Ethereum just kissed $4,000 and got smacked down. Again.

Yet crypto analysts keep sketching five-digit price targets for ETH. One projects $10,000. Another sees $13,500 by 2029. Meanwhile, larger wallets started buying back after weeks of selling.

So what’s the real story? Ether’s headed higher, but the path is measured in years, not months. Let’s break down what’s actually happening.

The $10,000 Question Nobody Wants to Answer

Analyst Ali Martinez dropped a long-term chart projecting ETH at $10,000. The catch? It won’t happen soon.

His weekly sketch shows a pullback into 2026, followed by a slow grind toward five digits around 2027 or 2028. That’s three to four years from now. Not exactly the hopium most crypto traders crave.

Plus, another analyst called The Long Investor set an even higher target. They’re eyeing $13,500 by 2029. Again, we’re talking about a multi-year timeline, not a quick moonshot.

These aren’t predictions for next quarter. They’re long-term outlooks that assume Ethereum clears major resistance levels first, then builds momentum over time. That’s a much different narrative than “ETH to $10K next month.”

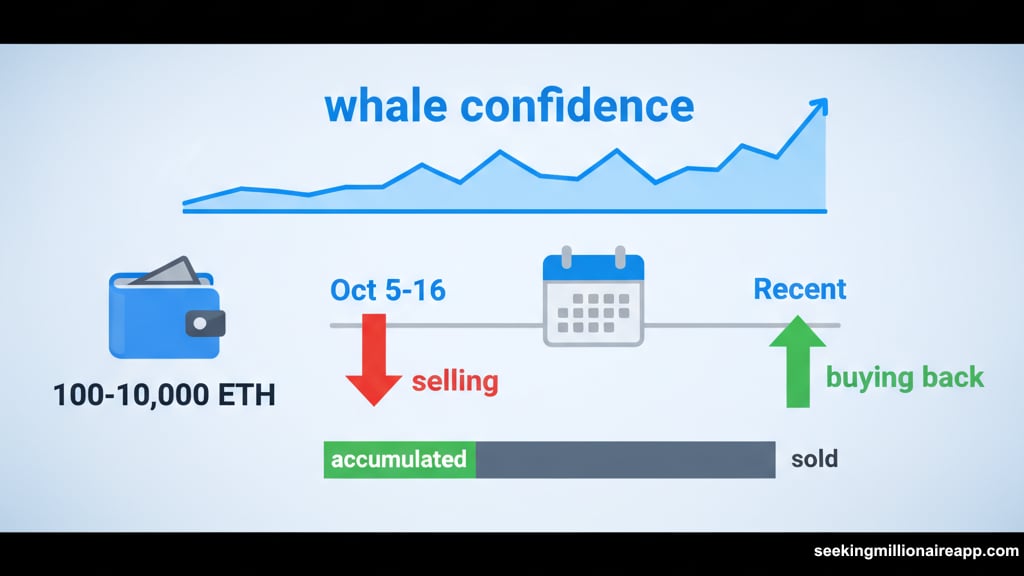

Whales Started Buying Again

Here’s the interesting part. On-chain analytics firm Santiment noticed something shifting.

Wallets holding 100 to 10,000 ETH started adding back coins. These “whales and sharks” had been dumping between October 5 and October 16. But recently they reversed course. In fact, they’ve already bought back about one-sixth of what they sold.

Santiment calls this a “sign of confidence” among larger holders. When big money stops selling and starts accumulating, that usually signals they expect higher prices ahead.

However, confidence doesn’t automatically translate to price action. ETH still needs to break through resistance before momentum can compound.

