Ethereum can’t catch a break. ETFs just logged $110 million in fresh money. But institutions dumped over $630 million in the same week.

That’s not a mixed signal. That’s two completely different investor groups making opposite bets on ETH’s future. One thinks the dip below $3,000 is a bargain. The other thinks it’s just the beginning of more pain.

So which side is right? Let’s follow the money and see what it tells us about where Ethereum heads next.

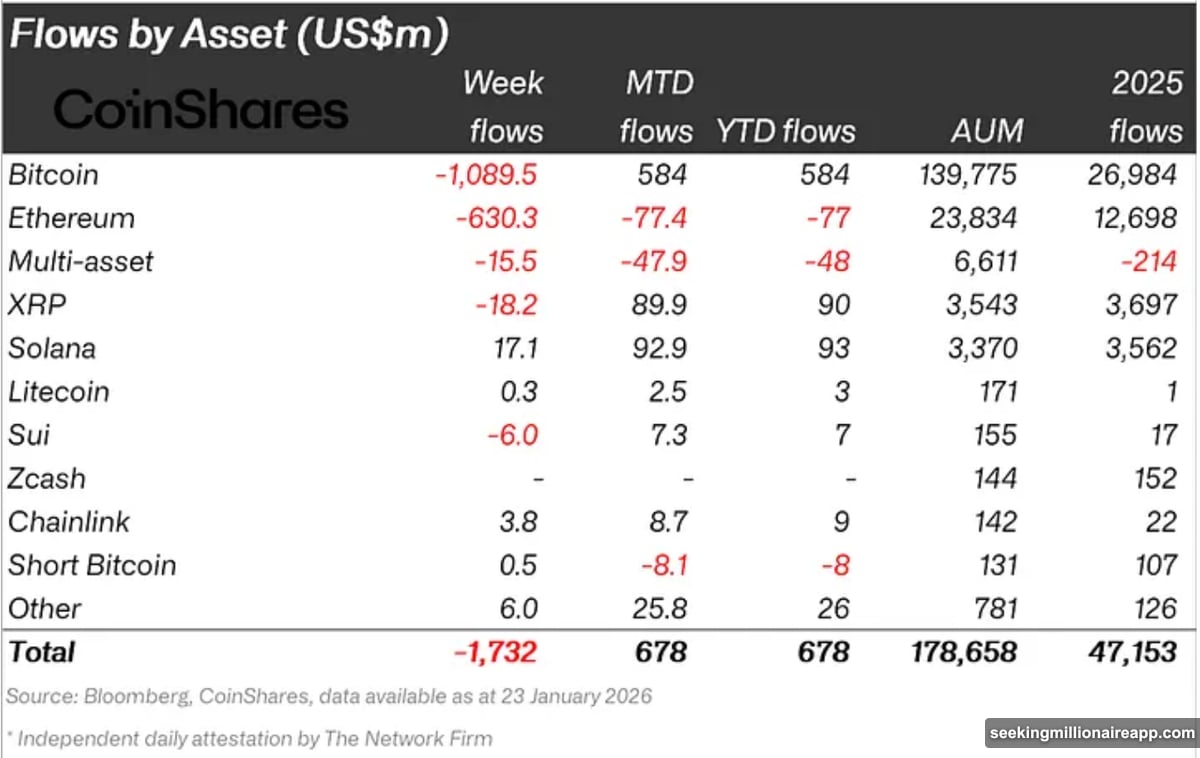

The Big Money Is Running Away

Institutions pulled $630 million out of Ethereum in the week ending January 23. That’s not profit-taking. That’s panic selling disguised as risk management.

This exodus wiped out earlier gains entirely. Month-to-date flows now sit at negative $77.4 million. Among major digital assets tracked, Ethereum posted the worst performance. Not just bad. The absolute worst.

Why does this matter? Institutional flows shape medium-term trends. These aren’t retail traders flipping coins on lunch breaks. These are funds with research teams, risk committees, and quarterly reporting requirements.

When they exit aggressively, they’re usually responding to something concrete. Maybe macro uncertainty. Maybe relative underperformance compared to other crypto assets. Maybe both.

Here’s the uncomfortable truth. If institutions stay defensive, Ethereum faces continued pressure. They control enough capital to influence liquidity conditions and price direction. Their absence creates a vacuum that retail enthusiasm rarely fills on its own.

