Barcelona’s blockchain crowd got a surprise in October. Nine major European banks announced they’re launching euro stablecoins. That’s the same tech crypto promised but couldn’t deliver at scale.

The European Blockchain Convention (EBC) drew over 5,000 people from 60 countries. But the vibe shifted from startup pitches to boardroom strategy. Banks, fund managers, and regulators filled the halls. Plus, nobody talked about getting rich quick anymore.

Europe’s blockchain story changed. The speculation phase ended. Implementation began.

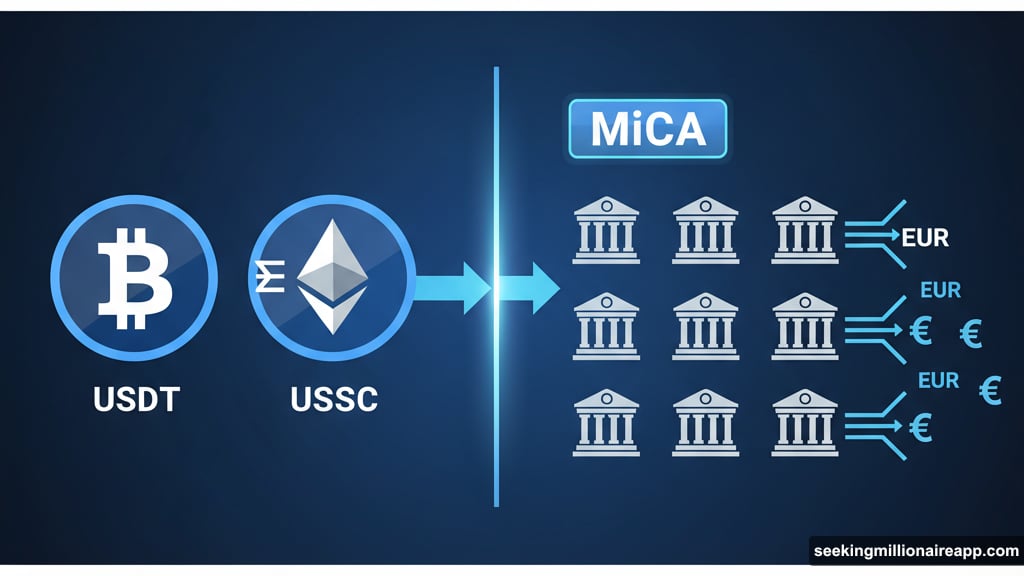

Stablecoins Became Banking Infrastructure

MiCA-compliant euro stablecoins dominated every conversation. Victoria Gago, EBC’s Co-founder, told attendees these aren’t just for crypto trading anymore. Banks want them for actual European payments.

Nine European banks plan to launch regulated stablecoins in 2025. That’s a direct challenge to USDT and USDC dominance. But it’s also validation that blockchain payments work.

The irony? Crypto evangelists spent years pitching decentralized money to skeptical bankers. Now those same bankers are building the infrastructure crypto promised but struggled to scale.

Standard Chartered, Société Générale, and Morgan Stanley sent senior teams. They weren’t there to learn about blockchain. They came to discuss how they’re already using it.

Tokenization Moved Beyond Proof of Concept

Laurent Marochini from Société Générale made the clearest statement. “What we’re building is not a product — it’s a new business architecture.”

Real-world asset tokenization isn’t experimental anymore. Banks are integrating digital assets into core financial systems. That means bonds, real estate, and fund shares moving on-chain.

Andrea Pignataro from ION Group backed this up. European institutions shifted from testing tokenization to deploying it. The conversation changed from “if” to “how fast.”

However, the shift raises questions about decentralization. Banks adopting blockchain doesn’t mean they’re adopting crypto’s ethos. They’re taking the tech and wrapping it in traditional finance structures.

Corporate Bitcoin Treasuries Got Serious Attention

One packed panel discussed companies holding Bitcoin on their balance sheets. That’s still controversial in Europe. But interest is growing.

Sander Anderson from H100 Group explained the appeal. “You now get Bitcoin exposure with all the future yield for free — that’s very attractive for large allocators.”

Börse Stuttgart Digital’s Joaquin Sastre Ibañez summarized Europe’s stance: “Bitcoin first, maybe ETH second.” Conservative but committed.

Family offices attended in significant numbers. They’re not treating crypto as speculation anymore. Instead, they view it as portfolio diversification backed by regulatory clarity.

Meanwhile, MiCA provided the framework that made institutional adoption possible. Europe moved slower than the US on crypto ETFs. But it built regulatory infrastructure that banks trust.

FC Barcelona Showed Web3’s Cultural Play

Sports teams adopting blockchain might sound like 2021 hype recycled. But FC Barcelona’s approach revealed something different.

