Ethereum just slipped under $4,000. Now traders face a simple question with no easy answer: short it or buy the dip?

The market split straight down the middle. Some analysts see weakness everywhere and recommend betting against ETH. Others point to on-chain data suggesting a massive rebound is brewing.

Both sides have compelling evidence. So who’s right?

The Case for Shorting Ethereum

Research firm 10x Research picked Ethereum as their preferred short play for November. Not Bitcoin. Ethereum.

Their reasoning centers on one critical weakness. The “digital treasury” narrative that drove institutional buying has collapsed.

Here’s what happened. Companies like BitMine bought ETH at cost throughout the summer. Then they sold it to retail investors at premium prices. This created a self-reinforcing cycle that pushed prices higher.

But that cycle broke. Institutional buyers stopped believing the story. So the capital that supported ETH’s rise simply vanished.

Plus, the numbers tell a harsh tale. Ethereum spot ETFs bled $311.8 million in outflows during the third week of October. Then another $243.9 million disappeared the following week.

BlackRock alone dumped $118 million worth of Ethereum in a single day. When the world’s largest asset manager exits that aggressively, retail investors should pay attention.

Technical analysis adds another warning signal. ETH is forming a bearish crossover pattern right now. The last time this exact setup appeared, Ethereum crashed from $3,800 to $1,400.

That’s a 63% drop. Nobody wants to experience that again.

But Derivatives Data Tells a Different Story

Wait though. Not everyone sees doom ahead.

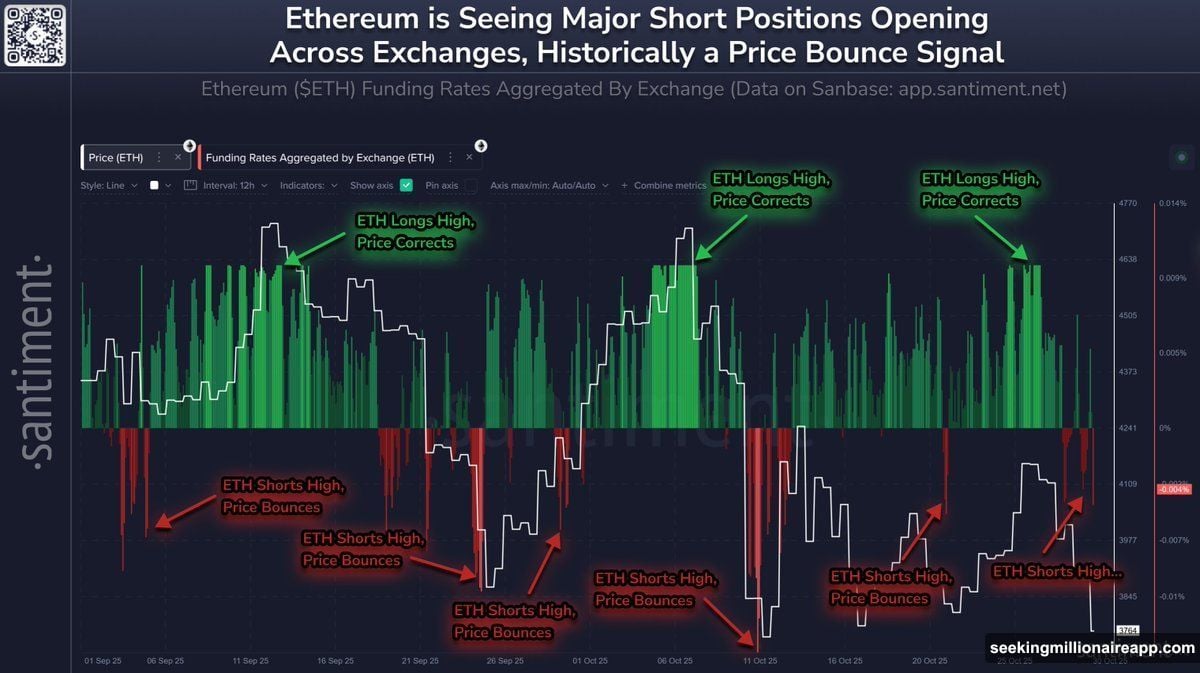

Santiment noticed something interesting as Ethereum fell to $3,700. Traders started piling into short positions again. And historically, that’s been the exact wrong move.

Here’s the pattern. When funding rates turn positive and longs dominate, prices typically correct. Excessive optimism builds up and the market needs to reset.

However, when shorts take over and funding rates go negative, rebounds often follow. We’ve seen this play out repeatedly over the past two months.

Right now, shorts are piling up fast. That creates perfect conditions for what traders call a “short squeeze.” If prices start rising, those shorts get forced to buy back their positions. This buying pressure can accelerate the upward move dramatically.

Moreover, Ethereum’s on-chain fundamentals look surprisingly strong. The Ethereum Ecosystem Daily Activity Index hit record highs in October 2025. This measures actual network usage, not just speculation.

High activity levels suggest real users are engaging with the network. That provides a solid foundation that pure price speculation can’t create. When fundamentals strengthen while prices fall, value investors start circling.

Institutional Exits vs Retail Strength

The disconnect between institutional and retail behavior creates an unusual dynamic. Big money is leaving through ETFs while on-chain activity surges.

This split rarely lasts long. Either institutions return when they see value, or retail enthusiasm fades when profits don’t materialize. Something has to give.

Analyst CryptoOnchain believes the on-chain strength will win out. They argue that genuine user growth provides better support than speculative capital. Users stick around. Speculators flee at the first sign of trouble.

Meanwhile, the technical picture remains mixed. Yes, bearish patterns are forming. But extreme negative sentiment in derivatives markets has preceded every major Ethereum rally this year.

Traders who shorted at previous pessimistic extremes got absolutely crushed. The question is whether this time is different or just another fake-out.

What November Actually Decides

Ethereum’s November performance will likely set the tone for Q4 and beyond. If it breaks decisively below $3,500, the bearish thesis gains credibility. Institutional outflows would validate the broken narrative story.

However, if ETH reclaims $4,200 and holds it, shorts could face severe pain. The on-chain activity data suggests enough fundamental strength exists to support a rally if sentiment shifts.

The real uncertainty comes from timing. Derivatives positioning points toward a potential squeeze. But that doesn’t mean it happens in November. Markets can stay irrational longer than shorts can stay solvent.

Smart money is watching funding rates closely. When they flip positive again, that’s the signal that excessive bullishness has returned. Until then, the short build-up creates explosive potential energy.

Neither side has this figured out yet. Ethereum sits at a genuine crossroads where both scenarios have merit. The coming weeks will reveal whether the bearish technicals or bullish derivatives positioning proves correct.

For now, the safest play might be the most boring one. Wait for confirmation rather than betting big on either direction. Let the market show its hand first.