Dogecoin just dropped 16% in four days. Most investors panicked. But longtime holders did something unexpected.

They bought more.

On-chain data reveals DOGE holders accumulated aggressively as price collapsed. Instead of fleeing for exits, they treated the dip like a clearance sale. This behavior often signals confidence among informed participants. Plus, it marks a sharp contrast to typical retail fear during crashes.

Let’s examine what actually happened and why it matters for DOGE’s next move.

Holders Stepped In as Price Collapsed

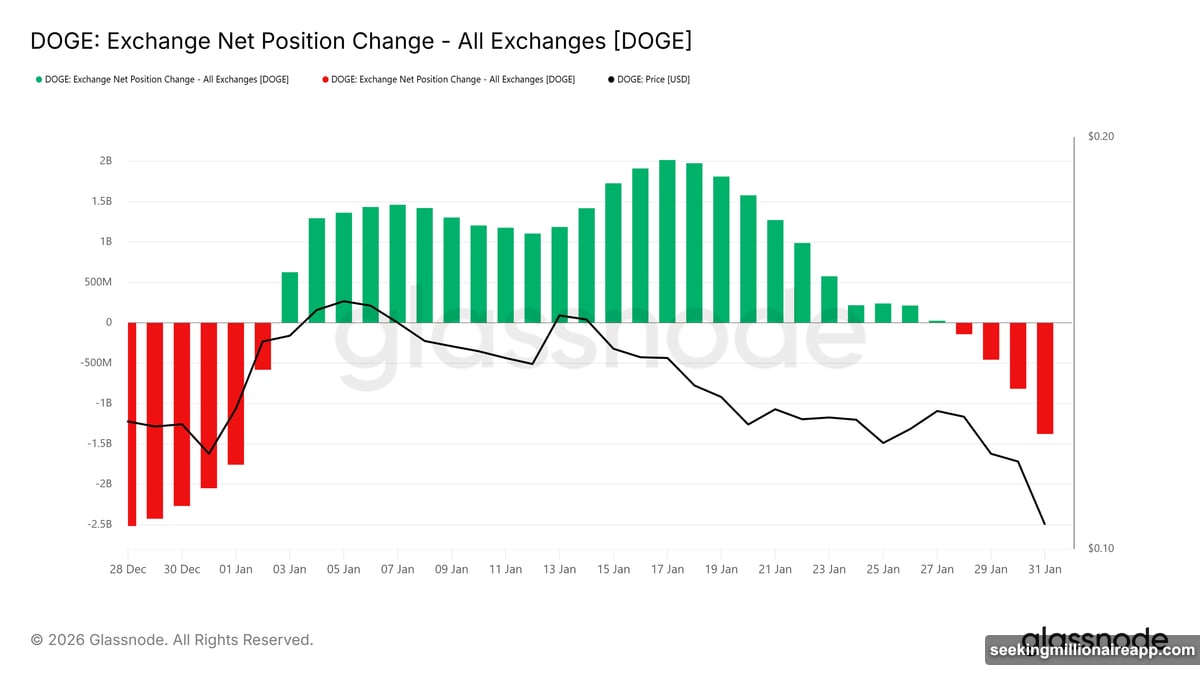

Exchange net position change tells the story clearly. DOGE moved off exchanges during the selloff. That means holders withdrew coins to cold storage rather than dumping into panic bids.

Buying pressure overtook selling as price fell below recent averages. Specifically, accumulation accelerated when DOGE briefly touched $0.094. This wasn’t hesitant nibbling. Active wallets increased exposure at lower prices with conviction.

This response pattern matters. When informed holders accumulate during fear, it absorbs selling pressure. That stabilizes price and limits further downside. We’ve seen this movie before with DOGE. Similar accumulation phases preceded past recoveries.

Moreover, the speed of the buying response suggests preparation. These holders waited for weakness. They had capital ready and price targets identified. That’s not amateur behavior.

