Trade tensions just decimated crypto markets. Ethereum took the hardest hit.

ETH plunged 7% Friday after Trump threatened massive tariffs on Chinese goods. That’s double Bitcoin’s drop and far worse than the broader market. Plus, over $600 million in leveraged positions got wiped out across all cryptocurrencies. ETH traders alone lost $235 million in long positions.

This wasn’t just a dip. It was a full-scale liquidation cascade.

Why Ethereum Got Crushed Harder Than Bitcoin

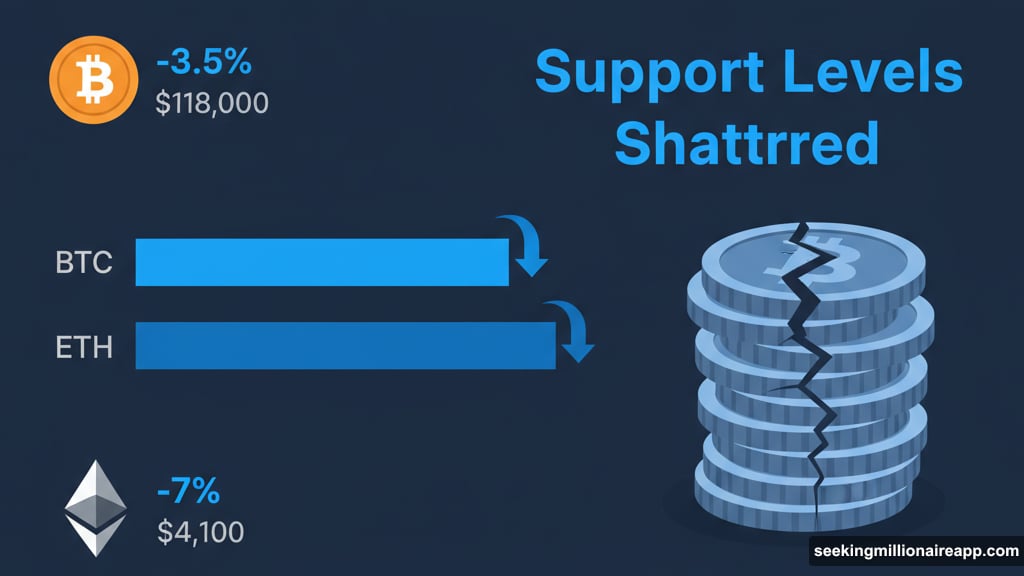

Bitcoin dropped 3.5% to slip under $118,000. Painful but manageable. Meanwhile, ETH nosedived from its session high to below $4,100—its weakest price since late September.

So what made ETH so vulnerable? Leverage.

Traders had piled into long positions betting on price increases. When support levels broke, liquidations triggered automatically. That forced selling created a downward spiral. Each liquidation pushed prices lower, triggering more liquidations.

The data tells the brutal story. Selling pressure materialized around 14:00 UTC with volume hitting 372,211 units. That’s nearly double the 24-hour average of 190,747 units. Markets couldn’t absorb that kind of sell-side pressure.

Critical Support Levels Shattered

Technical analysis reveals just how bad the breakdown was.

ETH smashed through multiple support zones. Volume-based resistance confirmed around $4,287. Then buyers tried rallying near $4,141 but failed completely.

However, something interesting happened just below $4,100. Buyers emerged. Not enough to reverse the carnage, but enough to potentially form new support.

That matters because support levels dictate whether we’re seeing a temporary crash or the start of something worse. If $4,100 holds, recovery becomes possible. If it breaks, we’re looking at prices not seen in months.

The Liquidation Death Spiral Explained

Over $235 million in ETH long positions evaporated Friday. Here’s how that happens.

Leveraged trading lets you control large positions with small capital. Say you put up $10,000 but control $100,000 worth of ETH using 10x leverage. Great when prices rise. Catastrophic when they fall.

Once your position drops a certain percentage, exchanges automatically liquidate to protect themselves. Your $10,000 vanishes and the exchange dumps your ETH onto the market.

Now multiply that by thousands of traders. Each forced sale pushes prices lower. Lower prices trigger more liquidations. More liquidations create more selling. The cycle feeds itself until leverage gets flushed from the system.

That’s exactly what happened Friday. And ETH traders were most exposed.

Trade War Fallout Hits Crypto

Trump’s tariff threats against China sparked the initial selloff. Markets hate uncertainty and trade wars create exactly that.

But crypto shouldn’t theoretically care about tariffs, right? Wrong.

Institutional money now dominates crypto markets. Those same institutions hold stocks, bonds, and other traditional assets. When geopolitical risk spikes, they reduce exposure across all risk assets simultaneously. Crypto gets sold alongside tech stocks and emerging market positions.

Besides, Chinese investors remain huge crypto holders despite government restrictions. Escalating trade tensions could mean stricter enforcement of those restrictions. That creates selling pressure from both sides of the Pacific.

Where ETH Goes From Here

Recovery depends on whether support holds near $4,100. Buyers showed up at that level, suggesting some demand exists.

Yet the technical picture remains bearish. Resistance now sits at $4,141 where the failed recovery attempt occurred. Even if ETH bounces, sellers will likely emerge at that level.

For meaningful recovery, ETH needs to reclaim $4,287. That would invalidate the breakdown and potentially trigger short covering from traders betting on further declines.

But that requires either trade war de-escalation or a major catalyst specific to Ethereum. Neither seems likely in the immediate future.

Leverage Lessons Nobody Learns

This isn’t the first massive liquidation event. It won’t be the last.

Yet traders keep piling into leveraged positions during bull runs. The promise of amplified gains blinds them to amplified risks. Then volatility spikes and they act shocked when positions get liquidated.

Here’s the uncomfortable truth. Most retail traders lose money using leverage. Exchanges profit from liquidations. The house always wins that game.

If you’re trading crypto with leverage, ask yourself one question. Can you afford to lose 100% of your margin? Because that’s exactly what happens during liquidation cascades. Your entire position vanishes while you watch helplessly.

The smart money uses minimal or zero leverage. They survive crashes like Friday’s and buy from panicked sellers. Meanwhile, leveraged traders get wiped out completely and miss the eventual recovery.

Choose wisely.