Ethereum can’t catch a break. The second-largest cryptocurrency hovers around $3,846 while investor confidence crumbles fast.

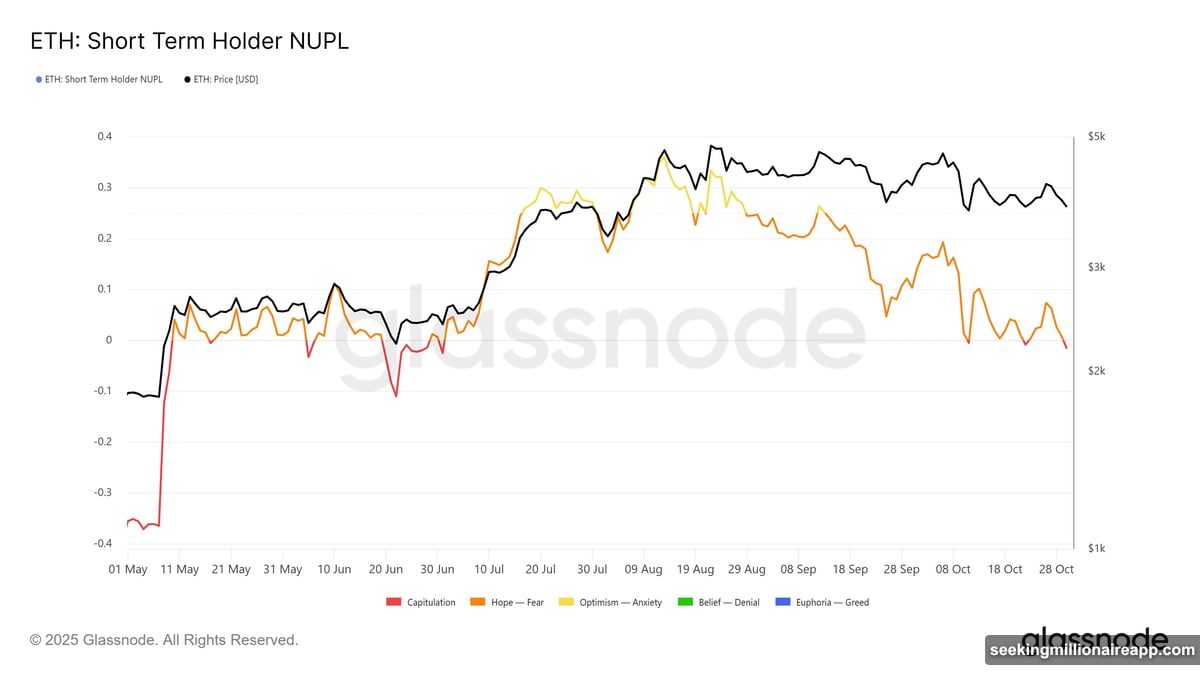

Market data reveals something troubling. The Net Unrealized Profit/Loss metric just entered capitulation territory. That’s trader-speak for “everyone’s underwater on their positions.” Plus, sentiment readings hit nine-month lows. Translation? Nobody wants to touch ETH right now.

But here’s where it gets interesting. Short-term holders might inadvertently trigger a bounce. Not because they’re bullish. Because they refuse to lock in losses.

Capitulation Zone Signals Oversold Conditions

NUPL metrics don’t lie. When they dip into capitulation, prices typically hit rock bottom before bouncing. Ethereum’s NUPL just crossed that threshold.

This zone historically precedes short-term rebounds. Why? Because when enough investors panic simultaneously, selling pressure eventually exhausts itself. Then even modest buying can push prices higher.

Ethereum experienced this exact pattern twice already this month. Both times, oversold readings sparked brief rallies before momentum faded. So another temporary recovery seems possible if the pattern holds.

However, these bounces rarely last long. They’re relief rallies, not trend reversals. Short-term holders take profits quickly. That selling pressure caps any significant upside movement.

Short-Term Holders Might Resist Selling

Here’s the psychology driving potential rebounds. Short-term holders bought ETH recently. Many sit on losses right now. Nobody enjoys realizing losses.

So these investors often hold stubbornly, hoping prices recover enough to break even. That resistance to selling at a loss can temporarily stabilize prices or trigger modest bounces.

Think of it as collective denial. Enough traders refusing to capitulate creates temporary support levels. Those support levels enable brief price recoveries before reality sets in again.

Yet this strategy only works if enough holders maintain conviction. Once that conviction cracks, selling accelerates rapidly. Then support levels collapse and prices drop harder.