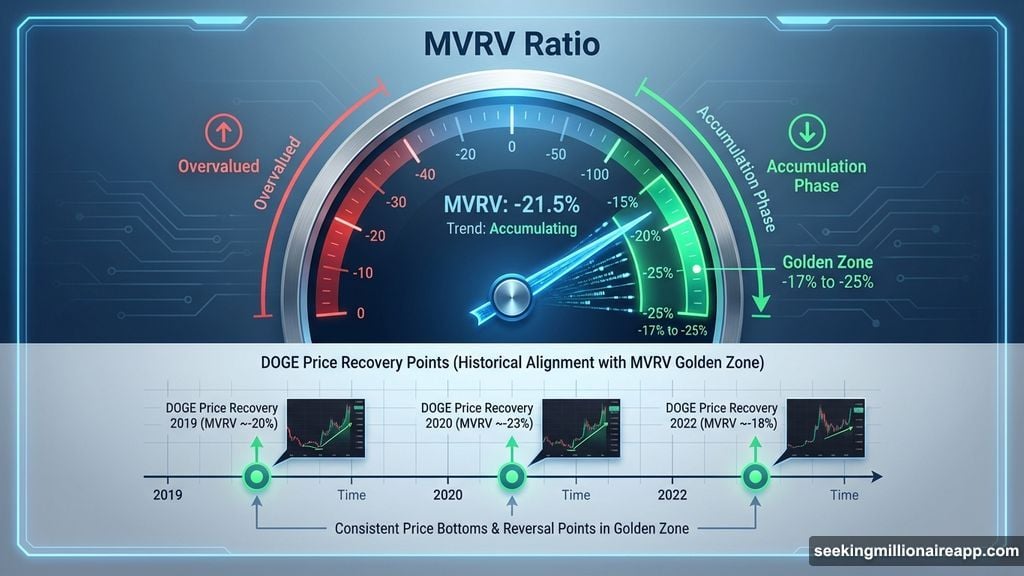

MVRV Entered the Golden Zone

Market Value to Realized Value ratio just hit the sweet spot. DOGE’s MVRV now sits between -17% and -25%. This range indicates unrealized losses across the network.

Here’s why that’s bullish. MVRV in this zone historically marks accumulation phases. Holders experience paper losses but refuse to sell. Loss saturation limits further selling as investors avoid locking in drawdowns.

Take previous DOGE cycles. Each time MVRV dropped into this range, rebounds followed. The pattern isn’t guaranteed but it’s consistent. Selling pressure fades once weak hands capitulate. Smart money steps in during these windows.

Right now, MVRV suggests the same setup. Network losses reached painful levels. Yet holders accumulated instead of panicking. That disconnect between sentiment and action often precedes trend reversals.

The math backs this up. When MVRV sits at -20%, average holders face 20% unrealized losses. Few investors sell at losses unless forced. So downside becomes limited while upside asymmetry builds.

Price Held Critical Support

DOGE trades near $0.105 at the time of writing. The coin briefly crashed to $0.094 during the selloff. That marked the weakest intraday level in weeks.

But dip buying emerged fast. DOGE quickly reclaimed $0.100, restoring short-term support. Holding this zone remains critical for recovery prospects. The $0.100 level now acts as psychological and technical support.

Next, watch $0.110 resistance. A move above that level would strengthen momentum materially. Such a breakout could push price toward $0.117. That would recover part of recent losses and shift sentiment back toward neutral.

However, downside risk persists if support fails. Breaking below $0.100 again would expose DOGE to renewed pressure. In that scenario, price could revisit $0.094 or fall lower. That move would invalidate the bullish thesis and delay recovery until demand improves.

Volume patterns support cautious optimism. Buying volume increased as price tested support. Selling volume declined as DOGE bounced. This divergence suggests accumulation continues even at higher prices.

What Comes Next for DOGE

The 16% crash created opportunity, not disaster. On-chain metrics show holders responded with accumulation instead of fear. MVRV entered the historical buy zone. Price held critical support despite intense selling.

These factors don’t guarantee immediate recovery. But they establish conditions that typically precede DOGE rebounds. Smart money positioned itself during weakness. Retail sentiment remains negative, which often marks bottoms.

So what should you watch? First, monitor whether $0.100 support holds on retests. Second, track exchange flows for continued accumulation. Third, observe MVRV movement back toward neutral territory.

If these signals align, DOGE could recover toward $0.117 relatively quickly. That would represent a 11% gain from current levels. Not life-changing, but respectable for a meme coin during uncertain markets.

The alternative scenario involves breaking $0.100 support. That would signal accumulation failed to absorb selling pressure. In that case, patience becomes the play until clearer bullish signals emerge.

Either way, this crash separated believers from tourists. Holders who bought during fear positioned themselves for potential upside. Those who sold locked in losses and missed the setup. Sometimes the best trades happen when everyone else is scared.