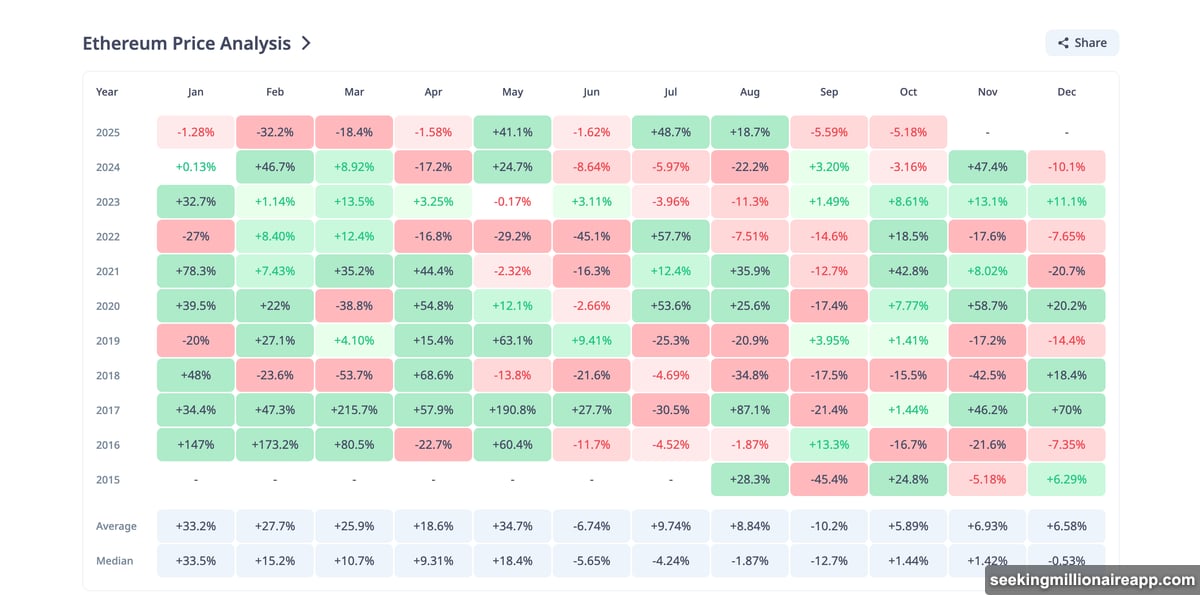

Ethereum just closed October down 6.8%. But history tells a different story for November.

The second-largest cryptocurrency has averaged nearly 7% gains each November over the past eight years. Last year’s performance was even better, posting a massive 47% surge. So despite recent weakness, November traditionally brings good news for ETH holders.

