Ethereum just lost 6% in 24 hours. Now it’s stuck below the $3,000 mark that everyone’s been watching.

But here’s the real story. The people who held ETH through everything are selling. Meanwhile, fresh investors are rushing in to fill the gap. So who wins this tug-of-war determines where Ethereum goes next.

Long-Term Holders Just Ditched Their Bags

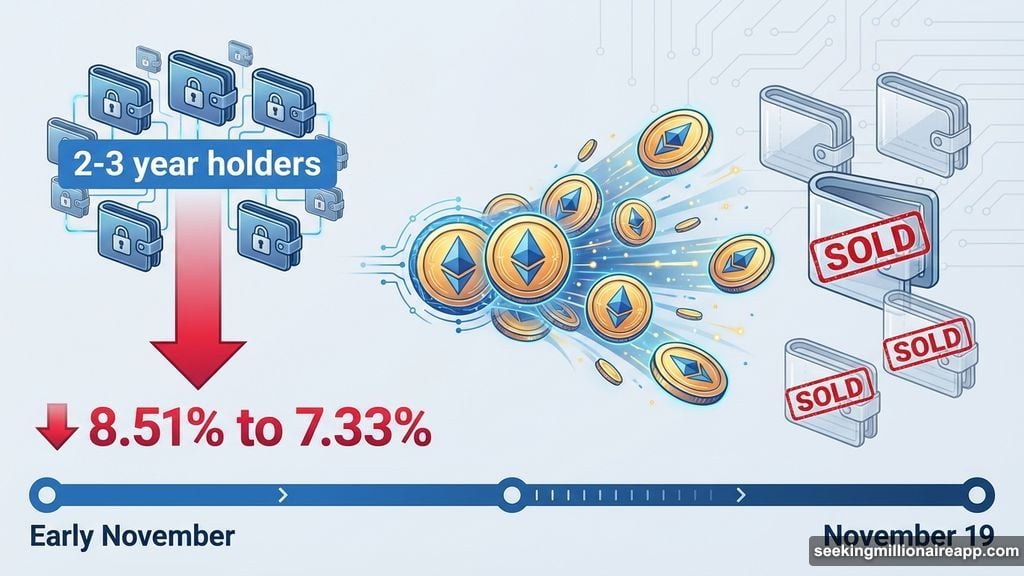

The data tells a brutal story. Ethereum holders who’ve kept their coins for 2-3 years started selling hard in early November. By November 19, they’d dumped enough to shrink their share from 8.51% to 7.33% of total supply.

That’s a massive exit. These aren’t day traders or speculators. These are the believers who held through bear markets and regulatory uncertainty. When they sell, it matters.

Moreover, they haven’t come back. Their positions stayed flat after the November selloff. So Ethereum lost its most stable source of demand just when it needed support most.

Think about what that means. The investors who understood Ethereum best decided the risk wasn’t worth it anymore. They took their profits and left. Now the market has to find someone else to hold those coins.

