Ethereum just flashed a classic bottom signal. The kind that usually marks major reversals.

But the price keeps sliding anyway. In fact, ETH dropped 18.5% in 30 days and lost another 5.2% this week. So what gives? If profit-taking pressure disappeared, why won’t the price respond?

The answer lives in the derivatives market. And it’s not pretty.

Profit-Taking Incentive Just Collapsed

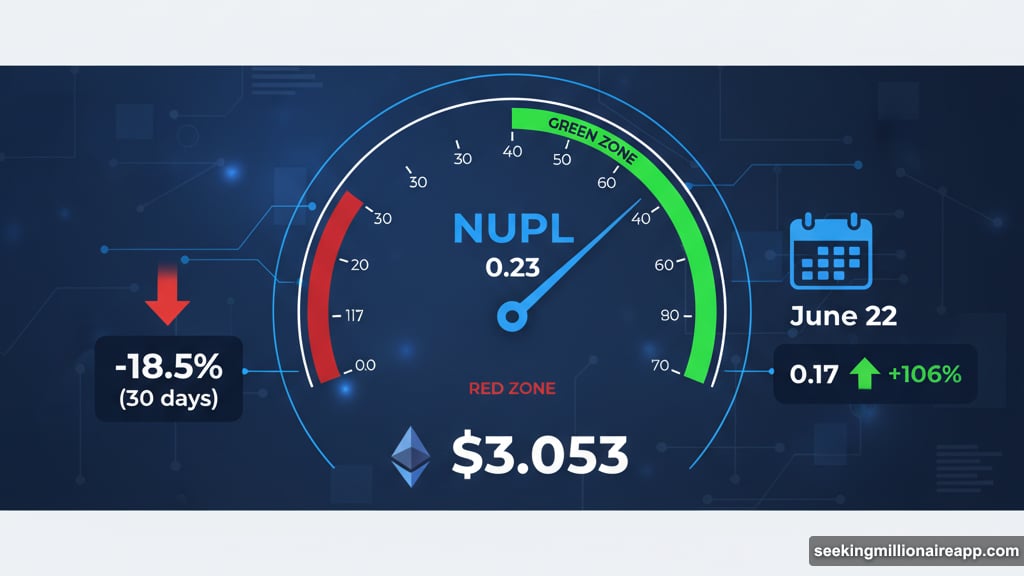

Net Unrealized Profit and Loss (NUPL) dropped to 0.23. That’s the lowest reading since July 1.

NUPL measures market psychology by tracking unrealized gains and losses across all wallets. When it crashes, it means holders have almost no reason left to sell for profit. That usually helps form a price floor.

Here’s the interesting part. The last time NUPL dropped this low was June 22, when it hit 0.17. ETH rallied 106% right after that bottom.

Today’s reading sits slightly above that June level. So technically, Ethereum could still fall further before matching those exact reversal conditions. But the profit-booking pressure is mostly gone either way.

Yet the price refuses to bounce. Why?

Long Liquidations Are Killing Every Rally Attempt

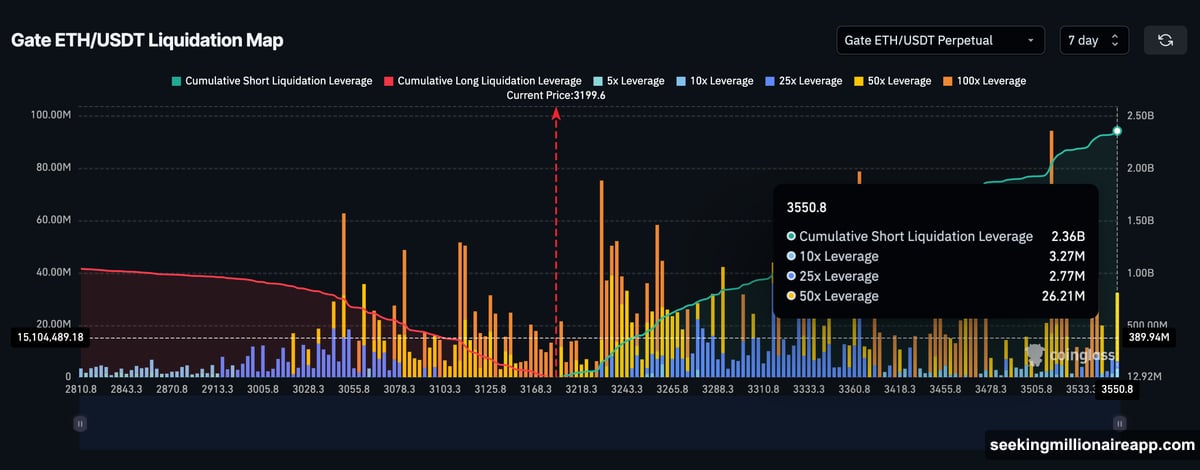

The derivatives market tells the real story. Gate’s ETH-USDT liquidation map shows $2.36 billion in short exposure. That sounds bullish.