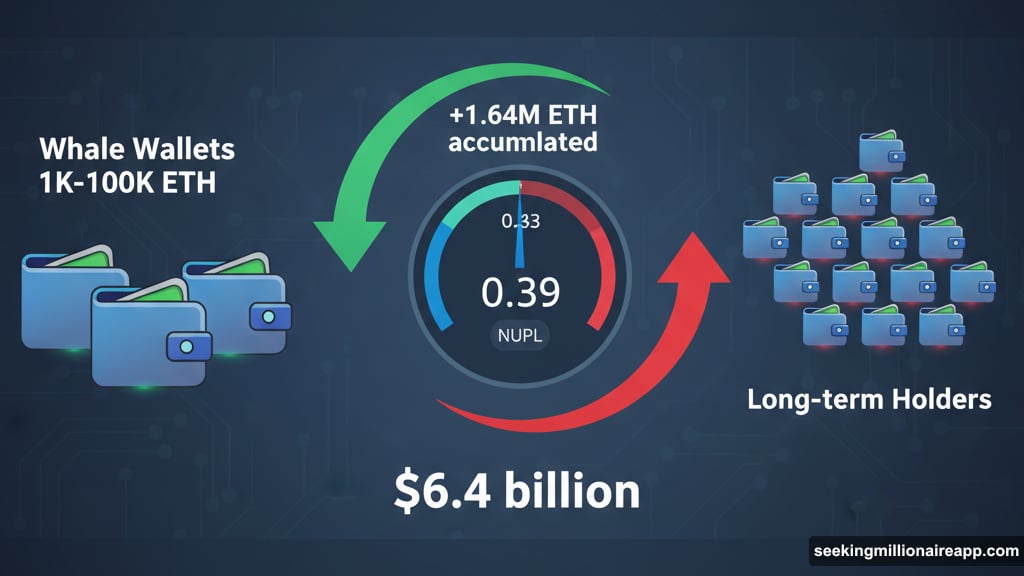

Plus, whale wallets quietly accumulated $6.4 billion worth of ETH during October’s decline. That kind of positioning often signals confidence before a rally. Meanwhile, technical indicators show sellers losing momentum, setting up a potential bounce toward $4,200 or higher.

Selling Pressure Fades as November Begins

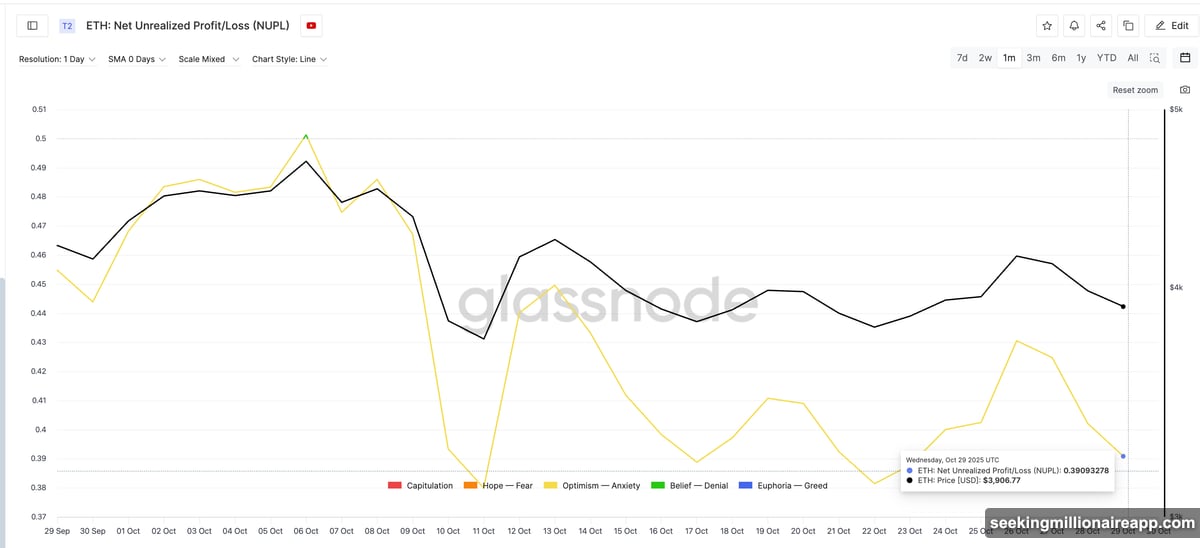

Ethereum’s Net Unrealized Profit/Loss (NUPL) metric dropped 9.3% since late October, falling from 0.43 to 0.39. That puts it near the monthly low of 0.38.

Why does this matter? NUPL measures whether investors hold profits or losses on their positions. Lower readings mean less incentive to sell. In fact, the last time NUPL hit 0.38, ETH rallied 13%, climbing from $3,750 to $4,240.

This pattern suggests investors who might have sold at higher profit levels are now holding steady. That reduction in selling pressure often precedes price stabilization or recovery.

Historical data backs this up. November has delivered positive returns in most years since 2017. The month averages 6.93% gains, with 2024’s 47.4% surge marking one of Ethereum’s strongest monthly performances ever.

But this year’s setup looks different. The dynamics playing out between major holders tell a more nuanced story.

Whales Keep Buying While Long-Term Holders Retreat

Large wallet addresses accumulated 1.64 million ETH throughout October. That’s roughly $6.4 billion at current prices, according to Santiment data.

These whale wallets, holding between 1,000 and 100,000 ETH, increased their collective balance from 99.28 million to 100.92 million ETH. They bought steadily even as the price declined 7% during the month.

