Digital Asset Treasury companies are teetering. Bitcoin and Ethereum’s sharp drops exposed what many suspected: most crypto treasuries have no real business underneath.

CoinShares’ James Butterfill just issued a stark warning. December will separate survivors from casualties. Companies that traded at 10x their asset value over summer now hover at or below parity. And the pressure keeps mounting.

Crypto Treasuries Built on Shaky Ground

DAT firms accumulated billions in Bitcoin and Ethereum during the bull run. Great strategy when prices climbed. Disastrous when markets tanked.

Most companies followed a simple playbook. Issue shares, buy crypto, promise investors exposure to digital assets. Easy money during bull markets. But this model has fatal flaws.

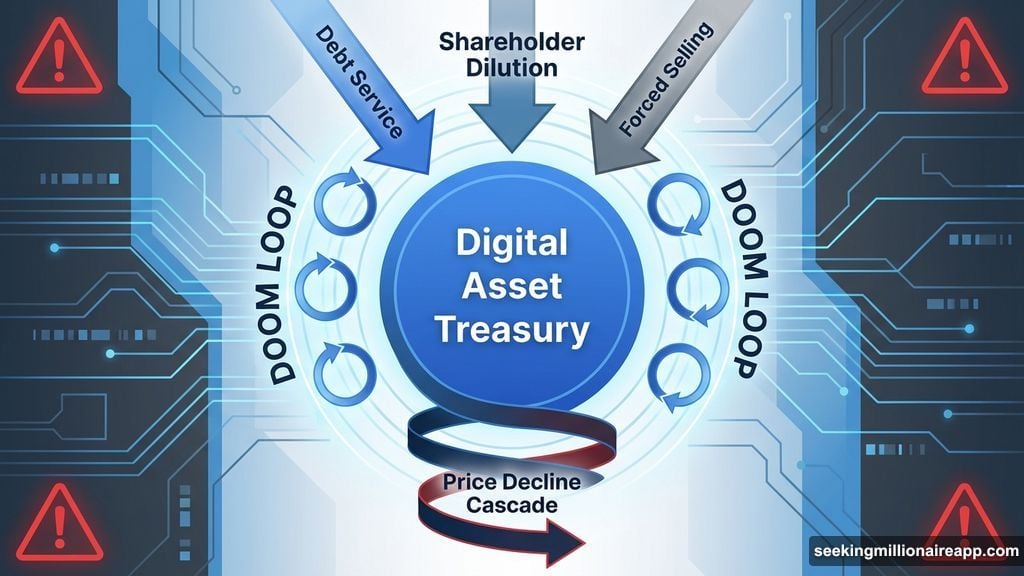

These firms carry massive debt against volatile collateral. They diluted shareholders repeatedly to buy more tokens. Worst of all, many lack operating businesses beyond treasury speculation. When prices drop, the entire structure wobbles.

Plus, macro conditions turned hostile. The Bank of Japan might raise rates, potentially unwinding the yen carry trade. Major institutions piled into short positions, betting DAT stocks would crater. Liquidations cascaded across crypto markets, amplifying selling pressure.

The fear is justified. If prices keep falling, treasuries might face forced selling to service loans or defend equity values. That creates a doom loop: falling prices trigger sales, which push prices lower, forcing more sales.

December Rate Cut Could Save Treasuries

Butterfill sees hope amid the chaos. Central banks might deliver rate cuts this month, particularly the Fed. That would ease liquidity stress and potentially spark a crypto rebound.

He notes improving macro conditions. Inflation cooled. Bond markets stabilized. Dollar strength may fade. These factors could support digital asset prices heading into year-end.

Moreover, many DAT firms still hold their positions. They haven’t panicked and dumped assets yet. If they maintain discipline and prices recover, companies that held firm will benefit. Meanwhile, aggressive shorts could face painful squeezes if momentum shifts.

“During the summer of 2025, many DATs were trading at 3x, 5x, or even 10x their modified net asset value and are now all hovering around 1x or even lower,” Butterfill explains. “Either declining prices trigger a disorderly unwind via an aggressive sell-off, or companies hold on to their balances and benefit from a potential recovery in prices.”

He leans toward the recovery scenario. But survival isn’t guaranteed.

Real Businesses Will Outlast Speculators

The market just administered a harsh lesson. Investors no longer tolerate treasury speculation disguised as business strategy. Companies with actual revenue streams and diversified operations will survive. Pure-play treasury bets face extinction.

Butterfill argues this correction is necessary. “The recent pullback in crypto markets has exposed their structural weaknesses,” he says. Problems include lack of operating businesses, excessive shareholder dilution, and extreme asset concentration.

The DAT model isn’t dead. It just needs fundamental reform. Winners will combine disciplined treasury management with legitimate business operations. They’ll use digital assets strategically, not opportunistically. And they’ll stop treating public markets as vehicles for speculative token accumulation.

Think global companies with diversified revenue streams. Digital assets enhance their balance sheets without defining their entire business. Long-term management replaces short-term speculation. These firms weather volatility because crypto represents one component of broader operations, not the whole story.

Short Squeeze Setup or Death Spiral?

December presents two paths. If prices stabilize or rise, DAT stocks could explode higher. Companies that held positions through the storm would benefit. Shorts covering positions would amplify upside moves. A Fed rate cut could trigger this scenario.

Alternatively, continued price declines could force selling. Leveraged positions unwind. Equity values collapse. Companies liquidate treasuries to survive. This death spiral destroys shareholder value and validates bearish bets.

Which scenario unfolds depends partly on macro conditions. Rate cuts, stable inflation, and improved liquidity favor recovery. Continued volatility and macro stress favor bearish outcomes.

But it also depends on company management. Firms with strong balance sheets, minimal leverage, and patient shareholders can ride out turbulence. Those relying on continued token appreciation or facing debt pressures have little margin for error.

The market is forcing discipline. Companies that built sustainable models will emerge stronger. Momentum players who treated treasuries like lottery tickets face reckoning. December will reveal who built real businesses and who just rode a bull market.