Jordi Mompart from the club explained their challenge. “We have five times more fans in Indonesia than in Spain — we must speak to them in their own language.”

Web3 tools let teams create direct relationships with global fans. NFTs, tokens, and digital experiences replace traditional marketing. Fans become participants instead of passive consumers.

Sebastien Borget from The Sandbox emphasized the shift. “Web2 is us telling you what it is. Web3 is you raising your hand and becoming part of it.”

Animoca Brands’ Robbie Young and Diego Borgo joined the discussion. They described how brands use blockchain to build communities that own pieces of the ecosystem.

Sports, entertainment, and gaming are testing grounds for mass Web3 adoption. Europe’s regulations make these experiments safer than US equivalents.

Networking Became Business Development

EBC evolved from a conference into a deal-making platform. The Buy-Side Breakfast connected institutional investors discussing stablecoin markets and tokenization strategies. Beach runs and side events along Barcelona’s coast created partnership opportunities.

Attendance jumped from 500 people in 2018 to over 5,000 in 2025. That growth reflects blockchain’s journey from niche topic to mainstream business conversation.

Victoria Gago noticed the change. “People aren’t just learning anymore — they’re negotiating deals, forming partnerships, and building real infrastructure.”

OKX, Bitpanda, Ripple, Fireblocks, Bitget, and Polygon sent teams. So did Galaxy Digital, Chainlink, and The Sandbox. The mix of crypto-native companies and traditional finance firms showed the sector’s convergence.

More than 250 speakers delivered 40 panels across two days. Topics spanned tokenization, custody, DeFi, AI integration, and digital identity. Plus, new themes emerged around blockchain for energy and data management.

Europe Found Its Rhythm

Europe’s approach differs from America’s move-fast ethos. MiCA provides regulatory clarity before innovation runs wild. That slows things down. But it builds foundations designed to last a decade.

Gago defended the strategy. “Europe might be slower, but we’re building the foundation that will last a decade.”

The Digital Assets Forum now expands to London and Abu Dhabi in 2026. EBC’s influence grows while keeping European regulatory priorities at its core.

American crypto conferences still buzz with airdrop hunters and new token launches. Barcelona felt different. Banks, regulators, and institutional investors dominated the narrative. The focus shifted from disrupting finance to integrating with it.

That’s either blockchain maturing or blockchain losing its edge. Depends who you ask.

The Regulatory Confidence Gap

Europe’s blockchain confidence stems directly from MiCA. The regulation took years to finalize. But it gave institutions the legal clarity they needed to commit capital and resources.

American crypto firms still navigate unclear SEC guidance. European companies know the rules. That certainty accelerated adoption among risk-averse institutions.

However, some crypto advocates worry MiCA favors incumbents. Regulatory compliance costs money. Large banks handle those costs easily. Small startups struggle.

The nine banks launching euro stablecoins have legal teams and compliance infrastructure ready. Crypto startups that pioneered stablecoins can’t compete on regulatory readiness.

Europe’s approach creates stability. But it might also cement traditional finance’s control over blockchain infrastructure.

What This Means for Crypto’s Original Vision

Bitcoin launched as a decentralized alternative to banks. Now banks are adopting blockchain to strengthen their position. That’s a strange outcome for a technology meant to disrupt them.

The panels at EBC rarely mentioned decentralization. Institutional custody, regulatory compliance, and business architecture dominated. Those topics matter for mainstream adoption. But they’re not what crypto’s early believers fought for.

Yet adoption requires compromise. Retail crypto users wanted financial freedom. Institutions wanted legal clarity and controlled infrastructure. Europe delivered the second thing.

Whether blockchain transforms finance or just digitizes existing systems remains unclear. Barcelona showed both paths exist. Banks adopting tokenization alongside crypto-native DeFi platforms.

The question is which model wins at scale. Or whether they coexist indefinitely.

Europe’s Bet on Structured Innovation

EBC 2025 marked Europe’s confidence in its blockchain strategy. The event proved the region found its approach: regulation-first innovation that prioritizes stability over speed.

American conferences still chase the next 100x token. Asian events focus on gaming and consumer apps. Europe builds financial infrastructure designed for banks, regulators, and institutional investors.

Gago reflected on blockchain’s evolution. “This industry has given me so much — being part of its evolution is an honor beyond words.”

That sentiment captures Europe’s blockchain moment. Less about revolutionary change, more about careful integration. Not disruption, but structured transformation.

Barcelona proved Europe isn’t following America’s crypto playbook. It’s writing its own. Whether that strategy delivers blockchain’s promise or dilutes it depends on your definition of success.

For now, Europe’s banks are betting big on digital assets. The crypto world watches to see if they deliver what decentralized projects couldn’t.