But ETFs Tell a Different Story

Spot Ethereum ETFs recorded $110 million in inflows this week. That’s after bleeding $609 million the previous week. The reversal is significant.

ETF buyers typically think in longer time frames. They’re not day trading. They’re building positions based on multi-month or multi-year outlooks. This group sees Ethereum’s recent weakness as a setup, not a breakdown.

The inflows suggest growing confidence that ETH’s recovery remains viable despite short-term volatility. Plus, ETF flows often precede broader market moves. If this momentum continues through the week, it could stabilize price action and reduce immediate downside risk.

However, the contrast with institutional outflows creates tension. Two sophisticated investor groups are making opposite calls. That division usually means someone is about to be very wrong. The next few weeks will reveal which side read the market correctly.

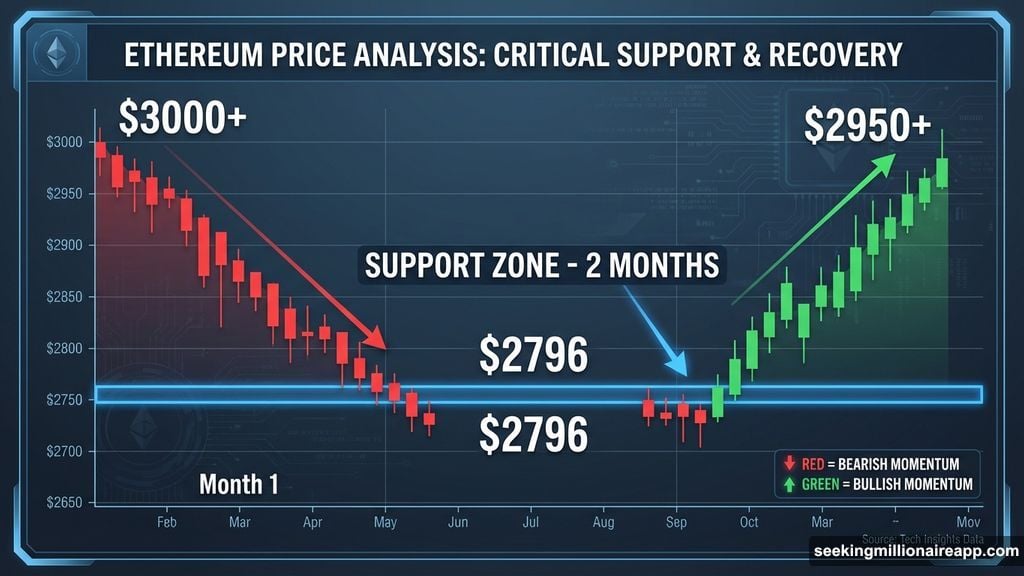

ETH Price Defends Critical Support

Ethereum dropped to $2,796 over the weekend. That support zone has held for more than two months now. Buyers stepped in again, pushing ETH back toward $3,000.

The repeated defense matters. Each time this level holds, it gains credibility. Traders start treating it as a line in the sand. Break below, and sentiment shifts fast. Hold above, and confidence builds for the next leg up.

If ETF inflows stay positive, Ethereum could reclaim bullish momentum. A clean break above $3,000 would improve sentiment immediately. The next target sits at $3,085. Clearing that resistance opens the path toward $3,188 and signals that recovery has real strength behind it.

But the downside scenario is equally plausible. If momentum stalls here, renewed selling pressure becomes likely. A drop back toward $2,796 would undermine recent buyer confidence. That would invalidate the bullish thesis and delay any sustained recovery attempt.

Why This Split Matters More Than You Think

Institutional exits and ETF inflows don’t usually happen simultaneously. When they do, it highlights fundamental disagreement about near-term direction.

Institutions might be overreacting to macro fears. Or they might be ahead of the curve, seeing weakness retail investors haven’t priced in yet. ETF buyers could be positioning brilliantly for a rebound. Or they could be catching a falling knife.

The truth is, nobody knows for certain. But the divergence tells us something important. Ethereum is at an inflection point. The next sustained move will likely be decisive, not gradual.

For traders, that means managing risk carefully. For long-term holders, it means watching which narrative wins. Does institutional caution prove justified? Or do ETF buyers look smart in hindsight?

The answer determines whether ETH defends $3,000 or breaks down toward deeper support levels. Watch the flows. They’ll tell you which group read the situation correctly before price confirms it.