Ethereum holders aren’t budging. Despite ETH struggling to break past $3,000 for weeks, network fundamentals tell a different story. Active addresses keep climbing while investors pull coins off exchanges at an accelerating pace.

The disconnect between price action and on-chain data creates an interesting setup. Plus, strong network participation suggests confidence remains intact even as charts frustrate traders. Let’s examine what the data reveals about Ethereum’s near-term prospects.

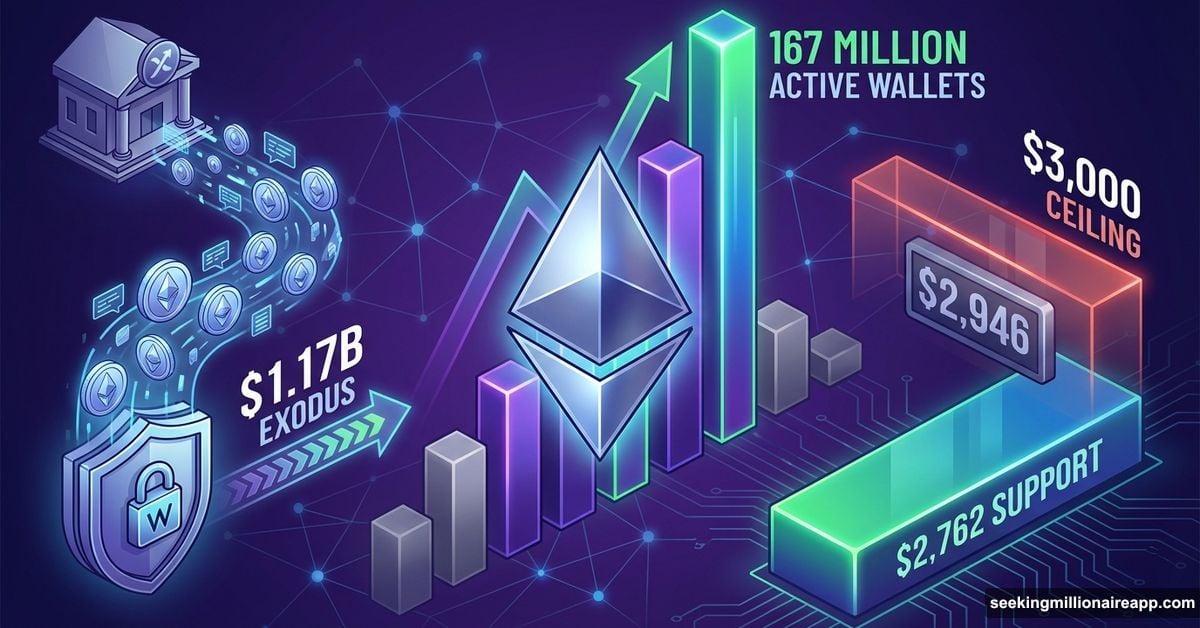

167 Million Active Wallets Dwarf All Competition

Ethereum dominates crypto by one massive metric: active addresses. The network supports over 167.9 million wallets holding balances. That’s nearly three times Bitcoin’s 57.62 million active addresses.

No other major cryptocurrency comes close to these participation levels. This gap reflects Ethereum’s broad utility beyond simple value transfer. Decentralized finance protocols, NFT platforms, and smart contract applications drive consistent engagement across the ecosystem.

Moreover, high wallet counts indicate widespread confidence. Users maintain positions despite sideways price action. That behavior often precedes recovery when broader market conditions improve.

The network continues attracting new participants while existing users stay active. So Ethereum maintains its position as the most utilized blockchain for complex financial applications. That foundation matters more than short-term price fluctuations.

