Bitwise just filed for a spot Dogecoin ETF using a regulatory shortcut. That means approval could come automatically in 20 days unless the SEC steps in.

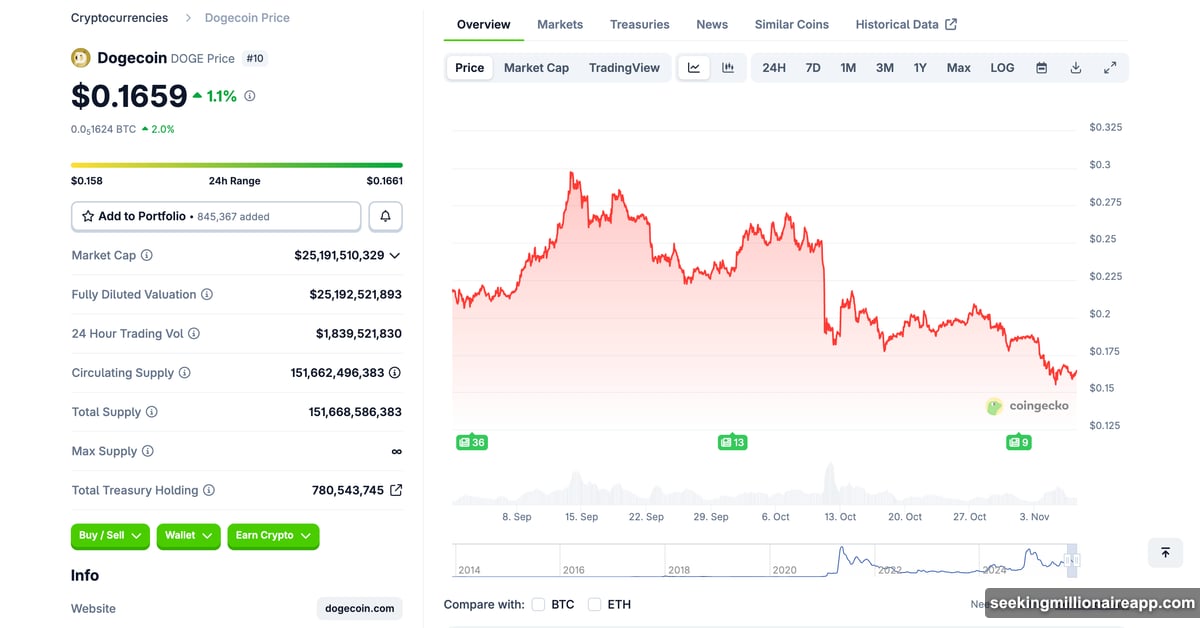

Meanwhile, DOGE’s price keeps falling. Down 44% since September despite growing institutional interest. So what’s going on?

Bitwise Chose the Fast Track

Bitwise isn’t waiting for traditional SEC approval. Instead, they’re using Section 8(a) of the Securities Act. This creates an automatic 20-day countdown.

Here’s how it works. After 20 days, the registration becomes effective automatically. Unless the SEC intervenes with specific concerns.

Bloomberg ETF analyst Eric Balchunas confirmed the strategy. Grayscale filed similar amendments for their own DOGE ETF too. Plus, last week saw three new crypto ETFs debut for SOL, LTC, and HBAR.

The Section 8(a) approach bypasses the standard 19b-4 exchange rule process. That usually takes much longer. But the SEC can still block it if they spot regulatory issues.

So the clock’s ticking. Twenty days could bring the first spot Dogecoin ETF to market.

Price Keeps Dropping Despite ETF Buzz

DOGE hit $0.297 back in September. Now it’s trading around $0.155. That’s a 48% drop from the peak.

Why the disconnect? ETF development moves on institutional timelines. Price movements follow social media hype and retail trading. These operate on completely different cycles.

Meme coins remain incredibly volatile. DOGE especially reacts to Twitter trends and celebrity endorsements. The upcoming ETF might change that dynamic over time.

Institutional money behaves differently than retail traders. ETFs provide regulated access without direct custody concerns. That could stabilize price discovery once significant capital flows through these vehicles.

But for now, the price decline continues even as Wall Street builds DOGE investment products.

Meme Coins Go Institutional

Bloomberg analysts estimate 90% probability for DOGE ETF approval. XRP sits even higher at 95%. The SEC appears comfortable with meme coin investment products now.

This represents a fundamental shift. Over 200 crypto ETF applications could gain approval by mid-2026. The SEC is currently reviewing 155 applications across 35 different digital assets.

ETFs transform how institutions access crypto. In-kind creation and redemption mechanisms provide tax efficiency. Compliance frameworks satisfy legal requirements. Custody arrangements meet fiduciary standards.

DOGE started as a joke cryptocurrency based on an internet meme. Now it’s becoming a regulated investment product alongside Bitcoin and Ethereum. That’s a remarkable evolution in just a few years.

The institutionalization changes market structure permanently. Capital that couldn’t previously enter due to compliance restrictions now has a regulated pathway. Pension funds, endowments, and traditional asset managers can finally participate.

The Approval Probability Game

Analysts track approval odds like political betting markets. DOGE ETF sits at 90% likelihood. That’s high confidence despite meme coin origins.

Several factors support approval. Bitcoin and Ethereum ETFs established regulatory precedents. Recent approvals for SOL, LTC, and HBAR proved the SEC accepts diverse crypto assets. The Section 8(a) automatic process suggests regulatory comfort.

However, the SEC maintains authority to intervene. If concerns arise about market manipulation, custody, or investor protection, they can delay or deny approval. The 20-day countdown isn’t guaranteed.

Grayscale’s parallel filing strengthens the case. Multiple firms pursuing DOGE ETFs signals broad institutional demand. Competition among issuers typically benefits consumers through lower fees.

The wave of applications suggests 2025-2026 will see comprehensive crypto ETF rollouts. What started with Bitcoin ETFs in early 2024 now extends across the entire crypto market.

Why Price and Products Diverge

Institutional product development and speculative price action operate independently. One doesn’t immediately influence the other.

DOGE price responds to immediate market sentiment. Elon Musk tweets can move it 20% in hours. Retail traders pile in during hype cycles and exit during fear.

ETF approvals follow regulatory processes. These move slowly through legal frameworks. Institutional capital deploys cautiously after thorough analysis. Large funds don’t chase daily price swings.

The gap between current prices and future ETF launches creates interesting dynamics. Some analysts expect prices to rise once ETFs launch and institutions deploy capital. Others argue the approval is already priced in.

History provides mixed signals. Bitcoin and Ethereum ETF launches saw initial excitement followed by corrections. The long-term trend remained positive, but short-term volatility persisted.

What Happens Next

Twenty days from now, we’ll know if Bitwise’s DOGE ETF launches. Unless the SEC intervenes, automatic approval takes effect.

Grayscale’s timeline runs similarly. Multiple DOGE ETFs could hit the market nearly simultaneously. That would fragment liquidity initially but provide investor choice.

The broader crypto ETF wave continues accelerating. With 155 applications pending, the next 12 months will reshape how traditional finance accesses digital assets.

For DOGE specifically, the price disconnect creates uncertainty. Will institutional demand reverse the downtrend? Or will meme coin volatility continue dominating price action?

The answer depends on capital flows. If major institutions allocate significant assets through ETFs, that should support prices. But if retail continues dominating trading volume, social media sentiment will remain the primary driver.

One thing’s certain: meme coins just became legitimate Wall Street products. Whether that’s good for DOGE holders remains to be seen.