Ethereum crashed hard. Most major holders now sit on paper losses. Yet nobody seems to be panic-selling.

The second-largest cryptocurrency lost over 30% this year. It fell below $2,000 last week, briefly recovered, then collapsed again. Now it trades at $1,971.

Here’s the strange part. Despite the pain, big money keeps accumulating.

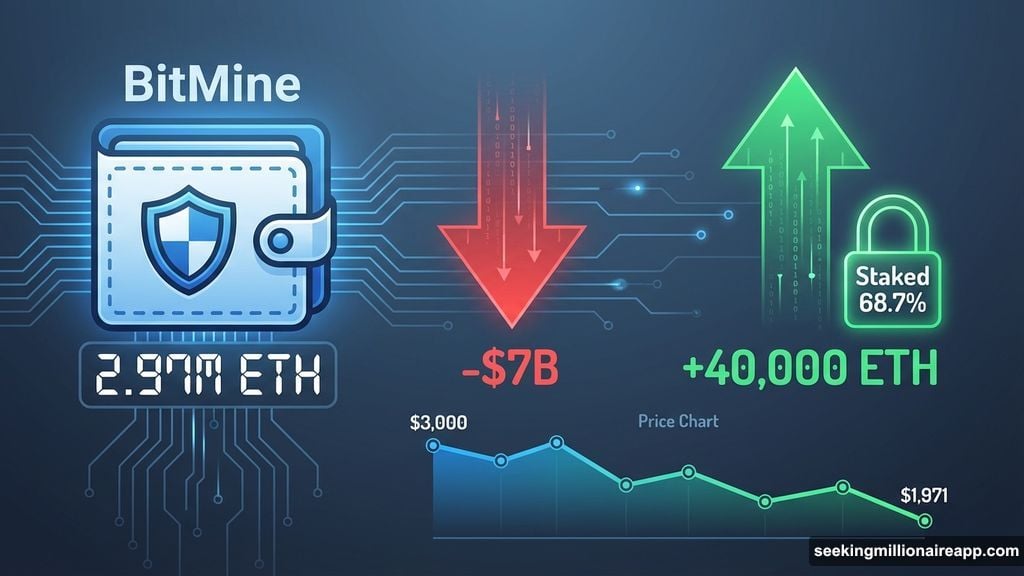

BitMine’s $7 Billion Loss Keeps Growing

BitMine holds the world’s largest Ethereum treasury. Their unrealized losses just crossed $7 billion.

Think about that number. Seven billion dollars in red ink. Most companies would liquidate positions and cut losses. Instead, BitMine bought 40,000 more ETH yesterday.

Plus, they staked another 140,400 ETH. That brings their total staked holdings to 2.97 million ETH, worth $6.01 billion. They’ve now locked up 68.7% of their entire Ethereum position.

This signals long-term conviction, not short-term trading. BitMine clearly expects Ethereum to recover, even as prices keep falling.