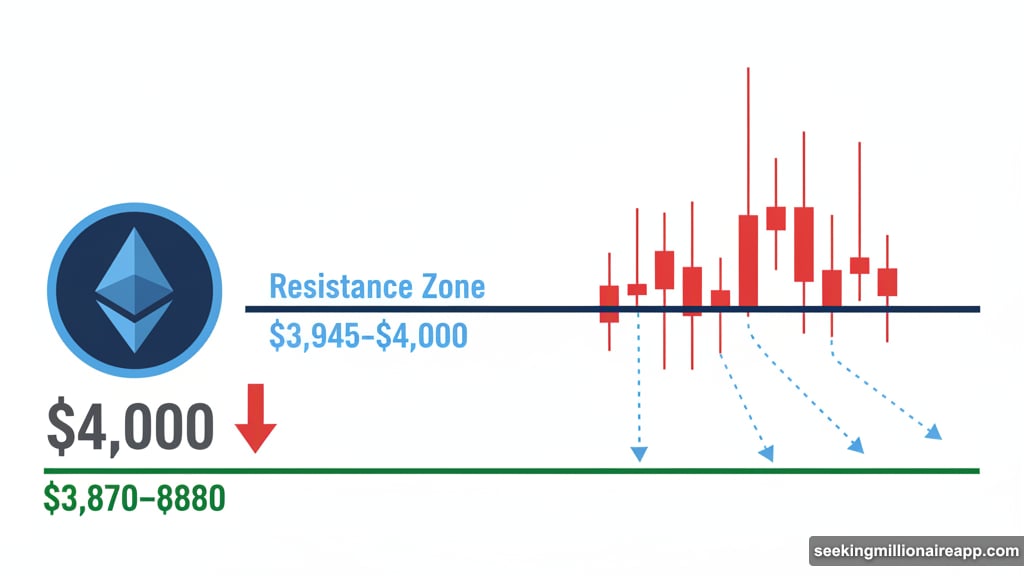

The $4,000 Problem That Won’t Go Away

Ethereum keeps getting rejected at the same level. Watch the recent price action closely.

ETH briefly touched $4,001.69 on October 25. Volume spiked 188% above the 24-hour average during that push. But sellers immediately capped the move. Price fell back and settled into a narrow range between $3,930 and $3,940.

Another attempt pushed toward $3,948, then faded without follow-through. The pattern is clear. Ether faces strong resistance between $3,945 and $4,000. Until it breaks and holds above that zone on daily closes, the multi-year bull case stays theoretical.

Moreover, support sits around $3,870 to $3,880. So ETH is coiling in a tight range beneath a ceiling it hasn’t cracked in weeks. That creates tension, but it doesn’t guarantee a breakout direction.

What Comes Next Depends on One Thing

The technical setup is simple. Break above $4,000 and hold, or fall back to support.

If ETH clears $4,000 decisively, the next target is $4,100. From there, early-month highs come back into view. That would validate the bullish structure and open the door for higher prices through the rest of 2025.

But if the immediate $3,930 shelf breaks instead, price likely drops to the $3,870-$3,880 demand zone. From there, bulls either defend or risk a deeper pullback that delays any five-digit scenarios even further.

The analyst projections don’t hinge on a single day’s price action. But near-term traction still matters. Converting high $3,900s into solid support would confirm that larger holders’ renewed buying is working.

Why This Takes Years, Not Months

Most crypto predictions ignore time frames. They throw out big numbers without context.

Martinez’s $10,000 target assumes Ethereum survives a 2026 pullback first. Then it climbs gradually over several years. That’s not a crash-and-pump cycle. It’s a maturation process.

Similarly, the $13,500 projection extends to 2029. That’s five years away. A lot can change in crypto over five years. New layer-2 solutions could eat Ethereum’s lunch. Regulatory pressure could slow adoption. Or institutional demand could accelerate faster than anyone expects.

The point is this. Long-term targets are useful for framing potential, but they don’t help you trade next week. They’re strategic outlooks, not tactical signals.

The Real Story Here

Ethereum sits at a crossroads. Larger holders are accumulating again after weeks of selling pressure. Analysts sketch ambitious long-term targets. But price remains stuck below $4,000 resistance.

So the bullish case exists, but it requires patience measured in years. If you’re looking for quick gains, ETH probably isn’t your play right now. If you’re willing to hold through volatility and wait for major resistance to give way, the multi-year outlook looks constructive.

Just remember. Projections are not promises. They’re scenarios based on assumptions that might not hold. Market structure can shift. Sentiment can collapse. Regulatory changes can derail everything.

The smart move? Watch that $4,000 level. If ETH breaks and holds above it, momentum could build. If it fails again, expect more sideways grinding or a test of support. Either way, $10,000 ether isn’t coming in 2025. It’s a 2027 or 2028 story, assuming everything goes right.