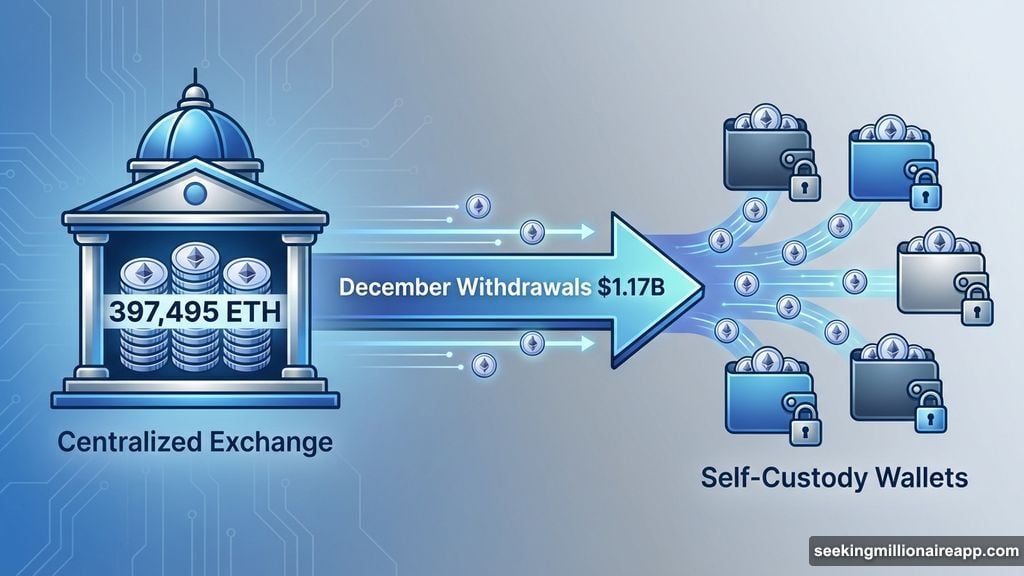

400,000 ETH Left Exchanges This Month

Exchange balances tell a compelling accumulation story. Since December began, investors withdrew approximately 397,495 ETH from centralized platforms. That represents over $1.17 billion in value moved to self-custody.

Why does this matter? Coins sitting on exchanges represent potential sell pressure. When investors move ETH to private wallets, they signal longer-term holding intentions. These outflows reduce immediate selling supply available in the market.

Furthermore, the withdrawal trend accelerated recently. Larger holders appear accumulating at current price levels around $2,900. Institutional players and experienced traders often move significant positions off exchanges before major moves.

Historical patterns show exchange outflows frequently precede price recovery. Lower exchange balances limit sellers’ ability to dump large positions quickly. Plus, this dynamic can amplify upward momentum once buying pressure strengthens.

The $1.17 billion withdrawn represents meaningful conviction. Investors betting with real money through their holding decisions, not just social media sentiment.

ETH Defended $2,762 Support Multiple Times

Ethereum trades at $2,946 at press time, remaining frustratingly close to the $3,000 psychological barrier. But price action reveals important technical structure beneath the surface.

The $2,762 level emerged as reliable support over recent weeks. ETH bounced off this zone multiple times as buyers stepped in to defend lower prices. Repeated tests without breakdown demonstrate demand exists at these valuations.

However, bulls need to prove they can sustain momentum above $3,000. Brief attempts to break through failed as selling pressure knocked ETH back down. That resistance now stands as the critical level determining near-term direction.

A clean breakout above $3,000 opens the path toward $3,131 next. Continued strength beyond that point targets $3,287, marking a significant recovery from recent lows. Those moves would confirm improving sentiment aligns with positive on-chain data.

Still, risks persist if selling intensifies. Breaking below $2,762 support invalidates the bullish setup entirely. That scenario could send ETH toward $2,681, marking a four-week low and forcing a reassessment of recovery prospects.

Technical traders watch these levels closely. The narrow range between strong support and stubborn resistance creates a coiled spring ready to move decisively in either direction.

Strong Fundamentals Eventually Win

On-chain data rarely lies. While prices move based on sentiment, leverage, and macro factors, network fundamentals reveal true user behavior and confidence.

Ethereum shows strength where it counts. Active addresses keep growing. Exchange balances keep dropping. Network utility remains unmatched in crypto. These factors build a foundation for recovery even as price frustrates holders.

The question isn’t whether ETH will break $3,000. It’s when. Patient investors accumulating at current levels position themselves for gains when momentum finally shifts. Those waiting for confirmation above $3,000 sacrifice early positioning for reduced uncertainty.

Markets reward patience until they don’t. But betting against Ethereum’s network strength has proven costly historically. The data suggests that pattern continues holding true even as short-term price action tests conviction.