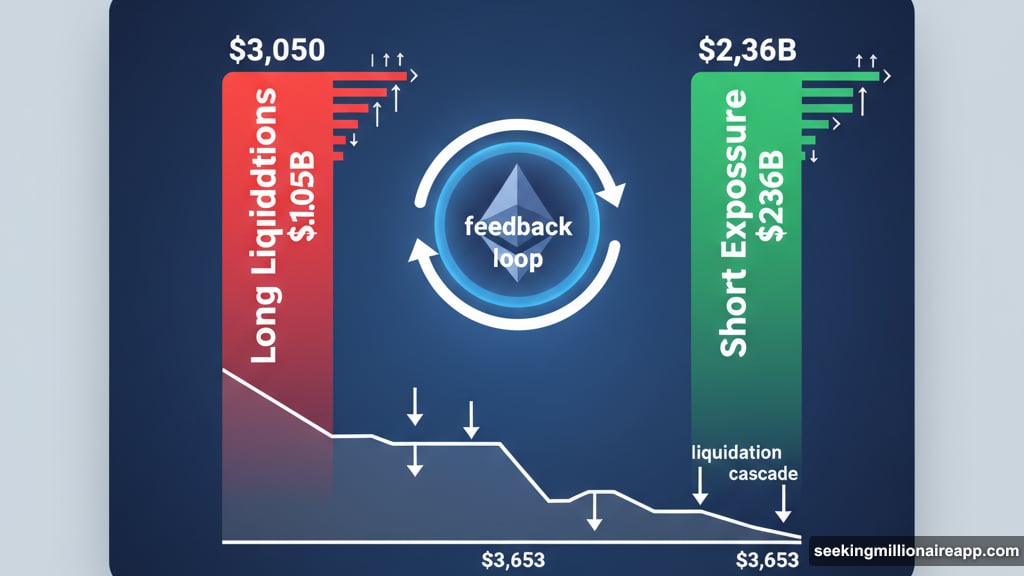

But there’s still $1.05 billion in long exposure sitting on the books. And that’s the problem.

The thickest long-liquidation cluster stretches up to roughly $3,050. Ethereum is trading right near that level now. So even a small price drop triggers forced selling from over-leveraged long traders.

This creates a feedback loop. Price dips slightly. Longs get liquidated. That selling pressure pushes price lower. More longs get stopped out. The cycle continues.

Long liquidations can easily overpower any positive signal from low NUPL. Even though shorts are over-exposed, the remaining long leverage is large enough to keep the market unstable.

This is why the bottom signal isn’t working. Ethereum can’t use a profit-floor setup as long as this liquidation wall remains intact.

The Chart Confirms the Same Risk Zone

The Ethereum price chart shows the same story. ETH is still trapped inside a falling channel. And $3,053 sits as the most critical support level.

Notice something? That’s the exact zone where the strongest long-liquidation cluster lives.

If price loses $3,053, the odds of a deeper drop rise sharply. That kind of breakdown could push NUPL down toward its June low of 0.17. Which would match the setup that came before the last major rally.

But there’s also a bullish path. It just needs far bigger confirmation.

ETH must reclaim $3,653 to show real strength. That’s still more than 14% above current levels. From there, clearing $3,795 would flip the structure from bearish to neutral.

This move also tests the upper boundary of the falling channel. That resistance zone only has two clean touches. So it’s not particularly strong. If NUPL stabilizes and shorts begin to unwind, a sharp rebound becomes possible.

But until those conditions merge, ETH stays stuck. Trapped between a fading profit motive and a stubborn liquidation overhang.

The Disconnect Between Signal and Price

Low NUPL should help form bottoms. That’s how it works historically. But this time, the derivatives market is fighting back.

The long-liquidation pressure creates a ceiling that NUPL can’t break through. Even with minimal profit-taking incentive, forced selling from leverage keeps pushing price lower.

This disconnect explains why Ethereum looks weak despite showing a classic bottom indicator. The signal is real. But the market structure isn’t ready to respond yet.

So what happens next? Two scenarios make sense.

First, ETH could drop further and push NUPL down to 0.17 or lower. That would match the exact conditions from June. If that happens, a major reversal becomes more likely. But it requires pain first.

Second, shorts could start unwinding before ETH drops that far. If enough short traders close positions, it removes selling pressure. That would let the low NUPL reading do its job and support a bounce.

Either way, the derivatives market holds the key. NUPL is doing its part. But Ethereum price won’t respond until the liquidation overhang clears.

For now, patience is the only strategy. The bottom signal is there. But the market needs time to clean out the leverage before price can follow the indicator.