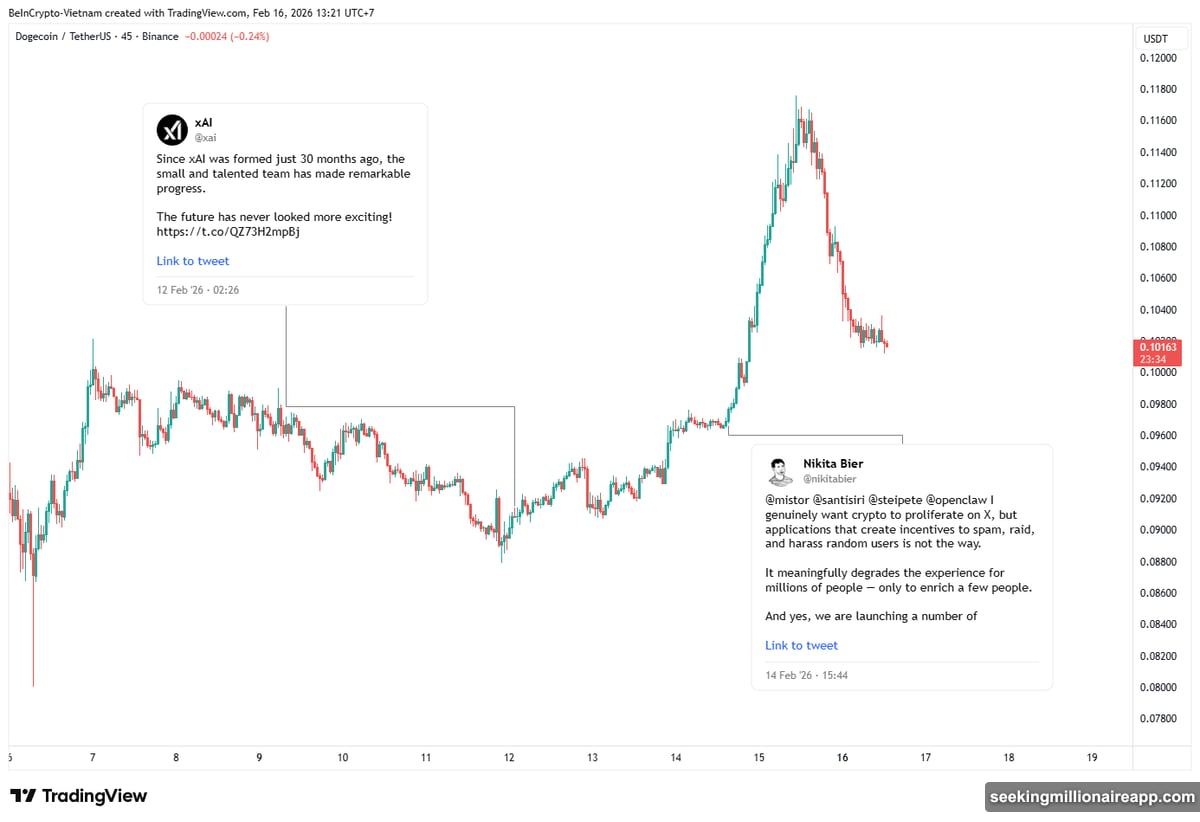

Dogecoin chatter just spiked hard. Mid-February brought a 33% surge in DOGE discussions across crypto communities.

Why now? Elon Musk dropped hints about X Money testing. Plus, whispers about crypto trading features on X got holders excited. But social buzz doesn’t always translate to price action. Let’s dig into what’s actually happening.

X Money Testing Fuels Fresh Speculation

On February 12, Musk revealed something important. X Money entered internal employee testing. The company expects a limited public rollout within one to two months.

That news alone sparked serious conversations. Data from LunarCrush shows mentions jumped 33% compared to the previous month. This marks the strongest discussion activity DOGE has seen in months.

However, here’s the catch. Nobody knows if X Money will actually support DOGE payments. Musk previously mentioned DOGE as a micropayment example. But that’s far from official confirmation.

Still, the speculation intensified on February 14. Nikita Bier, X’s Head of Product, announced “Smart Cashtags.” This feature will let users trade crypto directly from their timelines. Click a ticker symbol, execute a trade.

So naturally, DOGE holders connected the dots. They’re betting X integrates DOGE for payments or trading. LunarCrush noted analysts throwing around price targets like $1 or $2. Those predictions assume X adoption becomes reality.

Price Bounced But Faces Resistance

The social excitement translated to modest price movement. DOGE climbed from $0.09 to above $0.11 in mid-February. Then it pulled back to around $0.10.

That’s a decent short-term gain. But it’s still down over 75% from peak levels last year. The recovery looks fragile when you zoom out.

Analyst Daan Crypto Trades identified a key range. DOGE now trades between $0.08 and $0.13. Breaking above $0.13 would signal strength. From there, the 200-day moving average sits at $0.16 to $0.17.

Yet reaching that level requires more than social media hype. Sustained buying pressure needs to materialize. Right now, the data suggests otherwise.

