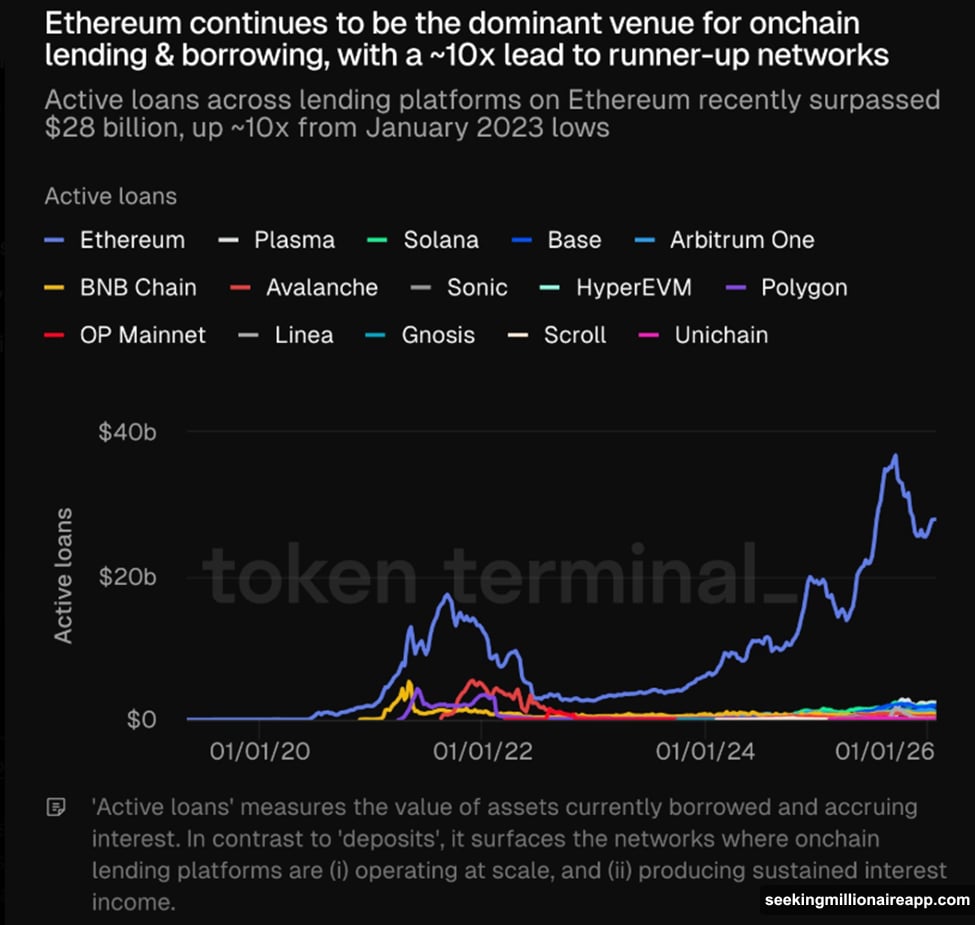

Ethereum’s on-chain lending markets crossed $28 billion in January 2026. That’s not just growth—it’s a tenfold jump from early 2023 lows.

