Ethereum just flashed the same technical pattern that triggered a massive rally back in May. Plus, whale wallets are loading up right before today’s Fusaka upgrade goes live.

History might be about to repeat itself. In fact, the setup looks eerily similar to what happened just before the Pectra upgrade, when ETH surged 56% in a single week. So the big question is: can Fusaka pull off the same trick?

The Pectra Playbook Is Happening Again

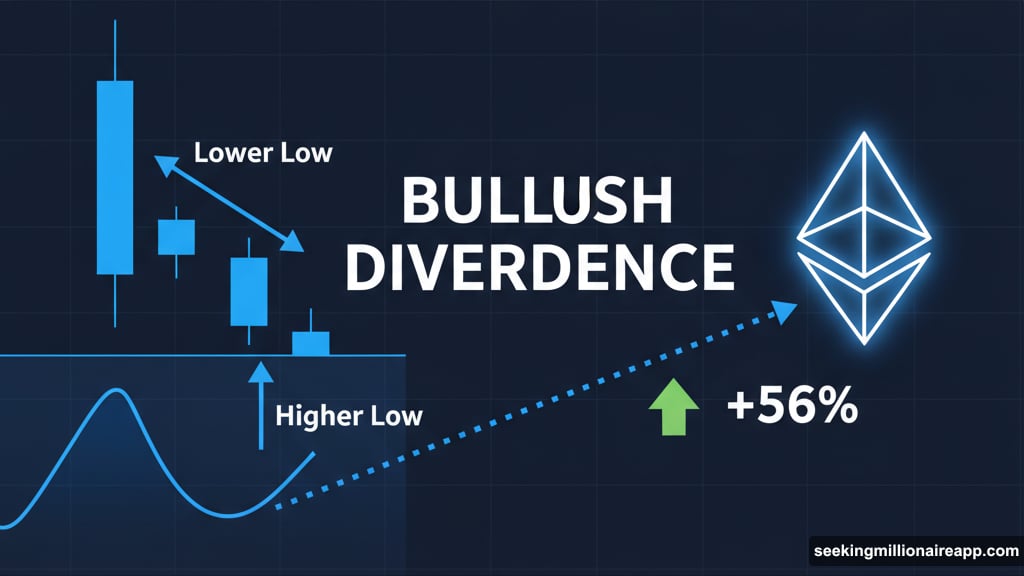

Remember May 2025? Ethereum ran from strength to strength during the Pectra upgrade phase. Between May 6 and May 13, ETH surged 56% after forming a bullish divergence pattern.

Here’s how that pattern works. Price makes a lower low, but RSI (Relative Strength Index) makes a higher low. It signals that sellers are losing control even when the chart still looks weak. Think of it as a trend reversal signal.

Now look at what’s happening right now. Between November 4 and December 1, ETH made a lower low. But RSI formed a higher low. That’s the exact same structure that appeared before Pectra launched on May 7.

So ETH is basically running the Pectra playbook all over again. And today’s Fusaka upgrade could be the catalyst that triggers the move.

Big Money Is Moving In

Technical patterns are one thing. But whale behavior tells another story. And the whales are accumulating hard.

The number of Ethereum addresses holding at least $1 million jumped from 13,322 to 13,945. That’s a 4.68% increase. Since each wallet holds a minimum of $1 million, this represents at least $623 million in fresh capital entering the network.

Big buyers don’t usually show up by accident. They accumulate ahead of major technical upgrades for a reason. Historically, that’s a constructive sign.

Moreover, this whale activity combined with the bullish divergence pattern builds a solid case. Fusaka could act as the spark that ignites a rally—if Ethereum breaks through one critical level.

One Price Level Decides Everything

Whether ETH delivers a Pectra-style extension depends entirely on clearing a single supply wall. Glassnode data reveals the heaviest near-term resistance between $3,154 and $3,179. About 2.76 million ETH sits in that zone.

This cluster aligns almost perfectly with the chart’s key resistance at $3,166. That’s not a coincidence. It’s where most short-term holders are sitting, waiting to sell.

A clean daily close above $3,166 would change the game. Here’s why. First, it would show that buyers absorbed the largest supply zone. Second, it would open room for a push toward $3,653.

But here’s where it gets interesting. If momentum mirrors the Pectra structure, a 56% rally from December’s lows would target roughly $4,262. That also matches a strong historical ceiling.

So breaking $3,166 isn’t just about clearing resistance. It’s about unlocking the path to a major move higher.

The Downside Risk Is Real

Nothing is guaranteed in crypto. And Ethereum’s structure weakens fast if support fails.

Below $2,996, the bullish case starts to crack. Losing that range exposes $2,873 as the next support level. If selling pressure expands, $2,618 becomes the deeper target to watch.

That’s why today matters so much. Fusaka goes live, whales are accumulating, and the technical setup mirrors Pectra. But ETH needs to break $3,166 to prove the bulls are in control.

Fusaka Changes How Ethereum Processes Transactions

So what exactly is Fusaka? It’s an upgrade that improves how efficiently Ethereum processes transactions. Think of it as optimization work under the hood.

Upgrades like this don’t always move markets. But when they land during strong technical setups with whale accumulation, they can act as catalysts. That’s what happened with Pectra. And it’s what could happen with Fusaka.

Meanwhile, Ethereum has already climbed over 13% since December 1. The broader market recovery helped. But the timing ahead of Fusaka suggests traders are positioning for something bigger.

Still, ETH remains down more than 17% over the past month. So this isn’t a runaway bull market yet. It’s a potential inflection point where momentum could shift dramatically—or fizzle out entirely.

The $3,166 Breakout Is Everything

All eyes should be on $3,166 today. That’s the line in the sand. Above it, ETH has room to run toward $3,653 and potentially $4,262 if the Pectra-like rally materializes.

Below $2,996, the bullish thesis weakens fast. And below $2,873, bears take control.

The technical pattern is set. The whales are positioned. Fusaka drops today. Now we wait to see if history repeats itself or if this setup falls apart.

Either way, the next few days will tell us everything we need to know about Ethereum’s near-term direction.