re positioning before the next leg up confirms.

Second, exchange outflows are validating the buys. Tokens are leaving exchanges across all three projects. That means whales are buying to hold, not to flip for quick profits.

Third, smart money is moving alongside whales. When proven traders and large holders both increase positions, the odds of continuation improve significantly.

These aren’t random whale games. The accumulation patterns suggest conviction plays rather than speculative rotations. Privacy tech, decentralized trading infrastructure, and meme coin platforms — whales are spreading bets across crypto’s most active sectors.

Whether these bets pay off depends on broader market conditions and Bitcoin’s direction. But the whale positioning at the start of November gives a clear roadmap of where big money expects strength.

For retail traders, the lesson is simple. Watch what whales do, not what they say. The on-chain data doesn’t lie.