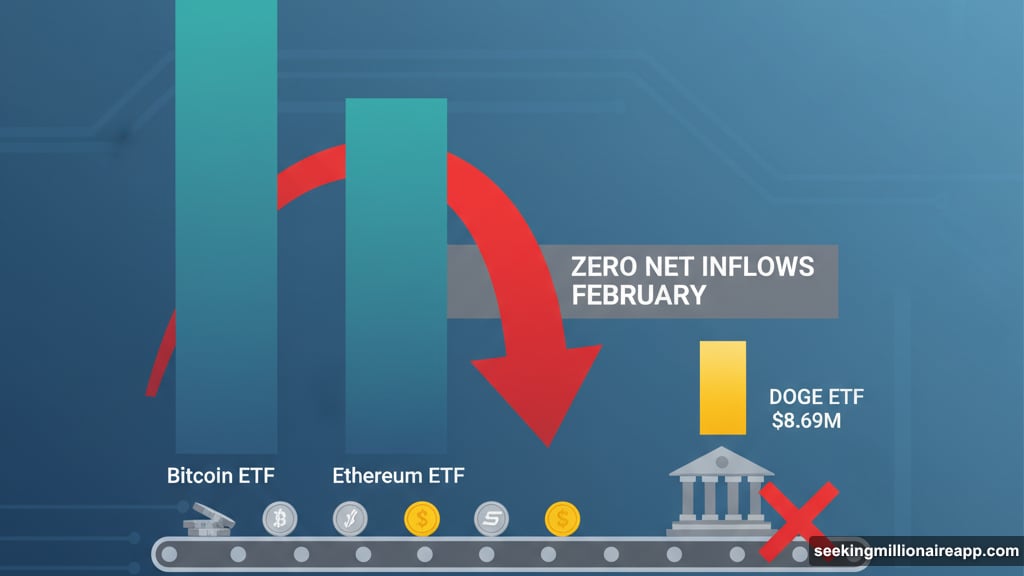

Institutional Money Still Missing

Here’s where things get concerning. DOGE spot ETFs launched in the United States months ago. Since then, total net inflows have barely moved.

February brought zero net inflows. Literally nothing. Since launch, these ETFs hold just $8.69 million in total assets. Compare that to Bitcoin or Ethereum ETFs. The difference is massive.

This tells you something important. Institutions aren’t buying DOGE. Retail speculation drove the recent bounce. But institutional money provides the sustained demand needed for real rallies.

Moreover, DOGE’s supply model creates constant selling pressure. The network mints roughly 5 billion new tokens every year. That’s continuous dilution unless demand keeps pace.

So far, demand hasn’t kept pace. The unlimited supply remains a structural weakness for long-term value preservation.

Technical Setup Suggests Caution

Short-term price action looks modestly bullish. DOGE held the $0.08 support level during last week’s test. Buyers defended that zone, which signals some underlying strength.

But the middle of a trading range is tricky. DOGE sits around $0.10 right now. That’s neither confirming a breakout nor signaling a breakdown. It’s stuck.

Breaking above $0.13 with volume would change the picture. That move would suggest buyers are taking control. Until then, the range continues.

Below $0.08, things get uglier. That level represents strong support. Losing it could trigger cascading stops and accelerate downside.

What Actually Matters Going Forward

Social buzz matters for meme coins. DOGE proved that during past rallies. But this time feels different. The hype cycle seems weaker.

X Money could legitimately boost DOGE if integration happens. Millions of X users trading or tipping with DOGE would create real utility. That’s fundamentally different from pure speculation.

However, nothing’s confirmed yet. Musk hasn’t explicitly promised DOGE support. Smart Cashtags might support dozens of cryptocurrencies. DOGE could be just another option, not a featured asset.

Plus, even with X integration, the supply issue remains. Five billion new tokens per year is substantial inflation. Demand needs to outpace that consistently.

Institutional hesitation also speaks volumes. ETF inflows track professional investor sentiment. Right now, that sentiment looks ice cold.

The Bull Case Requires Perfect Execution

For DOGE to hit $1 or $2, several things need to happen. First, X Money must launch with DOGE prominently featured. Second, adoption needs to spread rapidly among X’s user base. Third, broader crypto markets need to cooperate.

Even then, the math gets challenging. DOGE’s market cap would need to multiply several times over. That requires either massive new capital inflow or significant token burns.

Token burns aren’t coming. The DOGE protocol doesn’t include that mechanism. So it’s all about demand.

Can social excitement alone drive that? History says maybe. DOGE rallied to absurd levels before. But those rallies happened during peak bull markets with heavy retail participation.

This environment feels different. Retail interest hasn’t returned at scale. Institutions remain skeptical. Regulatory uncertainty continues.

Betting on Musk’s Next Move

Ultimately, DOGE’s fate ties directly to Musk’s decisions. If he pushes DOGE integration on X, price could explode. His influence over this token remains unmatched.

But that’s also the problem. One person shouldn’t control a cryptocurrency’s destiny. The dependence on Musk creates fragility. He could change his mind. Regulators could intervene. Priorities could shift.

For now, DOGE holders are betting on the best-case scenario. X Money launches. DOGE gets featured. Adoption grows. Price follows.

That’s a lot of “ifs.” Meanwhile, structural weaknesses persist. No institutional support. Unlimited supply. Range-bound price action.

Short-term speculation might push DOGE higher. But sustained recovery requires more than tweets and testing announcements. It needs actual utility, adoption, and demand that overwhelms supply.

Right now, those ingredients aren’t clearly present. Social buzz is back. But talk is cheap. DOGE needs real catalysts to justify higher prices.