Ethereum’s December upgrade isn’t getting much attention. That’s a mistake.

VanEck just published analysis suggesting Fusaka could fundamentally reshape how rollups operate. We’re talking lower costs, better scaling, and a complete shift in how Ethereum generates value. Plus, this happens in just weeks.

Let’s break down what actually matters.

The Data Bottleneck Nobody Talks About

Ethereum validators currently download every single transaction. That creates problems.

Rollups like Base and World Chain now submit roughly 60% of all transaction data to Ethereum. So validators struggle with bandwidth and storage demands. Moreover, that bottleneck limits how many rollups can scale effectively.

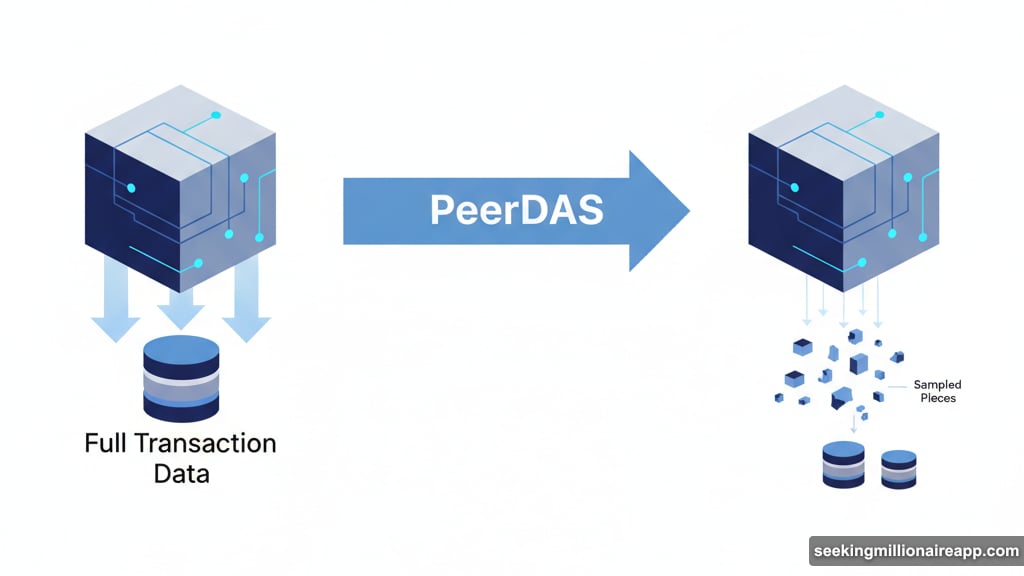

Fusaka introduces Peer Data Availability Sampling (PeerDAS). Instead of downloading everything, validators sample smaller pieces to verify blocks. Think of it like checking a few pages of a book instead of reading cover to cover.

This matters because it removes the main obstacle preventing Ethereum from handling more rollup data. Validators won’t need massive bandwidth anymore. Storage requirements drop significantly. And the network can safely increase blob capacity without straining infrastructure.

Blobs Already Doubled This Year

Ethereum developers increased blob limits once in 2025. Demand kept rising anyway.

Base and World Chain consume most blob capacity right now. But more rollups launch every month. Each needs data availability to function. So current limits won’t sustain growth much longer.

PeerDAS solves this by making it cheaper and easier to verify larger amounts of data. That means Ethereum can raise blob capacity again without requiring validators to upgrade hardware. The result? Lower costs for rollups, which translates directly to cheaper transactions for users.

Fee Revenue Disappeared. ETH’s Role Changed

VanEck highlighted something critical. Mainnet fee revenue dropped as activity shifted to layer-2 networks.

Many investors see this as bearish. But VanEck argues the opposite. Ethereum’s value now comes from settling rollup transactions, not from base layer fees. ETH acts as the security layer underpinning billions in rollup activity.

