Ethereum is sitting below $2,000, and the average holder is losing money. Yet one major player just dropped tens of thousands of ETH into their portfolio. That’s either brilliance or stubbornness — and the data might tell us which.

BitMine has been quietly making the case that this drawdown is actually a setup for serious upside. Their reasoning isn’t based on gut feeling. It comes from on-chain data, historical cycle analysis, and some pretty compelling numbers around realized price and recovery rates.

So what exactly are they watching? And should the rest of us be paying attention?

Realized Price Shows How Deep the Pain Really Goes

Let’s start with the metric at the center of BitMine’s thesis: Ethereum’s realized price.

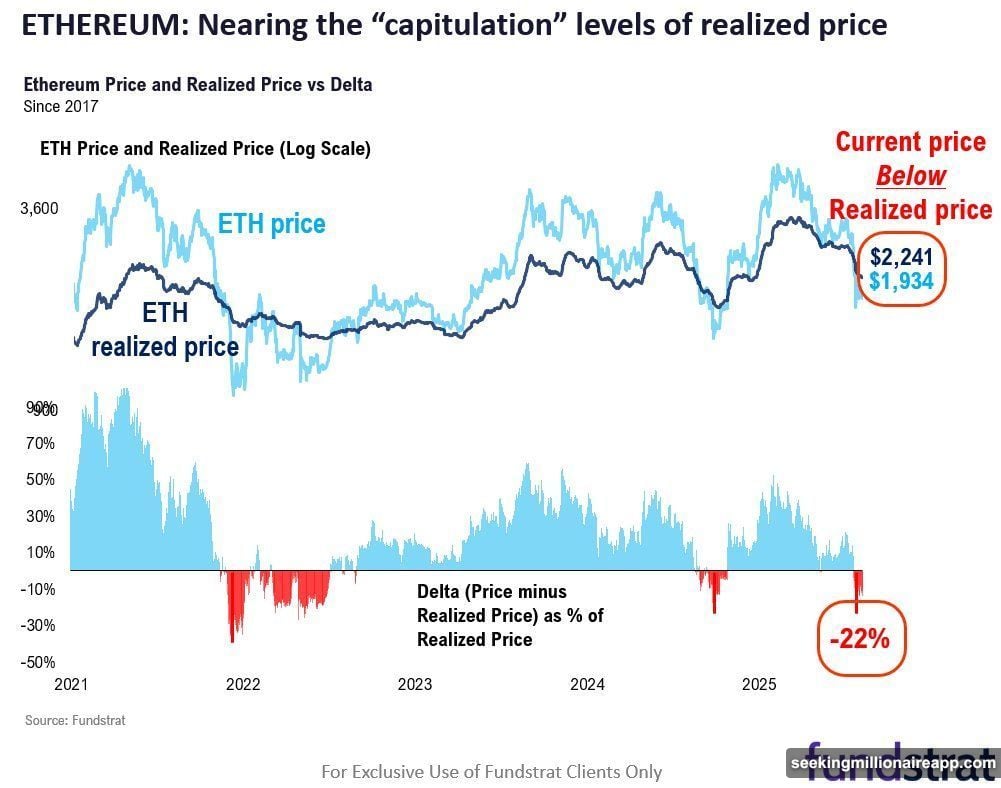

Realized price is an on-chain valuation metric. It shows the average acquisition cost across all ETH currently in circulation. Think of it as the market’s collective cost basis — the price at which the average holder bought in.

Right now, that number sits at $2,241. With ETH trading around $1,934, the average investor is sitting on a loss of about 22%. That’s not just a bad week. That’s meaningful financial pain spread across the entire holder base.

But here’s where it gets interesting. BitMine’s analysis, drawing on research from Fundstrat’s Head of Digital Asset Strategy Sean Farrell, points out that this level of drawdown below realized price is historically rare — and historically significant.