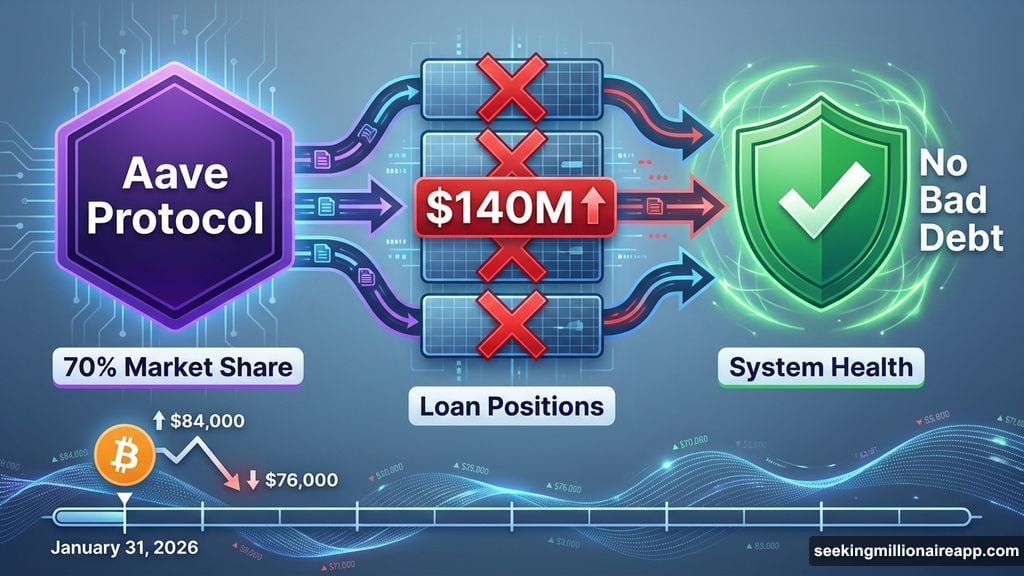

But here’s what really matters. During the brutal weekend crash that wiped out $2.2 billion in leveraged positions, Aave didn’t just survive. It processed $140 million in automated liquidations without missing a beat. No downtime. No bad debt. Just ruthless efficiency when markets needed it most.

This wasn’t luck. It was DeFi’s infrastructure passing its most critical stress test yet.

Aave Controls 70% of Ethereum Lending for a Reason

Aave dominates Ethereum’s lending ecosystem with roughly 70% market share. According to Token Terminal data, active loans across Ethereum-based platforms achieved that tenfold increase from January 2023 to January 2026.

Why does one protocol control so much? Trust earned through performance.

Meanwhile, crypto lending overall hit $73.6 billion by Q3 2025. That’s a 38.5% quarterly jump, nearly tripling since early 2024. Bitcoin ETF approvals and sector recovery drove much of this growth, per Kobeissi analysts.

However, DeFi leverage remains relatively modest. It represents just 2.1% of the $3.5 trillion digital asset market, compared to 17% in traditional real estate. Still, that concentration in algorithmic platforms like Aave creates potential for rapid automated liquidations during volatility.

That’s exactly what happened last weekend.

Weekend Crash Tested DeFi’s Crisis Shield

Late January 2026 brought a perfect storm. Bitcoin plunged from $84,000 to below $76,000 amid:

- Thin weekend liquidity pools

- Middle East geopolitical tensions

- US government funding uncertainties

Over $2.2 billion in leveraged positions got liquidated across centralized and decentralized exchanges within 24 hours. Markets were bleeding everywhere.

Then Aave’s automated systems kicked in. The protocol processed over $140 million in collateral liquidations across multiple networks on January 31. Aave founder Stani Kulechov called it “another significant stress test” that the protocol handled “without any issues, fully automated.”

But it wasn’t smooth sailing. Ethereum gas fees spiked above 400 gwei. That created “zombie positions”—undercollateralized loans hovering near liquidation thresholds that couldn’t be profitably cleared immediately because transaction costs exceeded potential profits for liquidators.

Despite this friction, Aave prevented what could’ve been catastrophic contagion across DeFi.

Automated Liquidations Prevented Broader Meltdown

Had Aave failed, undercollateralized positions would’ve accumulated into bad debt. That triggers cascading liquidations and ecosystem-wide panic.

Instead, the protocol’s automation acted as a crisis shield. Other platforms like Compound, Morpho, and Spark absorbed smaller liquidation volumes. But none had Aave’s scale or automation to handle the surge effectively, according to DefiLlama data.

Even major players relied on Aave’s stability. Trend Research deleveraged by depositing 20,000 ETH ($43.88 million) to Binance and repaying Aave loans. Lookonchain data shows they sold hundreds of millions in ETH to reduce exposure during the crash.

This highlights both opportunity and vulnerability. Yes, active loans and leverage are rising. But Aave’s resilience during extreme volatility signals that DeFi infrastructure is maturing beyond its experimental phase.

The protocol absorbed large-scale liquidations without systemic failures. That reinforces Ethereum-based lending as a stabilizing force when traditional markets panic. It’s becoming the “flight-to-quality” option for institutional and retail participants alike.

Market Reality Check: AAVE Token Still Bleeds

Despite this bullish infrastructure story, AAVE token price tells a different tale. The token dropped over 6% in 24 hours following the crash, trading at $119.42 as of early February 2026.

Why? Broader market weakness outweighs protocol fundamentals in the short term. The US economy is showing cracks. That’s dragging down every risk asset, not just crypto.

But here’s my take. Protocol performance matters more than token price volatility for long-term DeFi adoption. Aave proved it can handle crisis-level stress without human intervention or bailouts.

Traditional finance required government backstops during 2008 and 2020 crises. DeFi protocols like Aave are building automated systems that absorb shocks without begging for rescue packages.

That’s genuinely revolutionary infrastructure. Token prices will catch up once markets stabilize and investors recognize what Aave just accomplished.

The weekend crash wasn’t a failure for DeFi. It was proof of concept under fire. And Aave passed with flying colors.