Ethereum just reclaimed $2,000. Good news, right? Not exactly.

Whale wallets are flip-flopping between massive sells and equally massive buys. Long-term holders switched from accumulation to distribution. And ETH price action? Stuck in neutral while everyone tries to figure out what comes next.

The real story isn’t about technical resistance levels. It’s about market indecision at the highest levels.

$5.3 Billion Changed Hands. Price Barely Moved

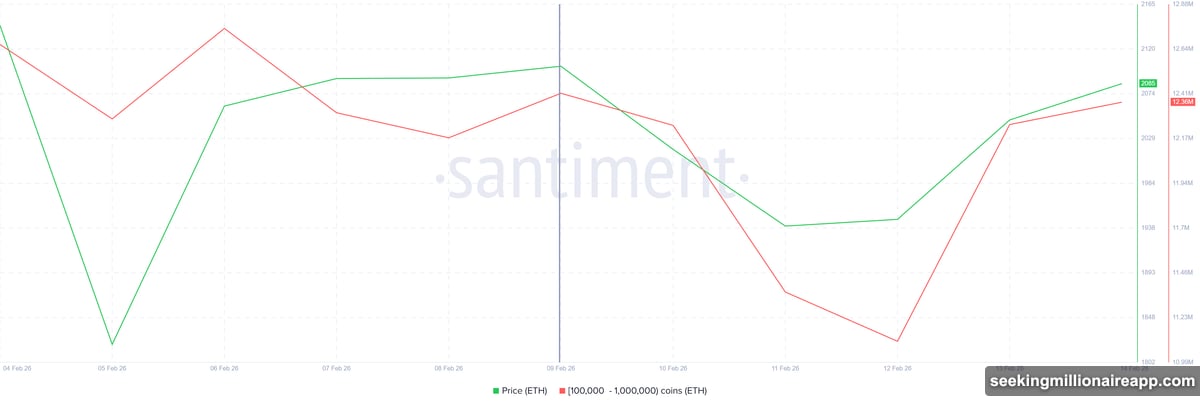

Large Ethereum holders created chaos this past week. Wallets holding 100,000 to 1 million ETH dumped 1.3 million tokens between February 9 and February 12. That’s $2.7 billion worth of selling pressure.

Then something weird happened. The same whale cohort bought back 1.25 million ETH within 48 hours. That’s another $2.6 billion flowing back in.

So what does this mean? Absolutely nothing for price direction. When whales sell and immediately rebuy similar amounts, they create liquidity without conviction. The market gets volume but no clear signal about where it’s heading.

This back-and-forth behavior keeps ETH trapped in a range. No decisive uptrend. No sustained downtrend. Just expensive volatility that goes nowhere.