The 9th Decile Signal Most Traders Miss

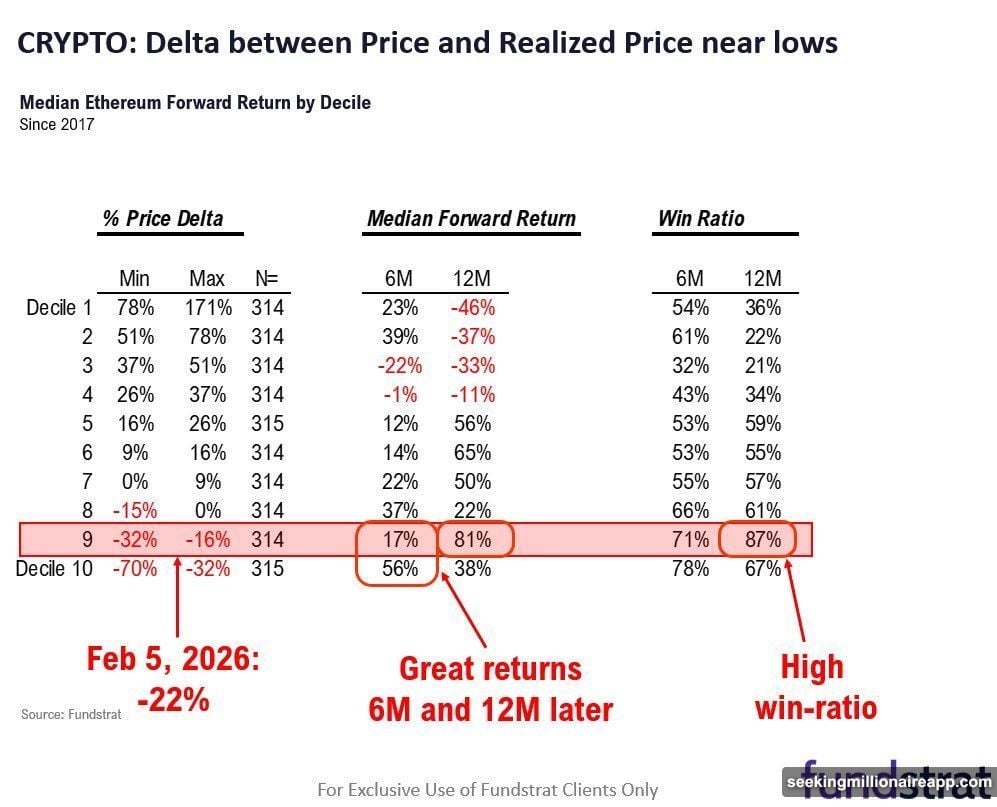

Farrell’s research uses a decile framework to put current conditions in context. Decile analysis splits historical data into ten equal groups ranked by severity. The 9th decile represents some of the most extreme readings ever recorded.

Ethereum’s current drawdown from realized price falls squarely in that territory.

So what happens next, historically speaking? The data is striking. When ETH has landed in the 9th decile of realized-price drawdowns, the median 12-month forward return comes in at roughly 81%. The win rate — meaning how often ETH traded higher one year later — sits at 87%.

That’s not a guarantee. But it’s a strong statistical lean.

“Is this the bottom? Seems like we are closing in on that low. Looking beyond the near-term, the risk/reward for ETH is positive,” the BitMine post on X noted.

For context, the analysis also modeled potential floor scenarios. Using the 2022 bear market, where ETH fell as much as 39% below its realized price, the implied low would be around $1,367. Using 2025’s milder 21% discount as the reference point, that floor rises to approximately $1,770.

Neither scenario is comfortable. But both suggest the worst-case math is becoming more bounded.