New Money Is Rushing In

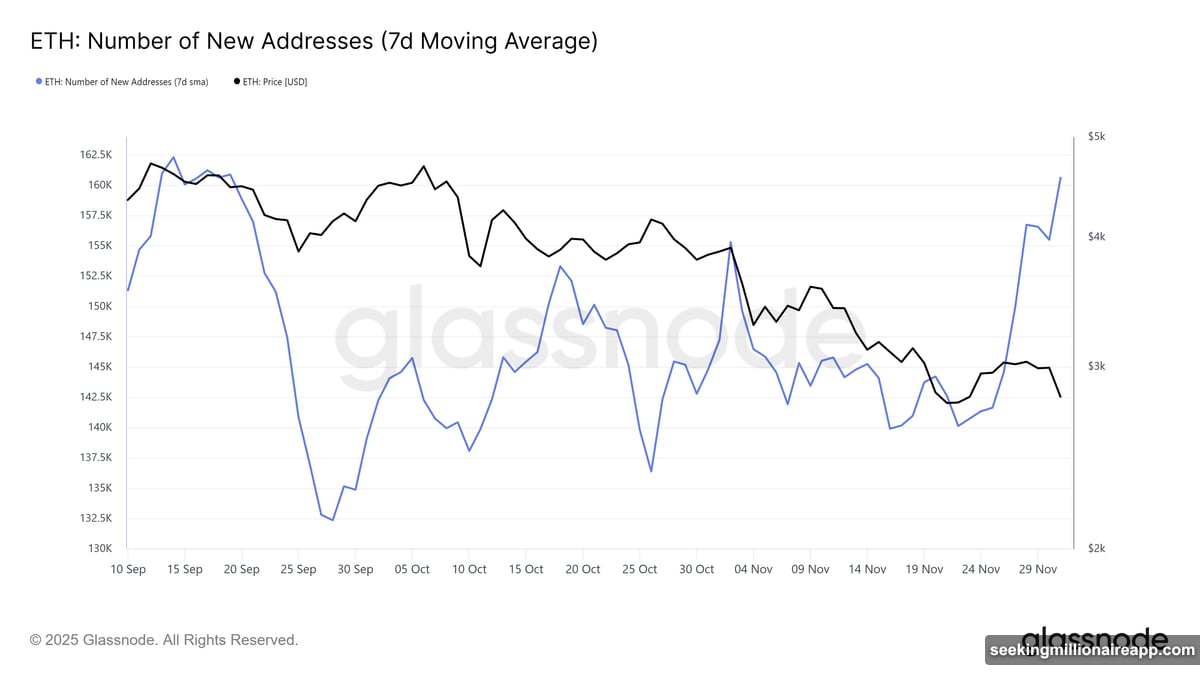

Here’s where it gets interesting. New Ethereum addresses jumped 13.4% last week, climbing from 141,650 to 160,690. That’s the biggest weekly spike in over two months.

Fresh addresses usually mean fresh capital. New investors see opportunity where veterans saw risk. Plus, they’re buying at lower prices after the recent drop, which could work in their favor.

But there’s a catch. New holders tend to be less stable than long-term believers. They panic easier. They chase trends faster. So this surge in new addresses might stabilize prices short-term without providing the foundation Ethereum needs for a real rally.

Still, it’s better than nothing. Without these new buyers, Ethereum would’ve dropped much harder when the long-term holders bailed.

The $3,000 Wall Keeps Blocking Progress

Ethereum is trading at $2,805 right now. That puts it just below the $2,814 resistance level it needs to break through.

The $3,000 mark looms larger. It’s both psychological resistance and a technical barrier that’s rejected ETH multiple times recently. Breaking through requires serious buying pressure that hasn’t materialized yet.

So here’s what could happen next. If new addresses keep growing and demand stays strong, Ethereum might finally punch through $3,000. From there, it could test $3,131 and potentially $3,287. That would flip the narrative back to bullish.

However, if the influx of new holders slows down, Ethereum will probably drift sideways between $2,814 and $3,000. Or worse, it could retest lower support levels if selling pressure returns.

The Real Problem Nobody’s Solving

Long-term holder supply dropped from 8.51% to 7.33%. That’s about 1.18% of Ethereum’s total supply that changed hands. At current prices, we’re talking billions of dollars worth of ETH.

New addresses are increasing, which is encouraging. But can they absorb that much supply? Probably not quickly enough to prevent further price weakness.

Plus, market conditions aren’t helping. Bitcoin’s recent volatility has dragged altcoins down. Regulatory uncertainty continues to weigh on investor confidence. And Ethereum’s own scaling challenges remind everyone that technical progress takes time.

So Ethereum sits in this awkward middle ground. It’s not crashing hard enough to scare away all the new buyers. But it’s not rallying strongly enough to bring back the believers who left.

The next few weeks will reveal whether new holders can fill the gap left by long-term investors. Or whether Ethereum needs those veterans to come back before it can reclaim the $3,000 level and push higher.