Dogecoin cracked the $0.20 barrier Tuesday. Volume tells the real story here.

The meme coin surged 1.8% from $0.19 to $0.20, but the breakout came with serious conviction. Trading volume hit 674.52 million tokens—170% above the typical 24-hour average. That’s not retail FOMO. That’s institutional money moving in.

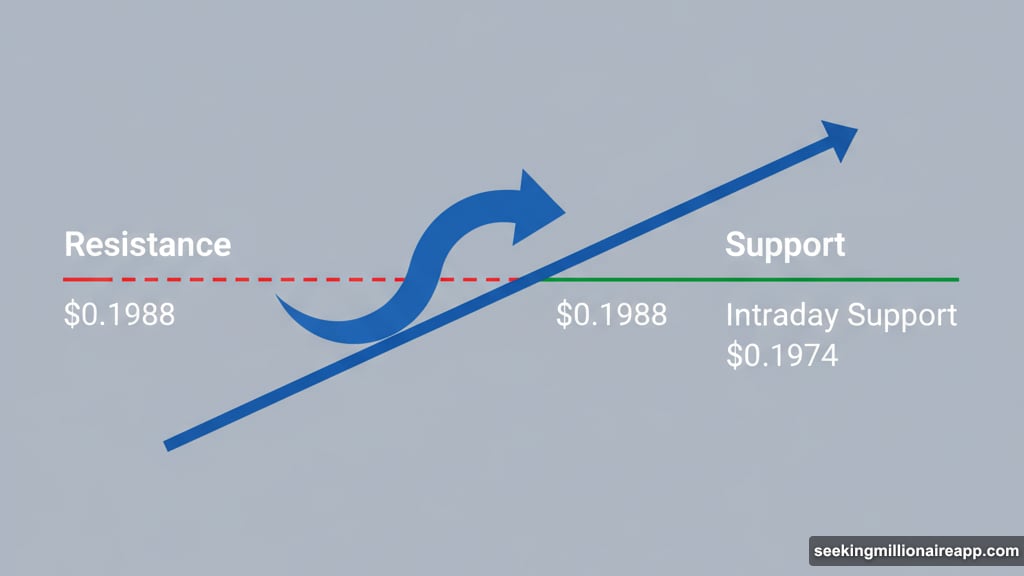

What changed? After a week of grinding beneath $0.195, DOGE finally broke through the $0.1988 resistance level. Plus, the broader crypto market rally in Bitcoin and Ethereum provided the perfect backdrop for this move.

The Volume Story Nobody’s Talking About

Volume spikes matter more than price moves in crypto. Here’s why.

DOGE’s breakout occurred during a single hour on October 23rd. Between 11:00 and 12:00, the token jumped from $0.1963 to $0.1995. But here’s the kicker—that one hour saw nearly triple the normal daily volume.

That kind of concentration suggests coordinated buying. Retail traders don’t move markets like that. Instead, this pattern shows institutional players positioning ahead of the next leg up.

Moreover, the volume didn’t immediately collapse after the breakout. Sustained participation continued throughout the session, defending gains against late-day profit-taking. So the accumulation thesis strengthens with each passing hour.

Price Action Reveals Calculated Moves

DOGE didn’t just spike and crash. The post-breakout behavior shows discipline.

After touching $0.2003, the token entered a tight consolidation range between $0.1990 and $0.2003. That’s healthy price action. Buyers and sellers reached equilibrium without triggering panic selling or euphoric buying.

Furthermore, intraday lows consistently held above $0.1974. Each test of support brought fresh buying interest. Rising hourly support confirms accumulation rather than distribution.

Technical indicators back this up. MACD and RSI show modest bullish divergence across hourly timeframes. Yet momentum remains controlled, avoiding the overheated conditions that typically precede sharp reversals.

The $0.2000 Psychological Barrier

Round numbers matter in trading psychology. $0.20 represents more than just a price level.

DOGE briefly touched this threshold before pulling back into consolidation. That hesitation makes sense. Psychological barriers often trigger profit-taking as traders who bought lower see clean exit opportunities.