Tom Lee’s V-Shape Playbook

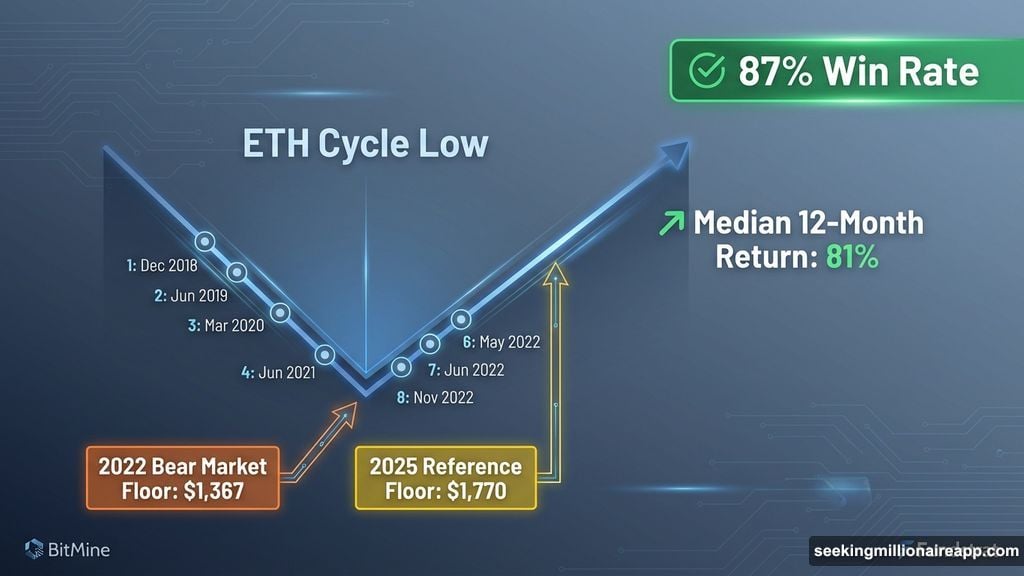

BitMine Chairman Tom Lee has been leaning into a specific historical pattern: Ethereum’s tendency to stage sharp V-shaped recoveries from major cycle lows.

Since 2018, ETH has experienced eight separate declines of 50% or more from local highs. That’s roughly one devastating correction per year. And after each one, the asset recovered — often aggressively.

The most recent example came in 2025. Ethereum fell 64% between January and March of that year. Then it bounced hard.

“ETH sees V-shaped recoveries from major lows. This happened in each of the 8 prior declines of 50% or more. A similar recovery is expected in 2026,” Lee said. “The best investment opportunities in crypto have presented themselves after declines. Think back to 2025 — the single best entry points in crypto occurred after markets fell sharply due to tariff concerns.”

Lee’s point is that the pain itself creates the opportunity. Capitulation levels tend to mark turning points. And by multiple measures, ETH is approaching territory where previous cycles have turned around.

BitMine Has Skin in the Game — A Lot of It

This is where things get genuinely remarkable. BitMine isn’t just talking about Ethereum’s recovery potential. They’re betting heavily on it with real money.

According to CryptoQuant data, the company is currently sitting on approximately $7 billion in unrealized losses on their ETH holdings. That’s a staggering figure. Most firms facing that kind of underwater position would be quietly reducing exposure, not adding to it.

Instead, BitMine just bought more. Lookonchain reported a purchase of 10,000 ETH from Kraken, following a single-day acquisition of 35,000 ETH split between BitGo (20,000 ETH) and FalconX (15,000 ETH).

Taken together, these moves send a clear message. BitMine isn’t panicking. They’re positioning for what they believe comes next.

That kind of conviction is either deeply informed or deeply reckless. Given the data behind their thesis — the realized price gap, the 9th decile recovery rates, the V-shape historical pattern — there’s at least a serious analytical foundation for their stance.

What This Means for Regular ETH Holders

If you’re holding ETH right now and feeling the sting, the BitMine thesis offers some perspective worth sitting with.

The current drawdown is painful. Genuinely painful. Being below your cost basis isn’t fun, and there’s no guarantee this plays out the way historical cycles suggest it should.

But the numbers do point toward a historically significant setup. The 87% win rate for 12-month forward returns from this decile is hard to dismiss entirely. The pattern of V-shaped recoveries across eight prior 50%+ drawdowns gives at least some reason to think capitulation could be closer than it feels.

None of this means you should go buy ETH tomorrow. Markets can stay irrational longer than most people expect, and Ethereum has real competition, regulatory uncertainty, and macro headwinds to navigate. The $1,367 floor scenario is still on the table.

But if you’re already holding? The data suggests sitting tight has worked out more often than not in situations that looked a lot like this one.

BitMine clearly reached that conclusion before most of us did — and they’re putting serious capital behind it.