Dogecoin woke up Monday morning 6% richer. The meme coin that started as a joke now trades at $0.27, and some very serious money is flowing in.

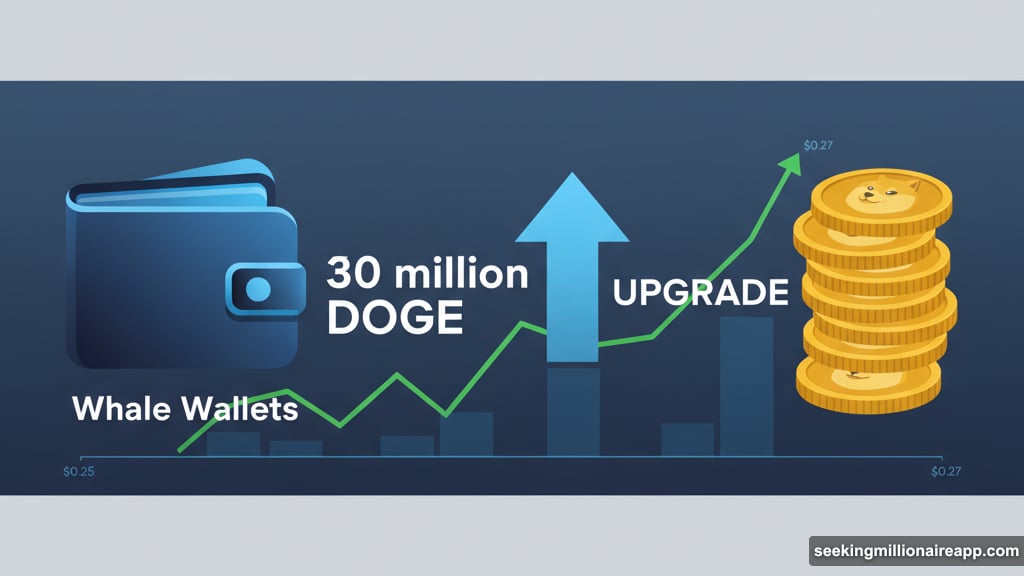

Between October 6 at 4 a.m. and October 7 at 3 a.m., DOGE climbed from $0.25 to $0.27. That might not sound dramatic. But the volume tells a different story—1.1 billion tokens changed hands in just 24 hours.

Plus, whale wallets added 30 million DOGE during the rally. These aren’t retail traders gambling spare change. These are accounts moving millions of dollars into a single token.

Retirement Funds Might Actually Buy Dogecoin

Here’s where it gets weird. Market chatter suggests the SEC might approve DOGE for 401(k) retirement accounts.

Sounds absurd? Maybe. But Bitcoin and Ethereum already won that approval. So the precedent exists for cryptocurrency in retirement portfolios.

However, nothing’s confirmed yet. The speculation alone drove buying pressure. Imagine what happens if approval actually lands.

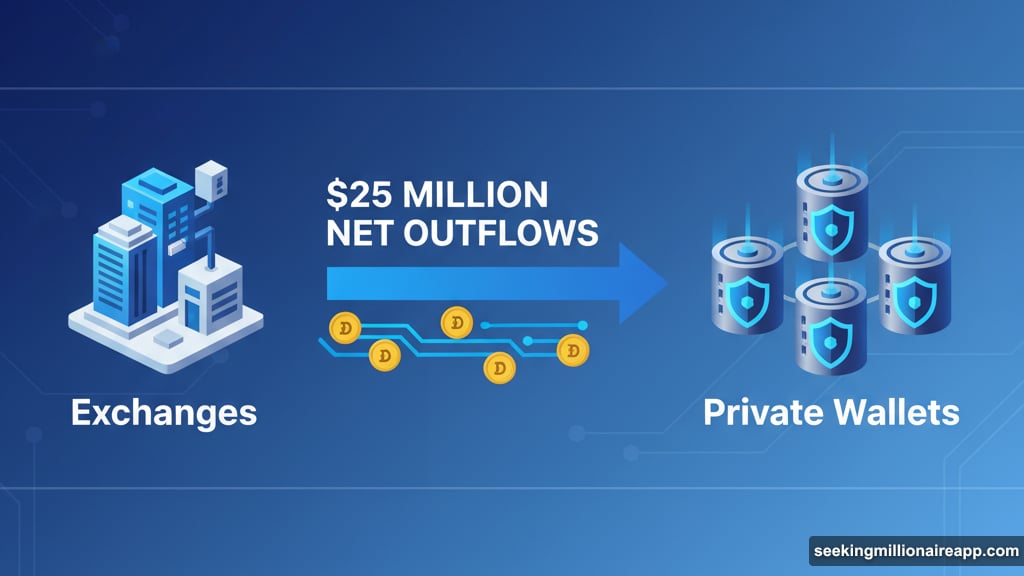

Meanwhile, exchanges saw $25 million in net outflows. That means traders withdrew tokens instead of selling them. Fewer coins on exchanges typically signals conviction—people expect higher prices ahead.

Technical Setup Points Toward $0.30

The chart shows an ascending triangle pattern. That’s trader-speak for “higher lows squeezing toward resistance.”

DOGE keeps bouncing off higher support levels while bumping into the same ceiling. Eventually, something breaks. Bulls bet it breaks upward.

Support now sits at $0.27 after multiple successful defenses. The next resistance? $0.30, which hasn’t budged in weeks.

But analysts also spotted a 42-day cyclical signal that historically precedes major moves. This signal just flashed during the breakout attempt. Coincidence? Traders aren’t assuming so.

The heaviest turnover hit during the 2 p.m. to 3 p.m. window—1.15 billion tokens moved in a single hour. That’s the kind of volume that usually accompanies institutional flows, not retail FOMO.

What Breaks DOGE Higher From Here

For $0.27 to hold, bulls need sustained closes above that level. Right now, it’s new resistance-turned-support. One bad candle could flip it back.

Beyond that, $0.30 becomes the real test. Break through cleanly, and the next targets sit at $0.32 to $0.35. Fail there, and DOGE likely retreats toward $0.25 again.

Whale accumulation matters too. Exchange outflows are tightening available supply. If big wallets keep pressing bids while tokens leave exchanges, basic supply-demand dynamics favor bulls.

Yet the late session showed consolidation around $0.27 with diminishing volumes. Some traders took profits. That’s normal after a 6% single-day move.

The Retirement Fund Angle Changes Everything

Most crypto rallies run on hype and technicals. This one might actually have fundamental backing.

If retirement funds gain access to DOGE, billions in institutional capital could enter the market. That’s not speculation money or weekend gambling. That’s long-term buy-and-hold capital from pension funds and 401(k) plans.

Still, the SEC hasn’t said a word about DOGE specifically. The entire narrative rests on pattern-matching with Bitcoin and Ethereum approvals. That’s thin evidence, even if the logic tracks.

But markets trade on expectations, not facts. Right now, enough traders believe the approval could happen. So they’re positioning before potential headlines hit.

Will it work? Nobody knows. But watching DOGE climb on retirement fund speculation definitely beats watching it pump because Elon Musk tweeted a dog meme. At least this rally has a thesis behind it.