Dogecoin just hit a wall. The popular meme coin slipped under $0.200 after whales sold over 1 billion DOGE tokens worth $180 million.

This isn’t just another dip. Technical indicators now show a Death Cross formation that ended three months of gains. Plus, the selling pressure keeps mounting as large holders continue to exit positions.

Trading at $0.185, DOGE faces serious downside risks. But could a quick rebound change everything?

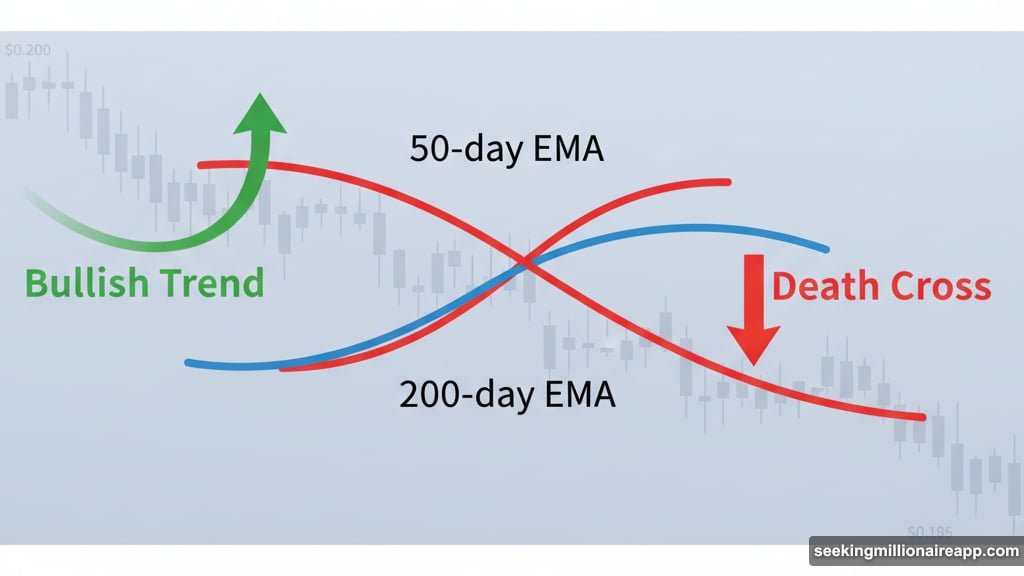

Death Cross Signals End of Rally

Dogecoin’s Exponential Moving Averages just formed a Death Cross. This happens when the 50-day EMA drops below the 200-day EMA.

For traders, it’s a red flag. The pattern typically marks the end of bullish trends. In fact, it confirms that upward momentum has completely vanished.

This crossover ends nearly three months of positive sentiment for DOGE. Moreover, it suggests the coin may face heightened vulnerability to broader market weakness.

Investor confidence is clearly weakening. So volatility could increase, pushing prices down even further. The technical picture doesn’t look promising right now.

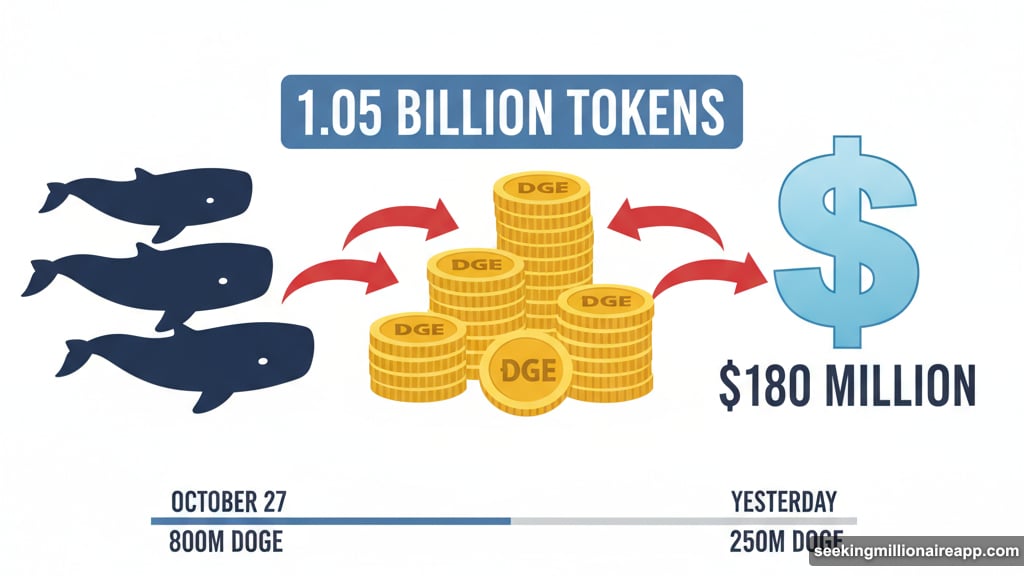

Whales Exit With $180 Million in Sales

Large holders aren’t waiting around. Data reveals that Dogecoin whales sold approximately 1.05 billion DOGE in just one week.

That’s over $180 million walking out the door. Here’s how the selling broke down:

Whales holding 10 million to 100 million DOGE started selling on October 27. They dumped 800 million tokens in total. Then, the bigger players jumped in.

Yesterday, whales holding 100 million to 1 billion DOGE began trimming positions. They sold another 250 million DOGE on top of existing sales.

This kind of large-scale selling rarely happens without reason. Therefore, it often weighs heavily on both price action and investor confidence.

Why Whales Lost Patience

The selling pattern suggests whales grew tired of waiting. Dogecoin spent weeks moving sideways without clear direction.

So major holders decided to cut losses or take profits. Their exits typically precede broader market corrections. Plus, the scale of recent liquidations indicates declining long-term conviction.

When whales sell, retail traders often panic. That creates a downward spiral that’s hard to reverse quickly. Right now, the market shows all those warning signs.

Price Risks More Downside

Dogecoin currently trades at $0.185. That’s just above immediate support levels, but barely hanging on.

Both the Death Cross and whale behavior point toward continued weakness. In fact, if momentum keeps fading, DOGE could easily drop to $0.175.

A break below that level opens the door to $0.165. Such a decline would likely trigger panic selling among retail traders. Then losses would intensify and any recovery would get delayed even longer.

The bearish thesis looks solid right now. However, markets can surprise when sentiment shifts unexpectedly.

Rebound Scenario Still Possible

Not everything points to doom. A swift rebound could see Dogecoin reclaim $0.199 quickly.

If that happens, the coin might push through $0.209 next. Such a move would invalidate the bearish outlook completely. Plus, it would restore some investor confidence and signal renewed market participation.

Short-term stability could follow. But reclaiming these levels requires significant buying pressure and positive sentiment shifts. That’s a tall order given current whale activity.

What Retail Traders Should Watch

Three factors will determine Dogecoin’s next move. First, whether whale selling continues or stops. Second, if Bitcoin and broader crypto markets stabilize. Third, whether retail buying pressure returns.

Right now, none of these factors look favorable. So the path of least resistance appears to be down. Yet crypto markets have proven time and again they can reverse quickly.

Traders should watch the $0.175 support level closely. A clean break below it confirms the bearish case. Meanwhile, reclaiming $0.199 would signal the selling pressure has exhausted itself.

Until then, caution makes sense. Dogecoin’s technical indicators and whale behavior both suggest more pain ahead before any meaningful recovery begins.