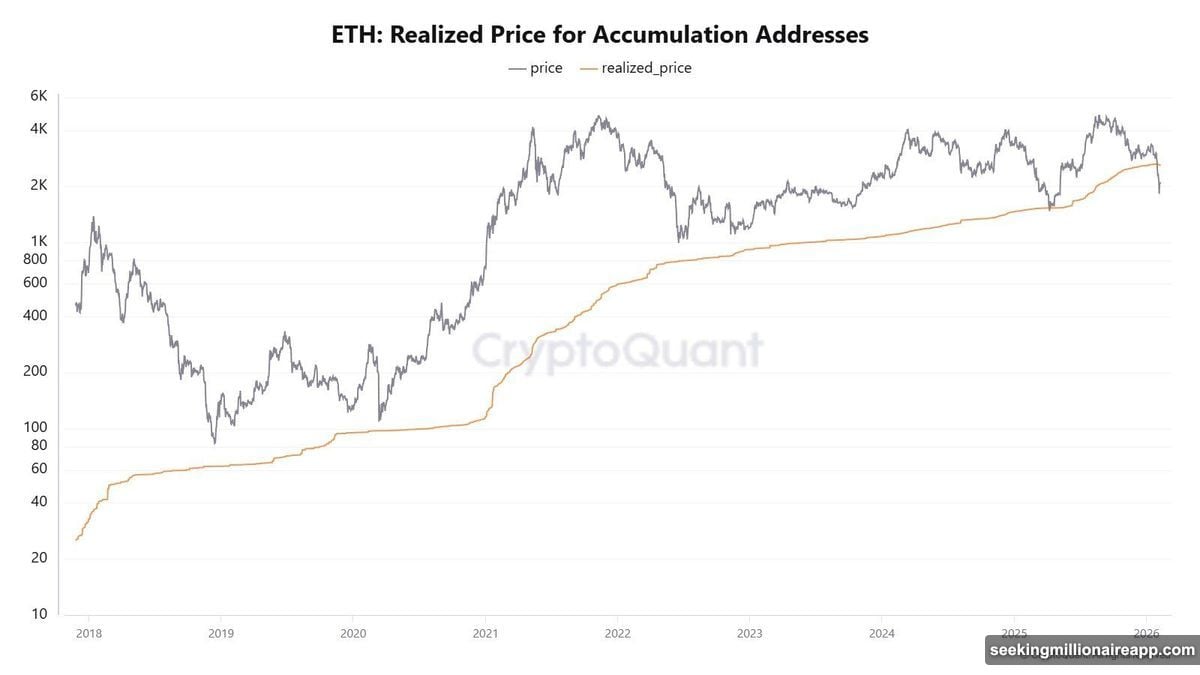

Whale Accumulation Started at Higher Prices

Large wallets began building Ethereum positions in June 2025. Back then, prices looked much better. Now those same addresses sit underwater.

CryptoQuant analyst CW8900 noted that Ethereum trades below the realized price of accumulation addresses. That means the current market price sits below the average entry point where whales started buying.

Most investors would stop accumulating after going negative. But whales are doing the opposite. In fact, their buying has intensified.

“Their accumulation is proceeding even more aggressive. The current price will likely appear attractive to ETH whales,” CW8900 explained.

So while retail investors might be panicking, sophisticated holders see opportunity in the dip.

ETF Investors Face Worse Pain Than Bitcoin Holders

Ethereum ETF investors have it particularly rough. The asset now trades well below their average cost basis of approximately $3,500.

James Seyffart from Bloomberg Intelligence highlighted the severity. ETF holders experienced a drawdown exceeding 60% at the recent bottom. That matches the brutal April 2025 correction.

Bitcoin ETF investors suffered too, but not this badly. Their losses look modest compared to Ethereum’s collapse.

Yet despite the pain, most ETF holders aren’t selling. Net inflows into Ethereum ETFs dropped from roughly $15 billion to below $12 billion. That represents selling, sure. But the majority of positions remain intact.

“This is a much worse selloff than the Bitcoin ETFs on a relative basis but still fairly decent diamond hands in grand scheme (for now),” Seyffart observed.

So even retail ETF investors show surprising resilience.

Exchange Flows Suggest Continued Accumulation

On-chain metrics support the accumulation narrative. Ethereum’s exchange net position change indicator turned negative recently.

More ETH is leaving exchanges than being deposited. Investors typically move coins off exchanges when they plan to hold long-term. Selling requires keeping assets on exchanges for easy access.

This pattern contradicts what you’d expect during a 30% drawdown. Fear usually drives deposits to exchanges, not withdrawals. Instead, holders appear to be moving Ethereum into cold storage.

The data suggests conviction despite obvious short-term pain.

Why Big Money Keeps Buying

The behavior seems irrational at first glance. Why accumulate a falling asset?

Several factors might explain the continued buying:

First, institutional timelines differ from retail. Individual investors panic over monthly or weekly losses. Institutions think in years or decades. A 30% drawdown barely registers for long-term holders.

Second, cost averaging makes sense at these levels. If you believe Ethereum eventually recovers, buying at $1,971 lowers your average entry price. BitMine clearly follows this strategy.

Third, staking rewards offset some losses. BitMine’s massive staked position generates yield. That partially compensates for paper losses while waiting for price recovery.

Finally, capitulation hasn’t happened yet. True market bottoms usually coincide with mass selling from strong hands. We’re seeing the opposite right now.

The Risk Nobody Talks About

Here’s what worries me. Sustained accumulation during downturns can indicate conviction. But it can also signal stubborn refusal to accept reality.

What if Ethereum doesn’t recover quickly? What if it trades sideways at these levels for years? Patient capital might eventually lose patience.

Moreover, staking introduces lock-up risk. BitMine’s 2.97 million staked ETH can’t be sold immediately during a sudden crash. That provides price stability on one hand. But it also creates forced diamond hands.

The strategy works brilliantly if Ethereum recovers. It looks foolish if prices keep falling.

Technical Levels to Watch

Ethereum needs to reclaim $2,000 and hold it as support. That level flipped from support to resistance last week. Until it flips back, bulls remain in trouble.

The next major support sits around $1,800. Breaking below that would likely trigger accelerated selling, even from current holders.

On the upside, clearing $2,200 would suggest the worst is over. But that requires breaking through significant resistance built during this drawdown.

For now, Ethereum trades in a dangerous zone. Low enough to hurt holders. But not low enough to trigger full capitulation.

What Comes Next

The current situation creates an interesting standoff. Prices reflect real stress. But capital behavior suggests major participants expect recovery.

Retail investors face tough decisions. Following whale strategies might make sense. Or it might mean catching a falling knife alongside institutional investors who can afford bigger losses.

Short-term, Ethereum likely continues chopping around $2,000. Broader crypto market conditions will determine whether it bounces or breaks lower.

Long-term, the whale accumulation narrative provides hope. But hope doesn’t equal strategy. Until Ethereum reclaims key technical levels, the downside risk remains very real.

Big holders show impressive conviction. Whether that conviction proves justified depends entirely on what happens next.