Big wallets are moving. While most traders panic-sold through October’s downturn, crypto whales quietly accumulated three specific altcoins just before Halloween.

The timing matters. Historically, Halloween marks a turning point for crypto rallies. Plus, these whale purchases happened during sharp dips, which typically signals confidence rather than speculation.

Let’s break down what the smart money bought and why.

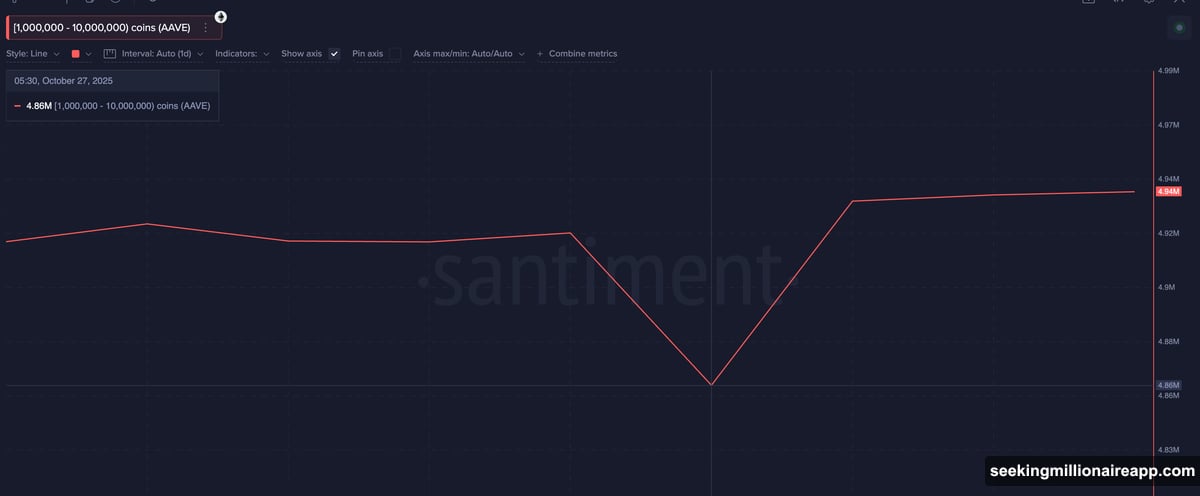

AAVE Whales Added $17 Million During the Dip

Aave caught serious whale attention starting October 27. Large holders controlling between 1 million and 10 million tokens increased their positions from 4.86 million to 4.94 million AAVE. That’s roughly 80,000 tokens worth about $17 million at current prices.

The accumulation came as AAVE dropped 6.3% in 24 hours. Moreover, the token extended its three-month downtrend to 17.7%. So why buy during weakness?

History suggests a pattern. Since 2020, AAVE has consistently bounced after Halloween, averaging 11.8% gains in the week following October 31. Therefore, whales appear to be positioning for another seasonal rally.

The technical setup supports this view. Between October 13 and 26, AAVE’s price made a lower high while the Relative Strength Index made a higher high. That’s called hidden bearish divergence, which typically signals trend continuation.

But here’s the twist. After that divergence played out and triggered the latest correction, whales started buying near support zones. Now the RSI moves in sync with price again, suggesting the selloff may be exhausting itself.

If $210 support holds, AAVE could rebound toward $230 and $248. However, breaking below $210 would likely push prices to $199. Losing that level would invalidate the bounce scenario entirely.

Maple Finance Stayed Green While Others Bled

Maple Finance (SYRUP) stands out as one of the few tokens that didn’t crater this week. The token trades around $0.41, up roughly 1% in 24 hours and nearly 10% over the past month.

That steady climb isn’t random. Whales holding between 1 million and 10 million SYRUP tokens grew their stash from 246.95 million to 254.62 million since October 28. They added approximately 7.67 million tokens worth about $3.14 million.

The Smart Money Index backs this bullish positioning. This metric tracks experienced traders who buy dips aggressively. It’s been making higher highs since October 23, signaling that sophisticated investors see opportunity here.

As long as the Smart Money Index stays above 1.29, the bullish bias remains intact. In terms of price action, SYRUP faces resistance at $0.43, which has rejected past breakout attempts.

Clearing $0.43 could spark a rally to $0.46. Holding above that level would strengthen the case for a broader uptrend. But if $0.39 fails, the next major support sits near $0.33.

Breaking below $0.33 would invalidate the accumulation setup. That would suggest whales need more time to build positions before any meaningful rebound forms.

Dogecoin Mega Whales Bet $255 Million on Recovery

Dogecoin (DOGE) attracted the biggest whale activity by dollar value. Mega holders controlling between 100 million and 1 billion DOGE increased their positions from 27.68 billion to 29.1 billion tokens since October 28.

That’s 1.42 billion DOGE added, valued at approximately $255.6 million. These aren’t small speculators. These are institutional-sized wallets making massive bets on near-term recovery.

Currently, DOGE trades around $0.18, down 21% over the past month as part of an ongoing downtrend. Yet whales continue buying despite the weakness. That shows conviction.

The 12-hour chart reveals hidden bullish divergence. Between October 17 and October 30, DOGE’s price made a higher low while the RSI made a lower low. This pattern typically precedes short-term rebounds.

DOGE now trades within a tight range between $0.17 and $0.20, which has held since October 11. If $0.17 support maintains, the setup suggests a possible move to $0.20. That represents 14.6% upside from current levels.

Breaking cleanly above $0.20 could then open the path to $0.27. However, losing $0.17 would likely push prices to $0.14. Dropping below that level would invalidate the bullish case and extend the consolidation phase.

Why Halloween Timing Matters

These accumulation patterns aren’t coincidental. Crypto has shown seasonal tendencies, with late October often marking local bottoms before November rallies.

Whales understand this dynamic. So they position ahead of potential volatility spikes. Plus, buying during fear periods when retail sells allows them to accumulate at favorable prices.

Three factors make this Halloween different. First, the overall market dropped 3.7% recently, creating panic-driven dips. Second, these specific tokens showed technical setups suggesting oversold conditions. Third, smart money indicators turned bullish across all three assets.

That convergence of fear, technical support, and whale accumulation creates favorable conditions for rebounds. But timing remains uncertain. Markets could consolidate longer before any significant moves materialize.

Watch these key levels closely. AAVE needs $210 to hold. SYRUP must clear $0.43. DOGE requires $0.17 support. If those levels fail, whales may extend their accumulation phase before attempting any breakout.

The message is clear though. While retail panics, big money positions for recovery. Whether that recovery happens immediately after Halloween or takes weeks to develop, whales are placing their bets now.