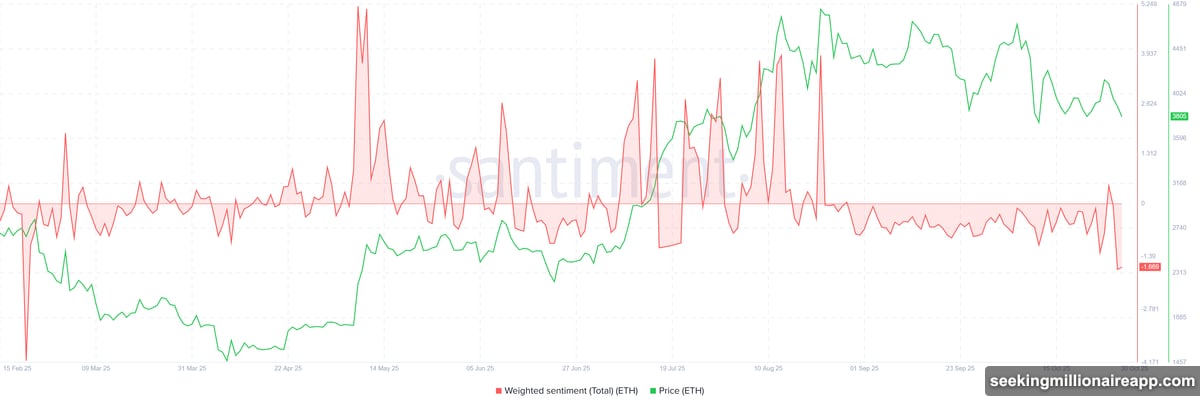

Weighted Sentiment Hits Nine-Month Low

Macro sentiment tells a darker story. Ethereum’s weighted sentiment just reached its weakest level since February. That’s genuinely concerning.

Weighted sentiment measures overall market mood across social media and trading platforms. Current readings show overwhelming bearishness. Traders aren’t excited about Ethereum’s prospects. They’re actively pessimistic.

This negativity typically reflects exhausted buying activity. When sentiment drops this low, new long positions dry up. Existing holders start questioning their positions. The result? Mounting selling pressure that overwhelms any relief bounce attempts.

Moreover, prolonged bearish sentiment makes recovery significantly harder. Even good news struggles to move prices when overall mood stays negative. So Ethereum faces headwinds beyond just technical levels.

ETH Remains Stuck in Consolidation Range

Ethereum currently trades in a tight range between $3,802 and $4,154. That’s where prices have bounced for weeks now. Low volatility defines the current environment.

This consolidation could persist longer. Neither bulls nor bears have enough conviction to break the range decisively. Instead, ETH just chops sideways between support and resistance levels.

If short-term momentum returns, Ethereum might retest the $4,154 resistance. Breaking above that level would invalidate bearish scenarios. It would signal that buyers finally regained control.

But that seems increasingly unlikely given current sentiment. More probable? Continued sideways movement until something breaks the stalemate.

Support Loss Could Trigger Deeper Drop

Here’s where things get dicey. Ethereum holds just above critical $3,802 support right now. Losing that level would confirm bearish momentum and likely accelerate selling.

A breakdown below $3,802 opens the door to $3,742 next. From there, $3,500 becomes the probable target. That’s roughly 9% downside from current levels.

Such a move would invalidate any bullish thesis entirely. It would signal that Ethereum’s consolidation was just a pause before resuming the downtrend. Plus, it would likely drag other altcoins lower alongside ETH.

Support levels matter psychologically. Once they break, selling often accelerates as stop-losses trigger and momentum traders pile on. That creates cascading price declines that overshoot technical targets.

Two Scenarios, Neither Particularly Bullish

So what happens next? Two possibilities exist. Neither looks great for ETH holders.

Scenario one: Short-term holders resist selling, creating temporary buying pressure. ETH bounces modestly toward $4,000-$4,150. Then momentum fades as sellers return. Prices drift back toward current levels or lower.

Scenario two: Support at $3,802 breaks on continued selling pressure. ETH drops toward $3,742 and potentially $3,500. Bearish sentiment deepens. Recovery becomes significantly harder.

Notice what’s missing? Any genuine bullish scenario. That’s because current conditions don’t support sustained upside. Sentiment is too negative. Momentum is too weak. Support levels look fragile.

The best realistic outcome? A brief dead cat bounce before more sideways or downward movement. The worst outcome? A breakdown that confirms deeper weakness ahead.

Ethereum needs a catalyst to break this pattern. Without one, the path of least resistance points sideways to lower. That’s frustrating for holders but honest about current market dynamics.

Choose your positions carefully. This market rewards patience over conviction right now.