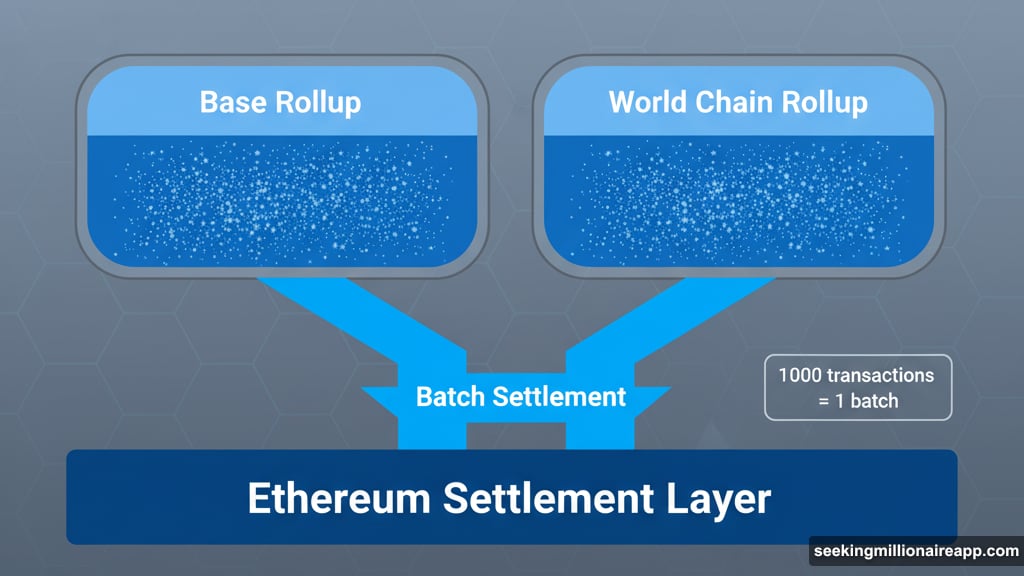

Think of it this way. Ethereum used to charge high fees because everyone transacted directly on mainnet. Now rollups handle thousands of transactions and settle them as a single batch. Fees per transaction dropped. But Ethereum’s role as the trust layer became more important.

Fusaka reinforces this shift. By lowering rollup costs, it encourages more activity to flow through Ethereum’s settlement layer. So while individual transaction fees stay low, total economic activity secured by ETH increases.

Institutional Stakes Keep Growing

VanEck warned about something most holders ignore. Unstaked ETH faces dilution risk.

Exchange-traded products now accumulate massive ETH positions for staking. Crypto treasury firms do the same. These institutional players earn staking yields while regular holders who don’t stake effectively lose value over time.

The gap widens as more institutions enter. Someone holding ETH in a cold wallet misses out on roughly 3-4% annual yield from staking. Meanwhile, institutional products compound that yield. Over years, the difference becomes substantial.

Fusaka makes this dynamic more important. Lower rollup costs drive adoption. More adoption attracts institutional investment. And institutional investors stake almost everything they hold.

The Privacy Problem VanEck Didn’t Mention

Ripple engineer J. Ayo Akinyele recently outlined plans to make XRP Ledger attractive to institutions through privacy features. Zero-knowledge proofs. Confidential tokens. Built-in compliance.

Ethereum doesn’t have those yet. Fusaka focuses purely on scaling. But institutions care deeply about privacy and compliance. So Ethereum’s rollup ecosystem will need similar features to compete for institutional adoption.

That creates opportunity. Rollups can implement privacy layers on top of Ethereum’s settlement layer. Some already started. But Ethereum mainnet itself remains transparent by default.

The question becomes whether rollup-based privacy proves sufficient for institutions or whether Ethereum needs protocol-level privacy eventually. VanEck’s analysis doesn’t address this. But it matters for long-term adoption.

December Timeline Creates Pressure

Fusaka goes live in December. That gives validators and rollup operators little time to prepare.

Most validators run standard hardware. PeerDAS changes how they process blocks. So they’ll need software updates and potentially configuration changes. Testing takes time. And any bugs discovered close to launch could delay the upgrade.

Rollups also need to adjust. Base and World Chain currently dominate blob usage. They’ll benefit most from expanded capacity. But they need to ensure their systems can handle the changes without disrupting user experience.

The tight timeline increases risk. But it also shows how urgently Ethereum developers want to address scaling constraints. Current blob capacity can’t support the growth rate rollups are experiencing.

What This Means for ETH Holders

VanEck called Fusaka’s implications “significant.” That’s analyst-speak for “pay attention.”

Three things change after December. First, rollup costs drop, making layer-2 transactions cheaper for users. Second, Ethereum can safely increase blob capacity to support more rollups. Third, ETH’s role as the settlement layer becomes more central to the entire ecosystem.

But holders face a choice. Stake ETH to earn yield and avoid dilution. Or hold unstaked and watch institutional players compound returns over time. The gap widens as more institutions accumulate positions.

Fusaka doesn’t directly affect this dynamic. But by strengthening Ethereum’s scaling roadmap, it makes the network more attractive to institutions. And institutional adoption accelerates the staking divide.

The Rollup-Centric Future Arrived

Ethereum stopped being a transaction platform. It became a settlement layer for rollups.

Most users never touch mainnet anymore. They transact on Base, Arbitrum, Optimism, or other layer-2 networks. Those rollups bundle thousands of transactions and settle them on Ethereum as a batch. Mainnet fees matter less. Security and finality matter more.

Fusaka accelerates this transition. By making it cheaper for rollups to post data, it encourages even more activity to move off mainnet. So Ethereum’s value comes from being the trusted foundation, not from processing individual transactions.

This shift confuses many investors. They see falling mainnet fees and assume Ethereum is losing relevance. Actually, the opposite happened. Ethereum became the settlement layer for an entire ecosystem of scaling solutions.

VanEck gets this. Their analysis focuses on how Fusaka strengthens Ethereum’s role as the trust anchor. Not how it restores mainnet fee revenue. Because that’s not the point anymore.