But the pullback was shallow. Price stabilized above former resistance at $0.1988, which now acts as support. That role reversal—resistance becoming support—validates the breakout as legitimate rather than a false move.

Market depth data shows increased bid liquidity around $0.1980-$0.1985. Buyers are defending this zone aggressively. So the foundation for another push higher looks solid.

What Traders Are Watching Next

The $0.1985-$0.1990 range became the new battleground. This zone determines whether bulls maintain control or bears force a retest of lower support.

A confirmed close above $0.2003 changes everything. That breakout would likely trigger algorithmic buying systems and momentum traders, pushing DOGE toward the $0.2030-$0.2050 range rapidly.

On-chain data supports this bullish scenario. Whale wallet inflows increased 2.1% over the past 48 hours. Large holders are accumulating, not distributing. That matters because whales typically position ahead of major moves, not after them.

However, failure to hold current levels introduces risk. A breakdown below $0.1980 could trigger stop-losses and prompt a retracement toward $0.1940-$0.1950. But so far, buyers keep showing up at dips.

The Bitcoin Correlation Factor

DOGE rarely moves independently of Bitcoin. This rally proves that relationship remains intact.

Bitcoin and Ethereum both extended early-week gains during DOGE’s breakout. That correlation reinforces the legitimacy of the move. When large-cap assets rally, meme coins like DOGE tend to amplify those gains.

But this creates dependency. If Bitcoin reverses or consolidates, DOGE could give back gains quickly. The token’s high beta to Bitcoin works both ways—amplifying gains during rallies and magnifying losses during corrections.

Still, the current macro backdrop favors risk assets. Bitcoin’s strength provides DOGE with runway to extend gains if momentum continues. So watching BTC’s behavior around key levels becomes crucial for DOGE traders.

Institutional Participation Changes the Game

Retail traders used to dominate DOGE trading. That’s changing.

The 170% volume surge suggests institutional participation. Retail doesn’t move that much capital in coordinated fashion. Instead, large players are using DOGE as a high-beta play on broader crypto market sentiment.

This shift matters for price stability. Institutional money tends to move more deliberately than retail FOMO. That could reduce volatility spikes and create more sustainable price appreciation—if the trend continues.

Moreover, increased institutional interest brings legitimacy. DOGE transitions from pure meme speculation toward a recognized vehicle for expressing crypto market views. That evolution could support higher valuations long-term.

The Risk Nobody Mentions

DOGE’s success depends entirely on broader market conditions. That’s the uncomfortable truth.

If Bitcoin stalls or reverses, DOGE won’t maintain these levels. The token lacks fundamental catalysts beyond market sentiment and speculative interest. So any shift in crypto market mood hits DOGE harder than fundamentally-backed projects.

Plus, the $0.20 level has acted as resistance multiple times historically. Each test makes the next breakout harder. Sellers remember these levels and position accordingly. So clearing this barrier decisively requires sustained buying pressure—not just a quick spike.

Profit-taking becomes inevitable as traders who bought at $0.15 or lower realize gains. That selling pressure could overwhelm new buyers if momentum fades. Managing risk around these levels makes sense for anyone holding DOGE positions.

What Happens at $0.21

The next major resistance sits at $0.21. Getting there requires breaking $0.2003 first, then clearing the $0.2030-$0.2050 zone.

Each level brings fresh selling pressure as previous buyers exit. But if volume remains elevated and Bitcoin cooperation continues, DOGE could punch through these barriers faster than expected. Momentum feeds on itself in crypto markets.

Conversely, a rejection at current levels would likely send DOGE back to test $0.19 support. That outcome wouldn’t invalidate the bullish thesis—just delay the next leg higher. Consolidation above $0.19 would set up another attempt at breaking $0.20.

For now, DOGE holds above former resistance. Volume confirms institutional interest. On-chain data shows accumulation. Those factors favor bulls, but crypto markets change fast. So staying flexible beats stubbornly clinging to any single scenario.

The breakout happened. Now we watch if it holds.