Long-Term Holders Started Selling Too

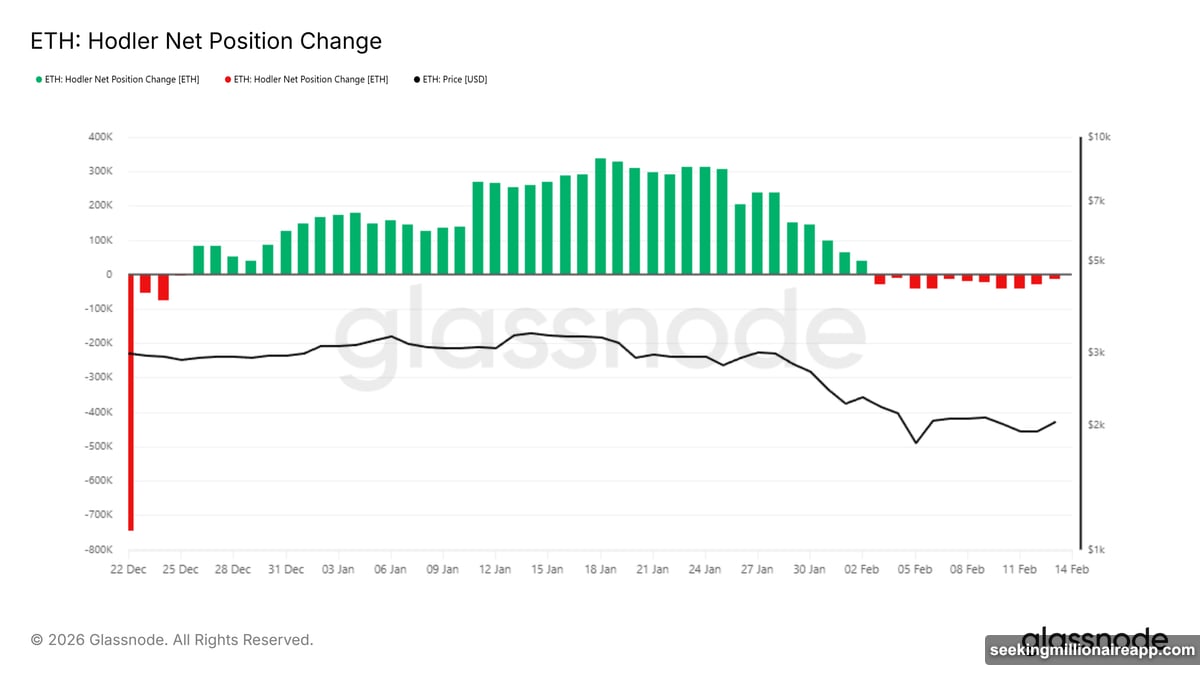

Things get worse when you look at the HODLer cohort. These are investors who held through multiple cycles and usually provide market stability.

Since late December 2025, long-term holders steadily accumulated ETH. That changed at the start of February. The buying slowed, then stopped. Now they’re distributing modest amounts back into the market.

The selling isn’t aggressive yet. But it signals something important. Investors with the strongest conviction are losing confidence. When HODLers become uncertain, rallies struggle to gain momentum.

Plus, this shift happened right as ETH was trying to establish support above $2,000. The timing couldn’t be worse for bulls hoping to push higher.

ETH Needs Conviction. It’s Getting Confusion Instead

Ethereum trades at $2,087 right now. That’s technically above the psychologically important $2,000 level. But barely.

The next major resistance sits at $2,241. Breaking through requires sustained buying from whales and long-term holders. Instead, both groups are sending mixed signals that cancel each other out.

Without clear accumulation patterns, ETH will likely keep bouncing between $1,902 support and $2,241 resistance. That’s a roughly 17% trading range. Enough to frustrate both bulls and bears, but not enough to establish a new trend.

Meanwhile, support at $1,902 remains critical. If that breaks, ETH could slide toward $1,800 or lower. But there’s no strong catalyst pushing it down either.

What Would Actually Spark a Rally

For ETH to break above $2,241 and push toward $2,500, three things need to happen. First, whale wallets need to shift from back-and-forth trading to sustained accumulation. Second, long-term holders must reverse their distribution trend. Third, both cohorts need to act simultaneously to create momentum.

Right now? None of that is happening. Whales are day-trading with billions. HODLers are quietly exiting. And price action reflects that confusion perfectly.

A move to $2,395 or $2,500 would invalidate the bearish setup. It would also require conviction that simply doesn’t exist in the market right now. Until holder behavior changes, sideways consolidation remains the most probable outcome.

The Market Needs to Pick a Side

Here’s what bugs me about this situation. Ethereum isn’t failing technically. The network works fine. Developer activity continues. Real-world adoption grows steadily.

But none of that matters when the largest holders can’t decide what they want. Whales selling $2.7 billion, then buying $2.6 billion back days later, creates noise without signal. Long-term holders switching from accumulation to distribution suggests even patient investors are uncertain.

So ETH sits at $2,087, above an important psychological level but unable to build momentum. The market needs clarity. Instead, it’s getting mixed messages that keep price action locked in a frustrating range.

Watch the $2,241 resistance and $1,902 support. Until whales and HODLers show real conviction, those boundaries define the game. Break above or below, and things get interesting. Stay inside, and we’ll keep having this same conversation for weeks.