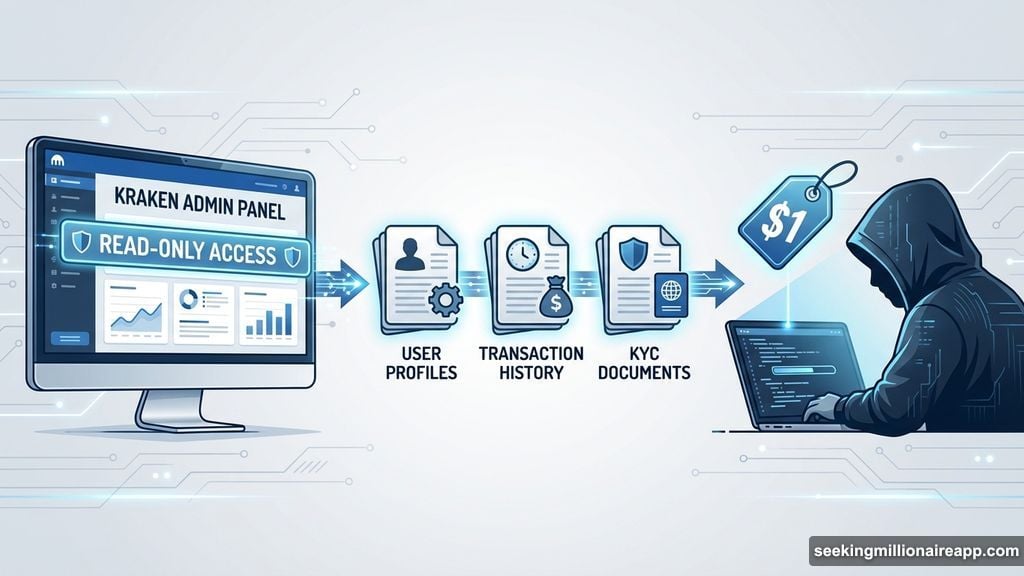

Someone’s selling Kraken admin panel access on the dark web for pocket change. The asking price? Just $1 for read-only credentials that allegedly expose user profiles, transaction histories, and full KYC documents.

Sounds too cheap to be real. But security experts aren’t laughing. Even if the listing turns out fake, the scenario highlights exactly how centralized exchanges remain vulnerable to privileged access compromises.

Here’s what’s actually at stake.

What the Dark Web Listing Claims

According to Dark Web Informer, the seller advertises read-only access to Kraken’s internal admin panel. That means no direct account modifications. But it includes viewing capabilities for sensitive data most users assume stays locked down.

The alleged access covers:

- User profiles with personal information

- Complete transaction histories

- Full KYC documents (IDs, selfies, proof of address)

- Source-of-funds documentation

- Support ticket generation ability

Plus, the seller claims access lasts one to two months, runs through proxies with no IP restrictions, and includes ticket creation functionality. That last detail matters more than it sounds.

Kraken hasn’t responded to requests for comment. So verification remains impossible right now.

Read-Only Access Isn’t Harmless

Many people assume read-only means limited damage potential. Wrong assumption.

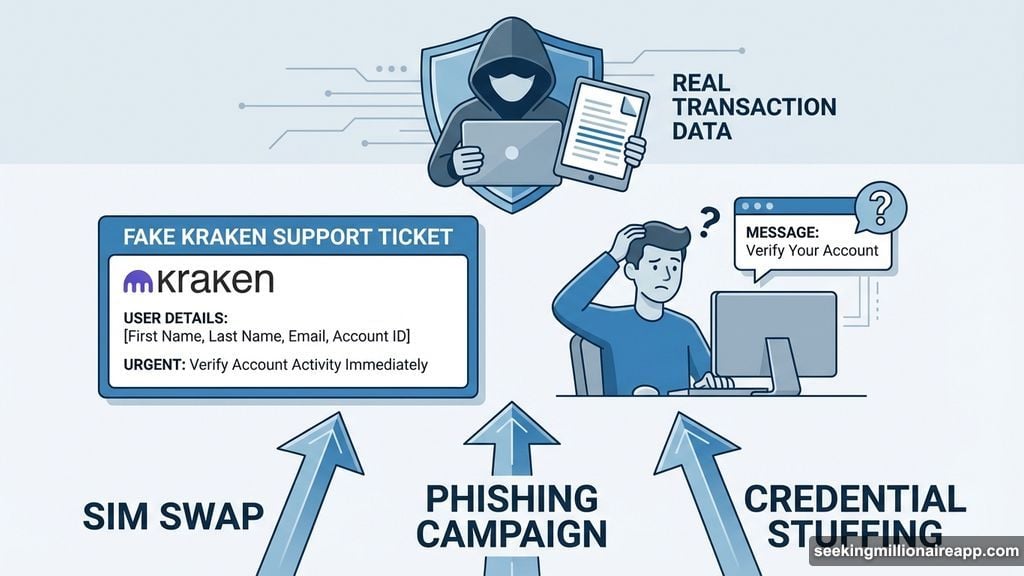

CIFER Security explains why this matters. Threat actors with read-only admin access gain something more valuable than account modification rights. They get intelligence for highly targeted attacks.

