Friday’s market crash wasn’t just bad. It was historically brutal.

Bitcoin dropped 13% in 60 minutes. Long-tail tokens got crushed even harder. ATOM briefly touched zero on some exchanges. Then everything snapped back in violent whipsaw moves that left traders stunned.

Jonathan Man from Bitwise called it the worst liquidation event in crypto history. After reviewing the wreckage, he estimated over $20 billion vanished as liquidity disappeared and emergency systems kicked in across the industry.

Open Interest Wiped Back to Summer Levels

Roughly $65 billion in open interest simply evaporated. That’s the total value of outstanding perpetual futures contracts across exchanges.

Think of perps as bets that mirror spot prices but never expire. Traders post margin, take leveraged positions, and settle in cash instead of actual coins. When prices move hard against you, exchanges liquidate your position to protect other users.

But here’s the problem. Liquidations need buyers on the other side. When everyone panics at once, those buyers vanish.

Man noted the reset pushed positioning back to July levels. Months of leverage building got erased in hours. So the market’s structural foundation changed overnight.

Liquidity Vanished When It Mattered Most

Order books went thin fast. Market makers widened their quotes or pulled bids entirely.

Why? They manage inventory and capital risk. During extreme uncertainty, they can’t afford to catch falling knives. So they step back and wait for stability.

That’s when emergency tools activate. Man highlighted two mechanisms that took over when normal trading failed.

Auto-deleveraging forced some profitable traders to close positions early. Exchanges trim winners when losing traders can’t pay. It’s harsh but necessary to keep the system solvent.

Hyperliquid’s vault system also stepped in. Their HLP liquidity pool bought at deep discounts and sold into spikes. Man said it “had an extremely profitable day” soaking up distressed flow.

Long-Tail Tokens Got Destroyed

Bitcoin and Ethereum saw big moves. But smaller tokens faced catastrophic drops.

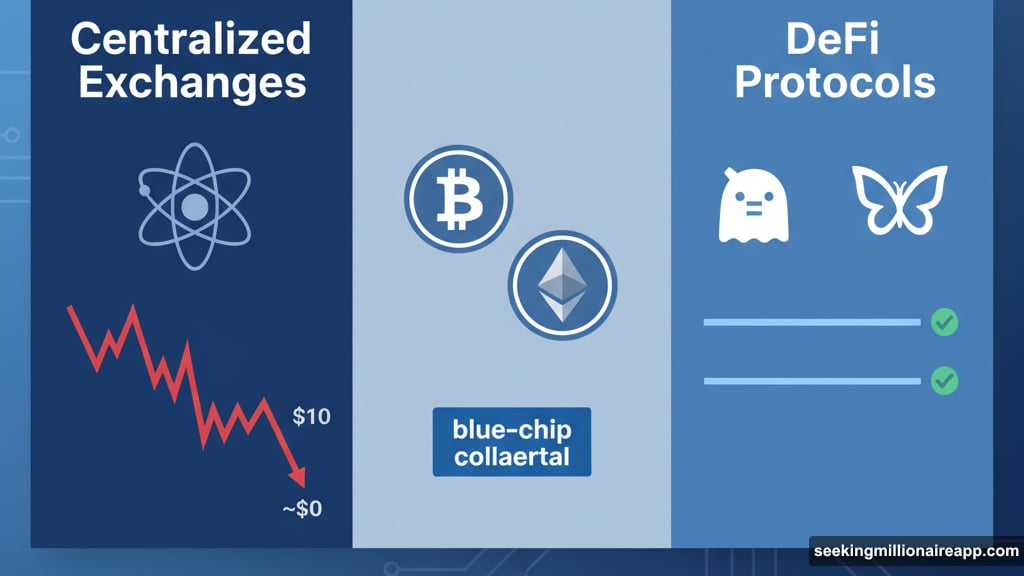

Centralized exchanges showed the worst dislocations. ATOM hitting near-zero wasn’t a glitch. It reflected paper-thin books and zero bid depth during peak panic.

For context, bitcoin fell from roughly $113,000 to $98,000 in an hour. Meanwhile, obscure altcoins lost 50%, 70%, even 90% of their value before rebounding.

Man emphasized this wasn’t about fundamentals. Pure market structure drove the carnage. When liquidity providers ghost you, prices can reach any level no matter how absurd.

DeFi Protocols Held Up Better

Interestingly, decentralized lending platforms handled stress well.

Aave and Morpho avoided cascade liquidations by accepting mainly blue-chip collateral like BTC and ETH. Plus, they hardcoded USDe’s price at $1 to prevent contagion.

That decision mattered because USDe traded around $0.65 on centralized exchanges during the chaos. The stablecoin remained solvent but faced temporary illiquidity.

Users who posted USDe as margin on centralized venues got liquidated anyway. Meanwhile, DeFi users with the same collateral stayed protected by fixed pricing.

So the same asset, different venues, totally different outcomes. That’s the operational risk Man warned about.

Market-Neutral Funds Faced Hidden Danger

Directional traders took obvious losses. But supposedly hedged funds encountered unexpected problems too.

Man said the real risks aren’t price moves when you’re neutral. They’re operational failures. Algorithms breaking. Exchanges going down. Prices marking wrong. Margin calls hitting before you can transfer funds.

He checked with several manager friends who reported making it through intact. But he expects “some c-tier trading teams got carried out” by issues they didn’t anticipate.

Cross-exchange spreads also blew out. ETH-USD showed $300+ differences between Binance and Hyperliquid at times. For arbitrage funds, that should be free money. But if you can’t execute fast enough or one venue freezes withdrawals, those spreads become losses instead of profits.

Why Friday’s Flush Actually Helps Now

Violent as it was, the liquidation event cleared out weak hands and excessive leverage.

Open interest dropped sharply. Positioning reset to healthier levels. Markets entered the weekend on firmer footing than they had Friday morning.

For traders with cash ready, extreme dislocations created opportunities. Buying ATOM at cents when fundamentals hadn’t changed? That’s the kind of setup that only appears during true panic.

Man noted prices recovered quickly from the worst lows. Bitcoin climbed back above $103,000 by Saturday. Altcoins that seemed dead bounced 30-50% in hours.

So while $20 billion in paper wealth disappeared, the survivors emerged into a less crowded, less leveraged market.

The Real Lesson Nobody Wants to Hear

Crypto markets still lack the infrastructure maturity they pretend to have.

Liquidity is fragile. Emergency systems work, but they’re brutal and arbitrary. Who gets auto-deleveraged? How venues price assets during chaos? These decisions happen algorithmically with zero human judgment.

Plus, the industry’s fragmentation makes everything worse. Same asset, wildly different prices across venues. DeFi versus centralized risk profiles. Stablecoin pricing that varies by platform.

Traditional finance has circuit breakers, trading halts, and standardized settlement. Crypto has the wild west with experimental safety rails bolted on afterward.

Man’s analysis makes clear this won’t be the last massive liquidation event. Leverage will rebuild. Traders will forget. Then another catalyst will test the system again.

The question is whether infrastructure improves before the next crisis, or whether we just keep having these $20 billion days until something breaks permanently.