The market just pumped on steady inflation data. But crypto whales aren’t celebrating yet.

Instead, they’re making calculated moves on three tokens. No euphoria. No FOMO. Just strategic positioning at technical levels that historically matter. Here’s what the smart money is buying and why these levels could determine the next leg up.

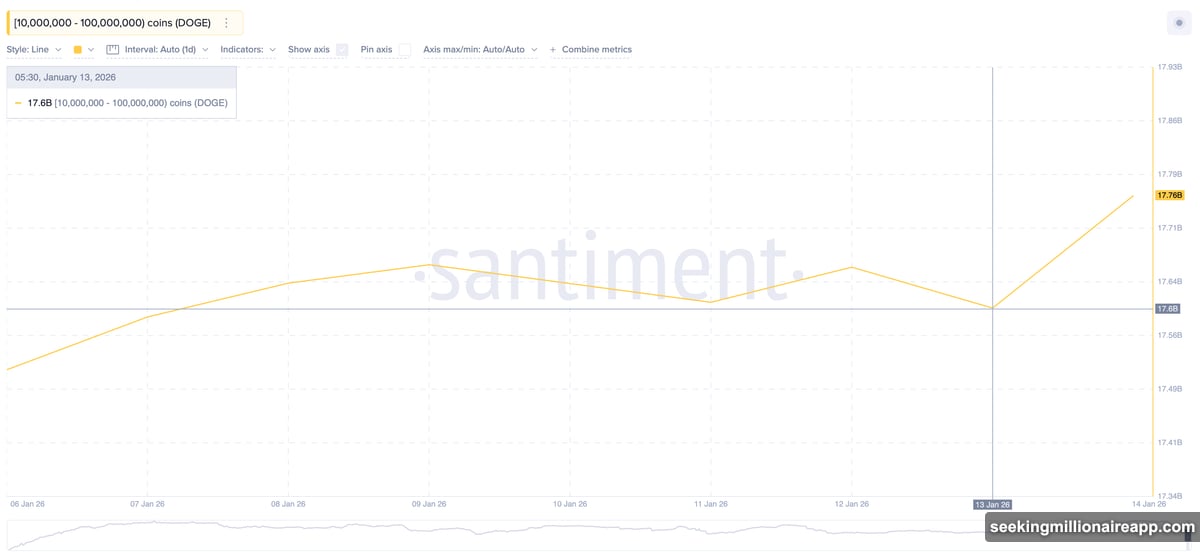

Dogecoin Whales Add $23.5 Million as Key Crossover Looms

DOGE just flipped a technical switch that crypto whales clearly noticed. The price reclaimed both the 20-day and 50-day exponential moving averages in the same move. That’s not random noise.

Large holders responded by adding 160 million DOGE in 24 hours. That’s roughly $23.5 million flowing into wallets holding 10 million to 100 million tokens. Their holdings jumped from 17.60 billion to 17.76 billion DOGE.

Here’s why this matters. The last time DOGE reclaimed these EMAs in this exact sequence was early July. That setup triggered a 73% rally. Now the 20-day EMA is closing in on the 50-day EMA again, potentially forming another bullish crossover.

The first test sits at $0.154, just 4.6% above current prices. Clear that level and DOGE faces the 100-day and 200-day EMAs as resistance. Beyond those, $0.209 comes into play. But lose the 20-day and 50-day EMAs and the bullish case weakens fast. Below that, $0.115 becomes the downside target.

Whales are betting on the breakout. Their timing suggests they’re not guessing.

Chainlink Whales Return With $3.1 Million After Constructive Pullback

LINK just formed something technical traders love to see. After a momentum warning earlier this month, the price pulled back and carved out a textbook cup-and-handle pattern.

Between December 9 and January 6, LINK’s price made a lower high while the Relative Strength Index made a higher high. That divergence signaled weakening momentum and drove the correction. But that pullback now looks deliberate rather than bearish.

Crypto whales are stepping back in. Over the past day, large holders added 220,000 LINK to their positions. Holdings increased from 503.20 million to 503.42 million tokens. At current prices, that’s $3.1 million in fresh accumulation.

The pattern projects to $17.62 if LINK can close above $14.10 and then push through $15.04. That’s roughly 25% upside from here. Plus, the handle portion of the cup-and-handle structure is pressing against the neckline now.

This explains why whales are buying despite recent gains. They’re positioning for the breakout, not chasing the move that already happened. Below $12.97 weakens the setup. Drop under $11.73 and the pattern fails entirely.

Uniswap Whales Position Early With $1.1 Million Bet

UNI whales are playing this one more carefully. They’re accumulating, but not aggressively. Since January 13, large holders added 200,000 UNI tokens. That’s roughly $1.1 million at current prices.

The restraint makes sense. Uniswap is sitting just below its 20-day exponential moving average. Historically, reclaiming that level has mattered for UNI. On November 8, breaking above the 20-day EMA sparked a 76% rally. On December 20, a reclaim produced 24% gains. Even on January 3, a brief reclaim pushed price up 13%.

Whales appear to be positioning ahead of the reclaim rather than waiting for confirmation. Smart money often buys before the technical trigger, not after. If UNI closes above the 20-day EMA and pushes toward the 50-day EMA, the bullish case strengthens considerably.

Key resistance levels sit at $5.98, then $6.57. Above that, $8.13 comes into play if market conditions cooperate. But if the reclaim fails, downside risk remains. Losing $5.28 weakens the setup. Break $4.74 and the short-term outlook turns bearish.

What Crypto Whales See That You Might Miss

The US inflation data came in at 2.7% year over year in December. That matched expectations and showed continued cooling. Markets interpreted this as reducing pressure around near-term rate cuts. Risk sentiment lifted across the board.

But crypto whales aren’t just reacting to macro data. They’re watching technical setups that historically produce moves. EMAs, pattern formations, momentum divergences. These levels matter because they represent where supply and demand dynamics shift.

Notice the pattern across all three tokens. Whales are adding exposure at technically significant points, not chasing pumps. DOGE at the EMA crossover setup. LINK at the cup-and-handle neckline. UNI just below the 20-day EMA reclaim.

These aren’t random bets. Large holders are positioning for potential breakouts while managing downside risk with clear invalidation levels. That’s how smart money operates. They prepare rather than chase.

The market pump might continue or might stall. But crypto whales are already positioned for the next leg. They’re betting on technical confirmation, not hoping for continued momentum. That approach typically works better than buying after the move already happened.

Watch these levels closely. If DOGE clears $0.154, LINK breaks $14.10, and UNI reclaims its 20-day EMA, these whale bets could pay off quickly. But if support breaks, expect these same whales to cut positions fast. Risk management matters as much as entry timing.