Ethereum broke out of a bullish triangle pattern three weeks ago. Everyone cheered. But the celebration might have been premature.

Behind the rally sits a troubling pattern. ETH price keeps climbing while internal strength fades. Plus, the biggest holders are quietly selling into the excitement. That’s rarely a good sign.

Let’s dig into what’s actually happening beneath the surface.

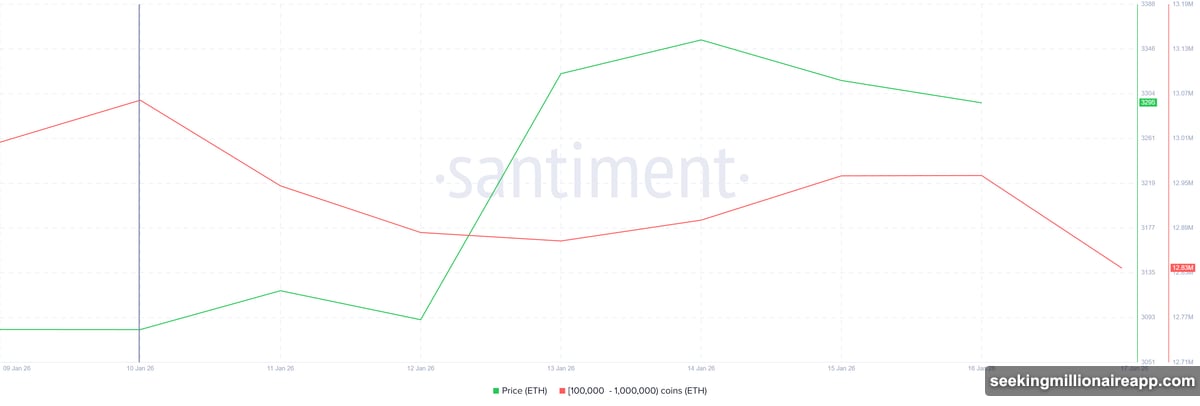

The Divergence Nobody Wants to See

Ethereum printed higher highs for nearly three weeks straight. Sounds bullish, right? But here’s the problem.

The Chaikin Money Flow indicator moved in the opposite direction. It registered higher lows while price climbed. This creates what traders call a bearish divergence.

What does that mean in plain English? Money is leaving Ethereum even as the price rises. Investors are distributing their holdings into strength rather than accumulating for further gains. That’s classic topping behavior.

Moreover, this pattern persisted for three weeks. Short-term divergences can resolve quickly. But multi-week divergences carry more weight. They suggest structural weakness rather than temporary noise.

When price appreciation happens alongside capital outflows, upside momentum erodes fast. The recent breakout now looks increasingly vulnerable to failure.

Whale Wallets Are Emptying

On-chain data confirms what momentum indicators suggested. Ethereum’s largest holders increased selling activity dramatically over the past week.

Wallets holding between 100,000 and 1 million ETH dumped more than 230,000 coins. That equals roughly $760 million at current prices. These aren’t retail traders panic-selling. These are sophisticated holders making calculated exits.

The timing matters too. Whales sold during the breakout rally, not before it. They used price strength as an opportunity to distribute holdings. When major players sell into breakouts, sustainability becomes questionable.

Furthermore, this selling aligns perfectly with the declining Chaikin Money Flow. Both metrics point to reduced confidence among those who move markets. That’s a dangerous combination for bulls hoping the rally continues.

Support at $3,287 Looks Fragile

Ethereum currently trades near $3,309, just barely holding the $3,287 support level. That line matters because breaking it would invalidate the bullish triangle pattern entirely.

The original breakout projected a 29.5% upside move toward $4,240. Nice target. But fading momentum and whale distribution threaten to turn that projection into fantasy.

Given current conditions, ETH will likely lose $3,287 support soon. A breakdown would send the price toward $3,131 next. That would confirm the triangle breakout as a fakeout and increase selling pressure significantly.

Below $3,131, things get uglier. A deeper correction into the $2,900s becomes possible. Each support level that fails accelerates downside momentum as stops trigger and weak hands exit.

Two Scenarios From Here

The bearish case seems more probable right now. Losing $3,287 support would validate the divergence pattern and trigger technical selling. That path leads toward $3,131 first, with $2,900-$3,000 as the next major zone.

However, bulls aren’t completely dead yet. If ETH successfully bounces from current levels and whale selling subsides, momentum could return. Holding $3,287 might allow a push toward $3,441.

Further strength from there could extend gains toward $3,802. That would invalidate the bearish outlook entirely and suggest the divergence was a false signal. But that requires whale behavior to change quickly.

The question is simple. Will major holders stop selling and start accumulating? Or will distribution continue until price breaks?

What Institutional Behavior Really Means

Whale selling during breakouts reveals a lot about market psychology. These holders likely accumulated ETH at lower prices weeks or months ago. Now they’re taking profits into strength.

That’s rational behavior. But it also means conviction is lacking at these levels. If whales believed ETH was heading to $4,000 or $5,000 soon, they wouldn’t be selling at $3,300.

Instead, they’re treating this rally as an exit opportunity. That suggests they see limited upside potential or increased downside risk ahead. Either way, it’s not bullish.

Retail traders often miss these signals. They see price rising and assume momentum will continue. Meanwhile, smart money quietly exits. By the time retail realizes what happened, support breaks and the correction accelerates.

The Broader Market Context Matters Too

Ethereum doesn’t trade in isolation. Bitcoin recently showed weakness, and altcoins typically follow BTC’s direction with amplified volatility.

If Bitcoin continues struggling, Ethereum faces additional headwinds regardless of its own technical setup. Conversely, a strong Bitcoin bounce could lift ETH and invalidate the bearish divergence.

So watching BTC price action becomes critical for ETH traders right now. The correlation between major cryptocurrencies remains strong. Ethereum rarely sustains rallies when Bitcoin is falling.

Additionally, macro factors continue influencing crypto markets. Regulatory developments, institutional adoption trends, and traditional market performance all impact sentiment. These external forces can override technical patterns quickly.

What Traders Should Watch Next

The $3,287 support level is the line in the sand. A daily close below that level would confirm breakdown and likely trigger accelerated selling toward $3,131.

Conversely, a strong bounce that reclaims $3,400 would ease immediate pressure. But the divergence pattern doesn’t disappear overnight. It would take sustained buying pressure and whale accumulation to fully invalidate the bearish signal.

Also monitor on-chain metrics closely. If whale wallets stop selling and start accumulating, that changes everything. Capital inflows returning would rebuild the foundation for genuine upside.

For now though, the evidence points toward weakness. Bearish divergence, whale distribution, and fragile support create a dangerous combination. Bulls need to defend $3,287 aggressively or risk a much deeper correction.

Choose your positions carefully. This isn’t the time for blind optimism. The data tells a cautionary tale that’s hard to ignore.