Friday morning shattered records nobody wanted to break.

Over $16 billion in leveraged long positions got liquidated in the span of hours. That makes this the largest single-day crypto liquidation event in history. Plus, it’s roughly 20 times bigger than the infamous COVID crash of March 2020.

What triggered this bloodbath? A single Truth Social post from President Trump threatening 100% tariffs on Chinese imports.

When One Post Breaks the Market

Trump’s tariff announcement didn’t just spook crypto traders. It sent shockwaves through global markets instantly.

Bitcoin plunged below $110,000 before recovering slightly to $113,294. Ethereum dropped harder, falling to $3,844 after touching lower levels. In fact, the CoinDesk 20 Index tanked 12.1% as panic selling accelerated.

The speed caught everyone off guard. Traders who went long expecting continued gains suddenly watched their positions evaporate. Liquidation cascades triggered more liquidations, creating a downward spiral that seemed impossible to stop.

Here’s the scary part. Most exchanges struggled to process the volume. So the actual liquidation total probably exceeds reported numbers significantly.

Comparing This Crash to Past Disasters

Friday’s carnage dwarfs previous catastrophic events. Let’s put the numbers in perspective.

The COVID crash in March 2020 liquidated $1.2 billion. Brutal at the time. But that’s just 6% of Friday’s damage.

When FTX collapsed in 2022, liquidations hit $1.6 billion. That felt apocalyptic then. Yet Friday saw nearly 12 times more value wiped out.

However, percentage-wise, Friday’s crash isn’t quite as severe as those earlier disasters. Why? The overall crypto market has grown massively since 2022. So while dollar amounts reached historic highs, the percentage decline was smaller relative to total market cap.

Crypto’s total market cap dropped to $3.87 trillion. Still enormous by historical standards. But the psychological impact of $16 billion vanishing can’t be understated.

Long Positions Got Absolutely Destroyed

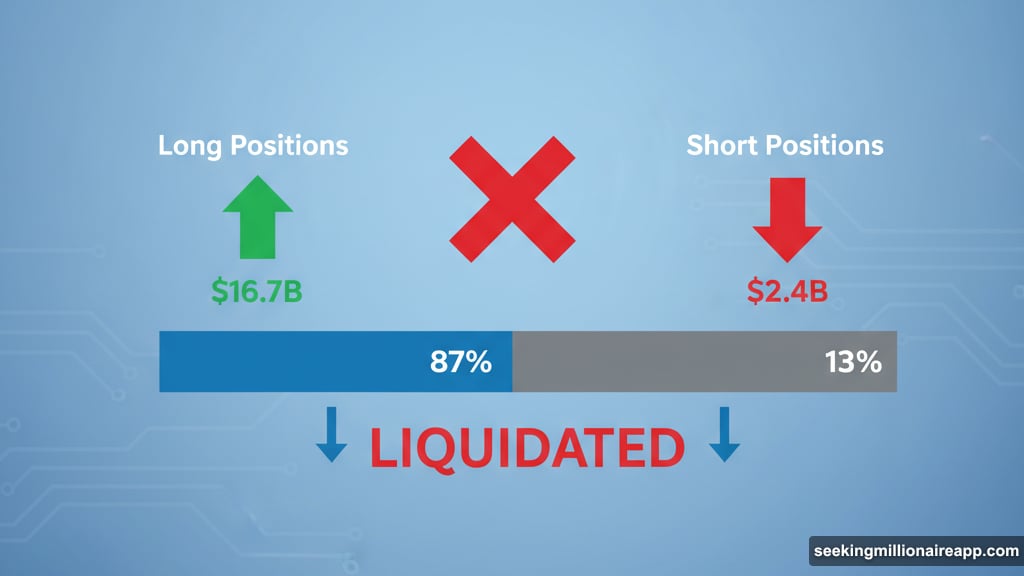

Out of $19.1 billion in total liquidations, roughly $16.7 billion came from longs. That’s an 87% concentration on one side of the trade.

What does that tell us? Most traders positioned themselves for continued upside. They bet on crypto’s momentum continuing. Instead, they got steamrolled.

Short positions only accounted for about $2.4 billion in liquidations. Bears were already positioned defensively. So they avoided the worst of the carnage.

This imbalance reveals how crowded the long trade had become. When everyone leans the same direction, sudden reversals turn catastrophic. Friday proved that lesson once again.

Binance’s Numbers Remain a Mystery

CoinGlass tracked $19.13 billion in liquidations. But they warned the actual total is “likely much higher.”

Why the uncertainty? Binance doesn’t report liquidation data as quickly as other exchanges. And Binance remains the world’s largest crypto platform by volume.

So significant liquidations probably happened there that aren’t reflected in current tallies. The true damage might exceed $20 billion once all data comes in.

That opacity makes analyzing these events harder. Traders can’t get complete pictures in real-time. They’re making decisions with incomplete information during the most volatile moments.

Ethena’s USDe Shows Cracks Under Pressure

Even stablecoins felt the strain. Ethena’s USDe briefly printed at $0.9996, dropping below its $1 peg.

That’s a mild deviation. But it highlights how derivatives market chaos stresses stablecoin mechanisms. When massive liquidations hammer perpetual futures, even overcollateralized stablecoins can wobble.

The Ethena team insisted USDe minting and redemptions remained fully operational. They pointed out the stablecoin became even more overcollateralized as unrealized gains from short positions got realized.

Still, any peg deviation during extreme volatility unnerves traders. It raises questions about stability under maximum stress. Fortunately, USDe recovered quickly. But the brief slip won’t be forgotten.

Trade War Fears Return at the Worst Time

Trump’s tariff threat reignited anxieties traders thought were fading. Markets had started believing US-China tensions were cooling. That belief evaporated instantly.

Now uncertainty dominates. Will Trump follow through? How will China respond? What happens to global trade flows?

Nobody knows. And markets hate uncertainty more than actual bad news. At least with confirmed tariffs, traders can model impacts. With threats, anything seems possible.

Making matters worse, the US government shutdown delayed key economic data releases. So traders are navigating without normal indicators right when trade war rhetoric returns to center stage.

Overleveraged Positions Were Ticking Time Bombs

This liquidation cascade was predictable. Not the specific trigger. But the inevitable result of excessive leverage building up.

Crypto derivatives markets had grown massive. Traders kept piling into leveraged longs as prices climbed. Exchange data showed open interest at record highs heading into Friday.

When everyone uses leverage to amplify gains, sudden reversals amplify losses just as dramatically. A 10% price drop can trigger liquidations. Those liquidations push prices lower. Which triggers more liquidations. The cycle feeds on itself.

Institutional futures open interest dropped $150 million on XRP alone. That single token’s liquidation cascade shows how interconnected these markets have become.

What This Means Going Forward

Friday’s crash won’t be the last. Leverage continues building as crypto markets mature. And geopolitical risks aren’t disappearing.

Smart traders will reduce leverage exposure. The potential gains don’t justify the liquidation risk. Especially when tweets can trigger $16 billion wipeouts.

Expect exchanges to face renewed scrutiny over their liquidation mechanisms. Regulators will ask why cascading liquidations happen so easily. And whether trading platforms have adequate safeguards.

For crypto bulls, Friday provided a harsh reminder. No bull market lasts forever. And leverage magnifies both gains and losses. The traders who survived are those who sized positions conservatively.

Those who got liquidated learned an expensive lesson. Hopefully they learned it well.