However, long-term holders moved in the opposite direction. The Holder Accumulation Ratio (HAR) dropped from 31.27% to 30.45% since late October. HAR tracks how many addresses increase their balances versus those reducing positions.

This divergence creates an interesting dynamic. Whales appear confident enough to accumulate through weakness. Meanwhile, older ETH holders who’ve seen multiple market cycles are trimming exposure instead.

Shawn Young, Chief Analyst at MEXC, explained this shift in perspective. “Recalibration into higher-beta assets is expected to accelerate as Bitcoin stabilizes above support. Ether fits this positioning well, offering yield-earning potential through staking and strong upside due to adoption.”

That explains why sophisticated investors might be positioning early. Ethereum’s staking yields and growing tokenized infrastructure make it attractive as a growth asset. But retail holders seem to want more market confirmation before fully committing.

If the Holder Accumulation Ratio stabilizes this month, it could signal retail conviction catching up to institutional confidence. That alignment typically amplifies buying pressure.

Technical Setup Points to Potential Recovery

Ethereum’s 2-day chart shows a hidden bullish divergence forming. Between August 21 and October 28, the price made a higher low while the RSI indicator made a lower low.

This pattern indicates sellers are losing strength even though the price hasn’t broken out yet. It’s a classic setup that often precedes upward moves, especially when combined with whale accumulation.

Currently, ETH trades near $3,860. Immediate resistance sits at $4,070, with the more significant barrier at $4,240. Breaking above $4,240 could open the path toward $4,620, the upper end of Ethereum’s long-term price channel.

Young highlighted similar price zones. “A break above $4,200 could open the path toward $4,500–$4,700, while rejection may simply prolong accumulation.”

These levels align with Ethereum’s current technical structure. The $4,200 to $4,240 zone serves as the critical confirmation point. A decisive close above it would validate the bullish scenario and target the $4,500–$4,700 range.

Support levels remain solid below current prices. The first line of defense sits at $3,790, with stronger support at $3,510. Falling below $3,510 would invalidate the bullish outlook and suggest deeper correction ahead.

But the combination of hidden divergence and whale accumulation favors gradual recovery. Young reinforced this view: “The macro structure appears constructive — the network continues to scale, transaction demand remains robust, and staking keeps absorbing supply pressure.”

Fundamental Strength Supports Technical Picture

Ethereum’s network fundamentals continue improving despite price volatility. Transaction demand stays strong, with daily active addresses and transaction counts holding steady.

Staking continues absorbing supply from the market. Over 34 million ETH is now locked in staking contracts, removing nearly 28% of total supply from circulation. This creates constant buying pressure as new stakers enter.

Moreover, Ethereum’s expanding role in tokenized assets adds long-term value. Major financial institutions are building tokenization platforms on Ethereum, from bonds to real estate. This institutional adoption provides a fundamental floor under the asset.

The network also completed several upgrades improving scalability and reducing costs. These technical improvements make Ethereum more attractive for developers and users alike.

So while short-term price action remains uncertain, the underlying fundamentals keep strengthening. That mismatch between price weakness and fundamental strength often resolves upward once sentiment shifts.

November Could Test Ethereum’s Historical Pattern

Ethereum enters November with mixed signals but favorable historical odds. The month has delivered gains in most years, with last November’s 47% rally standing out.

This time, whale accumulation and fading selling pressure create a similar setup. However, long-term holder caution adds uncertainty to the equation.

The technical picture leans bullish if support holds. A break above $4,240 could trigger the next leg higher toward $4,500 or beyond. But failure to hold $3,510 would suggest more consolidation ahead.

Young’s assessment captures the current moment well. “Either way, the macro structure appears constructive.” The network keeps growing, demand stays robust, and staking reduces available supply.

Whether November repeats its historical pattern depends on how these dynamics resolve. Whales are betting on strength. The question is whether broader market participants will join them or wait for more confirmation.

Based on current positioning and technical setup, Ethereum has the ingredients for a November rally. The challenge is converting that potential into actual price gains as the month unfolds.