Ethereum refuses to budge from the $3,000 mark. Two weeks of sideways trading tell only part of the story.

Recent institutional buys from BitMine and Trend Research look impressive on paper. But dig into the data. Selling pressure matches or exceeds that demand. Plus, four critical indicators flash warning signs that ETH might not recover anytime soon.

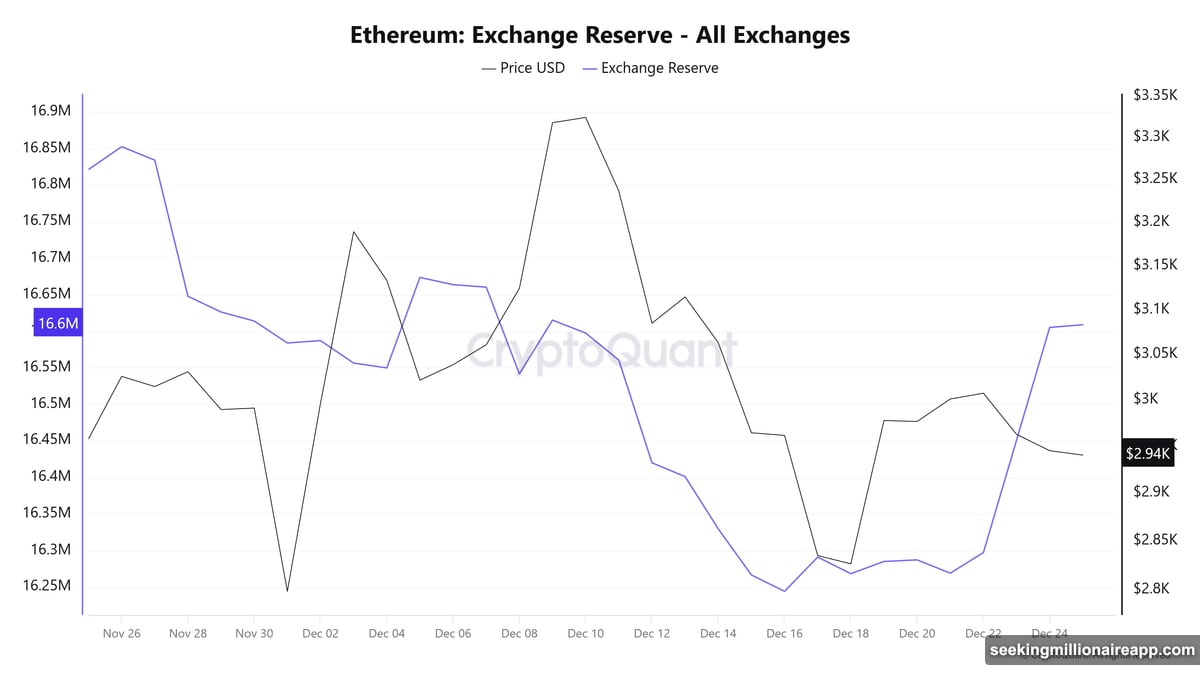

Exchange Reserves Spike During Holiday Week

ETH reserves on exchanges dropped steadily for months. Then December hit. Everything reversed.

This week alone, exchange reserves jumped from 16.2 million to 16.6 million ETH. That’s 400,000 ETH flooding onto trading platforms. And when tokens move to exchanges, they usually get sold.

One original whale dumped 100,000 ETH onto Binance. Meanwhile, BitMine grabbed 67,886 ETH and Trend Research added 46,379 ETH. Those buys look solid. But they don’t match the selling volume.

The math tells a brutal story. More ETH hits exchanges than institutional buyers can absorb. So prices face downward pressure. If this pattern continues through year-end, expect more pain ahead.

