The Ethereum Foundation just shuffled its leadership deck. But this isn’t your typical corporate musical chairs.

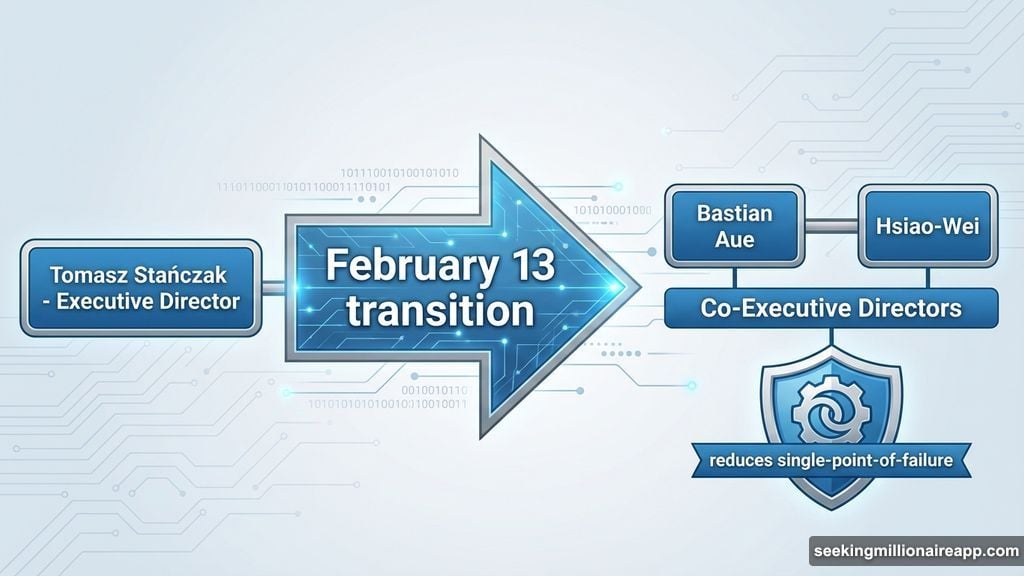

On February 13, Bastian Aue stepped into the interim co-executive director role. He replaces Tomasz Stańczak, who’s stepping down after a year of intense organizational overhaul. Yet the timing reveals something bigger than a simple personnel change.

Ethereum wants to survive for a millennium. That’s not marketing hype. It’s now official Foundation policy.

What Actually Changed at the Top

Aue brings institutional knowledge most executives lack. He worked directly with the Foundation’s executive team on grants and operations before this promotion. So he understands the organization’s internal mechanics intimately.

More importantly, he shares leadership duties with Hsiao-Wei. This co-director model maintains operational continuity while the Foundation pivots toward its century-spanning vision. Plus, dual leadership reduces single-point-of-failure risks that plague many crypto organizations.

Stańczak’s departure marks the end of a critical stabilization phase. He joined roughly 12 months ago when the Foundation faced harsh criticism for moving too slowly. Under his watch, internal teams became leaner and more responsive to developer needs.

Vitalik Buterin himself praised Stańczak’s impact. The co-founder noted how Stańczak pushed the organization “well outside its previous comfort zone.” That urgency transformed the Foundation from a bureaucratic entity into something resembling a nimble tech organization.

The Cypherpunk Mandate Returns

Aue’s appointment letter revealed the Foundation’s core priority. He emphasized building “real permissionless infrastructure, cypherpunk at its core.”

That language matters. It signals a return to Ethereum’s ideological roots after years of institutional expansion. The Foundation isn’t chasing trends or courting mainstream adoption anymore. Instead, it’s doubling down on censorship resistance and decentralization.

“Ethereum should outlast us,” Aue stated bluntly. His mandate focuses on protocol robustness that can weather centuries of geopolitical chaos and technological disruption. This long-term thinking contrasts sharply with the crypto industry’s typical quarterly planning cycles.