Specifically, they could:

- Impersonate Kraken support staff with convincing details

- Reference real transaction data to build trust

- Identify high-value users through transaction patterns

- Access wallet addresses and deposit/withdrawal behavior

- Generate support tickets for social engineering attacks

That support ticket feature becomes a weapon. Attackers can create seemingly legitimate communications that reference actual user activity. Most people would trust a support message that accurately describes their recent trades or deposits.

Moreover, the data provides ammunition for attacks beyond the exchange itself. SIM swap attempts, phishing campaigns, and credential stuffing attacks all become more effective when attackers know real transaction details and behavior patterns.

Crypto Exchanges Have Faced Similar Attacks Before

Admin panel compromises aren’t new. The crypto industry has seen this pattern repeatedly.

Mt. Gox fell in 2014 partly due to internal system vulnerabilities. Binance suffered an API key compromise in 2019. KuCoin lost funds in 2020 when attackers breached hot wallets. Crypto.com faced unauthorized withdrawals in 2022. FTX’s collapse in 2022 included reports of internal access issues.

Each incident reinforced the same lesson. Centralized systems with elevated privileges create single points of failure. Exchanges concentrate massive amounts of customer data in admin panels that become prime targets.

Kraken’s alleged exposure fits this pattern exactly. Whether this specific listing proves genuine or not, the vulnerability it describes remains real and persistent across the industry.

What Kraken Users Should Do Right Now

CIFER Security recommends assuming potential exposure and taking immediate protective action. Don’t wait for confirmation.

Start with authentication hardening. Enable hardware key authentication if available. Activate all global settings locks that prevent unauthorized changes. Whitelist withdrawal addresses so funds can’t move to unexpected destinations.

Then scrutinize all communications. Exercise extreme caution with any messages claiming to be from Kraken support, especially those referencing specific transaction details. Real support rarely contacts users proactively with that level of detail.

Watch for SIM swap warning signs. Sudden loss of cell service, unexpected password reset emails, and verification code requests you didn’t initiate all signal potential attacks. Respond immediately by contacting your carrier and exchange.

Consider moving significant holdings to hardware wallets or fresh addresses not visible in any potentially leaked transaction histories. This step protects against both direct theft attempts and future targeted attacks based on known holdings.

Finally, monitor accounts obsessively. Check login histories, review recent activity, and verify withdrawal addresses before every transaction. Paranoia becomes rational when your financial data might be exposed.

The Real Security Problem

Centralized custody creates inherent risks that architectural improvements can reduce but never eliminate. Exchanges must concentrate customer data somewhere. Admin panels require elevated access. Those facts create attack surfaces.

Better architectures help. Role-based access limits damage when credentials leak. Just-in-time permissions reduce standing privileges. Data masking prevents full visibility even for legitimate admins. Session recording creates audit trails. Zero standing privileges mean attackers must compromise multiple layers.

But even perfect architecture can’t eliminate insider threats, compromised credentials, or sophisticated supply chain attacks. As long as centralized exchanges hold customer data, that data remains a target.

Kraken faces several urgent needs if this report proves accurate. Identify the access source, whether from stolen credentials, insider action, third-party vendor compromise, or session hijacking. Rotate all admin credentials immediately. Audit access logs for suspicious patterns. Most importantly, communicate transparently with users about the scope and timeline of potential exposure.

Trust Collides With Reality

The incident highlights tension between crypto’s decentralized promise and centralized exchange reality. Users trust platforms with sensitive data and funds. Platforms concentrate that trust in systems vulnerable to compromise.

Skeptics online question the listing’s authenticity. “Almost certainly fake,” some argue. Maybe. But genuine or not, the scenario described remains entirely plausible given past incidents and ongoing threats.

That’s the uncomfortable truth. Whether this specific $1 listing represents real Kraken access or not, similar vulnerabilities exist across every centralized platform. The architecture demands it.

Users betting their security on exchanges need realistic expectations. Centralized custody means concentrated risk. Perfect security doesn’t exist. Breaches happen. Data leaks. Admin access gets compromised.

The question isn’t whether these incidents occur. It’s how platforms respond when they do.