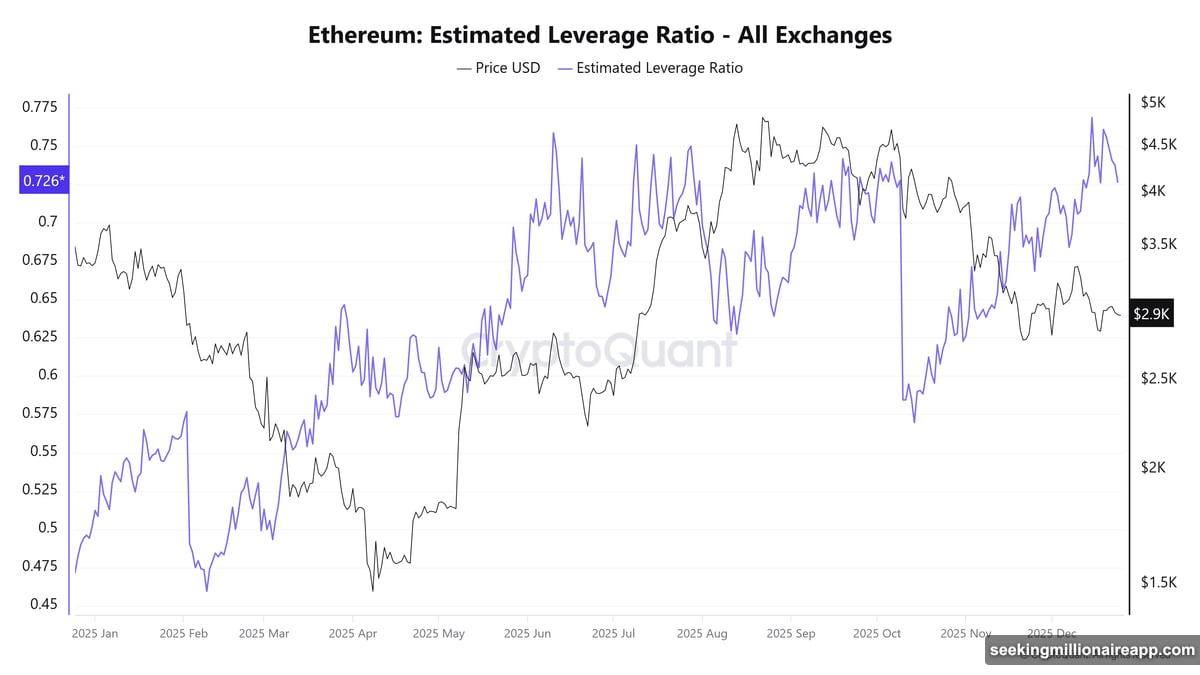

Leverage Ratios Hit Dangerous Territory Again

Ethereum’s estimated leverage ratio climbed back to alarming levels. CryptoQuant data reveals the problem.

This ratio divides exchange open interest by coin reserves. Higher numbers mean traders pile on more leverage. Right now, the ratio sits around 0.72 to 0.76. That matches October 10, when massive liquidations crushed the market.

Overleveraged positions create fragility. Small price swings trigger cascade liquidations. And with leverage this high, ETH remains vulnerable to sudden drops. One wrong move could wipe out hundreds of millions in leveraged positions.

Coinbase Premium Plunges Deeper Into Red

Ethereum’s Coinbase Premium turned negative in December. During Christmas week, it sank even lower to -0.08. That’s the worst reading in a month.

This metric compares ETH prices on Coinbase Pro versus Binance. Negative values mean US investors sell at discounted prices. And persistent selling from American traders signals weak domestic demand.

Until this premium flips positive, ETH struggles to gain momentum. US investors typically drive major rallies. But right now, they’re dumping coins instead of buying. That’s a massive red flag.

ETF Outflows Bleed Momentum for Second Month

December marks the second consecutive month of ETH ETF outflows. November saw $1.42 billion exit these products. This month already lost over $560 million.

Spot ETF demand usually drives price action. But without fresh institutional money flowing in, ETH lacks fuel for a rally. Instead, outflows drain enthusiasm and reduce upward pressure.

Glassnode highlighted the problem. Since early November, 30-day moving averages for both Bitcoin and Ethereum ETF flows turned negative. That signals disengagement from institutional allocators. And during low-volume holiday periods, this absence hurts even more.

What This Means for Traders

Four indicators point the same direction. Rising exchange reserves, elevated leverage, deeply negative premiums, and sustained outflows create a toxic combination.

ETH might consolidate sideways. Or it could test lower support levels. Either way, quick recovery looks unlikely. The data suggests more downside risk than upside potential right now.

Smart traders adjust accordingly. Set proper stop-losses for leveraged positions. Use prudent capital allocation for spot buys. And avoid chasing pumps when fundamentals look this weak.

The holiday period creates unpredictable volatility. Thin liquidity amplifies price swings. So protecting capital matters more than catching a bottom. Wait for genuine demand signals before going aggressive again.

Markets don’t care about hope. They respond to supply and demand. Right now, ETH faces too much supply and not enough demand. That imbalance rarely resolves quickly. Patience beats optimism when indicators flash this many warnings.