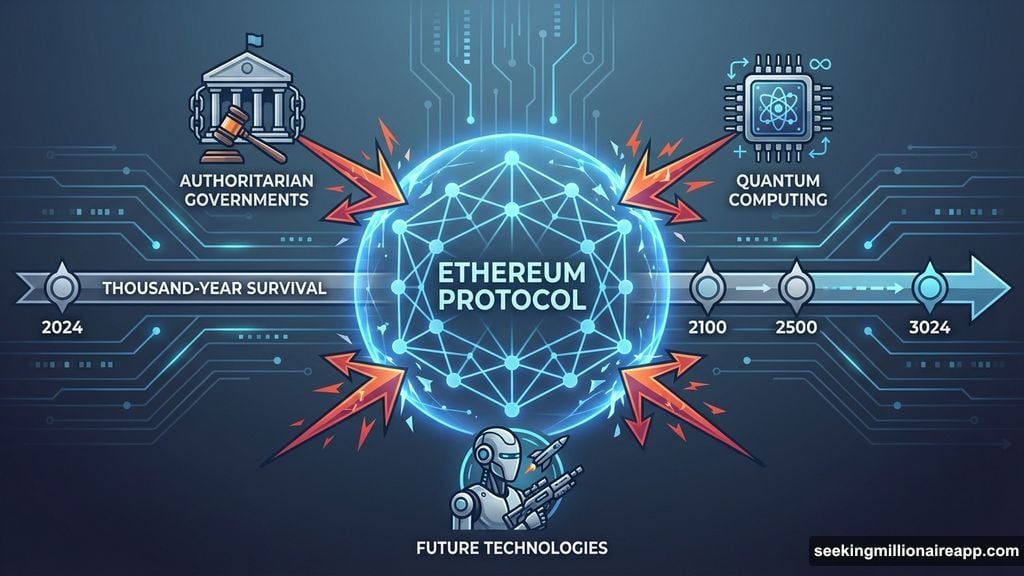

The thousand-year timeline isn’t arbitrary either. It forces the Foundation to consider threats most organizations ignore. How does a protocol survive authoritarian governments? What happens when quantum computing breaks current cryptography? Can Ethereum adapt to technologies that don’t exist yet?

These questions require different answers than “how do we compete with Solana this quarter.” So the strategic shift runs deep.

Market Reality Check

ETH reclaimed $2,000 on the day of Aue’s appointment. The token traded near $2,051 at press time, up roughly 5.5% over 24 hours. That price movement suggests investors welcomed the leadership transition.

However, zoom out slightly and the picture darkens. Ethereum dropped approximately 36% over the last quarter. That’s brutal by any standard. Plus, the broader crypto market struggled since the year began.

So Aue inherits a challenging environment. The Foundation needs to fund long-term research while ETH’s value fluctuates wildly. That tension between millennial planning and quarterly volatility will test his leadership immediately.

Yet the Foundation’s financial position remains strong. Years of treasury management mean they can weather extended bear markets. Still, sustained price weakness could force difficult prioritization decisions about which research projects to fund.

Stańczak’s Legacy Lives On

Tomasz Stańczak didn’t fail. He succeeded at his specific mandate: inject urgency and streamline operations. The Foundation needed that shock therapy after years of complacency.

Under his direction, teams became more efficient. Engagement with external developers expanded significantly. Internal processes that previously took months now completed in weeks. Those operational improvements created the stable foundation Aue now builds upon.

Moreover, Stańczak helped shift the Foundation’s culture. Before his tenure, the organization moved cautiously and avoided controversy. He encouraged calculated risk-taking and faster decision-making. That cultural evolution persists even as he exits.

His departure after just one year might seem abrupt. But it actually demonstrates strategic planning. Stańczak completed his turnaround mission. Now the Foundation needs different leadership for its next phase. That’s smart succession planning, not organizational chaos.

What This Means for Ethereum’s Future

The leadership transition reveals three critical insights about Ethereum’s direction.

First, the Foundation takes its stewardship role seriously. Most crypto projects lack this kind of institutional planning. The fact that Ethereum even discusses thousand-year timelines shows unusual long-term thinking.

Second, ideological purity matters more than market positioning. Aue’s emphasis on cypherpunk values suggests the Foundation won’t compromise core principles for mainstream adoption. That could alienate some institutional investors but strengthen the protocol’s resilience.

Third, the organization recognizes that different phases require different leadership styles. Stańczak brought urgency when needed. Aue brings institutional stability for the long haul. This leadership flexibility is rare in crypto organizations.

The thousand-year vision might sound granular. But it forces the Foundation to think beyond hype cycles and quarterly earnings. Can Ethereum truly become digital infrastructure that outlasts current governments and corporations? That question now drives strategic planning.

Whether the protocol achieves this audacious goal remains uncertain. But at least Ethereum’s leadership is asking the right questions. Most crypto projects can’t see past next quarter’s token unlock.