December crypto rallies sound like fantasy. But six years of price data tell a different story.

Five major cryptocurrencies show clear patterns of year-end strength. Not every December, though. These rallies cluster in specific market conditions when liquidity flows and confidence returns.

Let’s dig into what actually moves during the holiday season and why it matters for your portfolio.

Bitcoin Posts Massive December Gains in Bull Years

Bitcoin’s December track record splits sharply between bull and bear cycles. During expansion phases, the gains can be explosive.

In December 2020, Bitcoin surged about 48%. It climbed from roughly $19,700 to $29,000 as institutional interest peaked. Then in December 2023, it added another 12% as ETF speculation built momentum.

But the losses hit hard during tightening cycles. Bitcoin dropped 5% in December 2019, fell nearly 19% in 2021, slipped 4% in 2022, and declined just over 3% in 2024.

The pattern reveals something important. Bitcoin’s Santa rallies need favorable conditions. When liquidity dries up or macro stress hits, December becomes a trap instead of a gift.

Plus, timing matters within the month itself. The week after Christmas typically outperformed the week before in strong years. So waiting until December 26th often proved smarter than buying early in the month.

Ethereum Mirrors Bitcoin’s Cycle With Slightly Different Timing

Ethereum follows Bitcoin’s general December pattern but with its own quirks. The strongest moves came in the same years as Bitcoin’s rallies.

December 2020 saw ETH climb about 21%, moving from around $615 to $750. Network activity surged as DeFi protocols gained traction. Then December 2023 brought an 11% gain, tracking the broader market recovery.

However, Ethereum’s December crashes hit harder than Bitcoin’s in some years. It dropped 15% in December 2019, fell 20% in 2021, and slipped 8% in both 2022 and 2024.

The amplified losses make sense. Ethereum carries higher beta than Bitcoin during risk-off periods. When traders flee to safety, they dump ETH faster than BTC.

Yet when confidence returns, Ethereum often catches up quickly. Its utility in DeFi and NFTs creates buying pressure that Bitcoin lacks. So strong Decembers tend to push ETH higher as traders rotate into ecosystem plays.

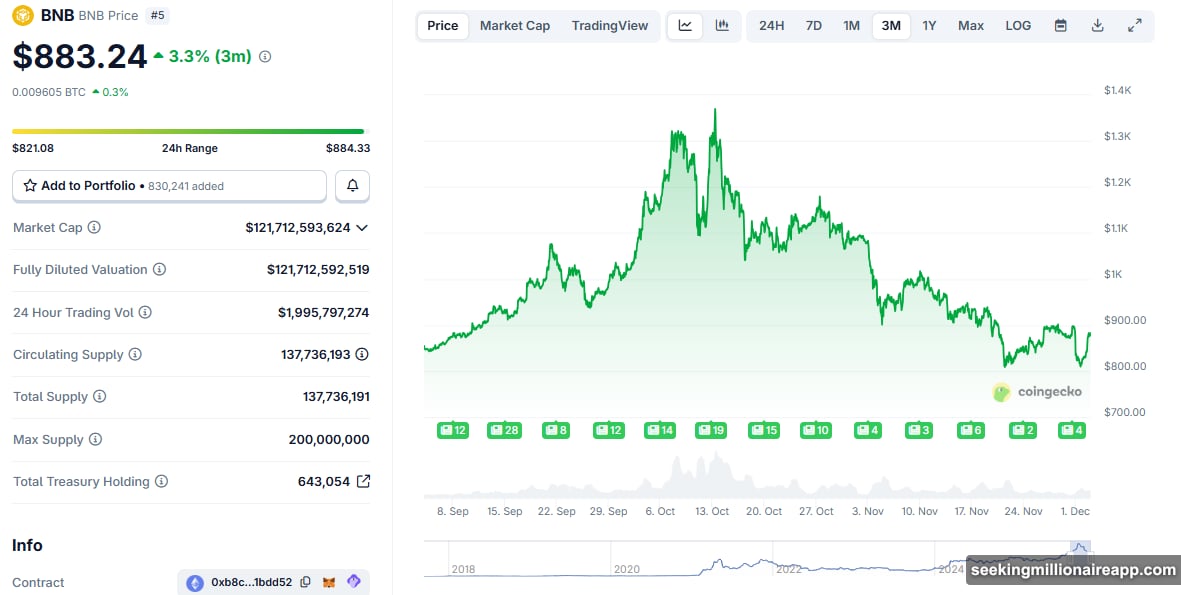

BNB Delivers Explosive December Moves With Higher Risk

BNB shows the most dramatic swings of any coin in this analysis. When December rallies hit, BNB often leads the charge.

The token jumped about 19% in December 2020 as Binance exchange volumes exploded. But its monster move came in December 2023 when BNB surged roughly 37%, climbing from around $228 to $312.

That rally followed improved clarity around Binance’s legal situation. Spot volumes rebounded, and traders piled back into the exchange’s native token. The momentum was relentless for nearly the entire month.

Still, BNB’s December crashes can be brutal. It fell 13% in 2019, 18% in both 2021 and 2022 during exchange-related fear. These drawdowns reflect BNB’s tight connection to Binance’s fortunes.

So BNB works as a high-beta December play. When sentiment swings positive, it outpaces Bitcoin significantly. But when stress hits, the losses pile up faster than most traders expect.

Litecoin Acts Like Leveraged Bitcoin During December

Litecoin behaves like a turbo-charged version of Bitcoin’s December moves. The gains hit harder in strong years, and the losses cut deeper in weak ones.

December 2020 brought Litecoin’s best performance. LTC surged about 42%, rocketing from roughly $88 to $125. That move tracked Bitcoin’s breakout and reflected growing payment adoption, including PayPal’s crypto integration.

But Litecoin also delivered some of the worst December losses. It dropped 13% in 2019, crashed nearly 30% in 2021, and fell 12% in 2022. Those moves show Litecoin’s high sensitivity to market direction.

Interestingly, Litecoin posted modest gains of about 5% in December 2023 and roughly 7% in 2024. These smaller rallies suggest it still benefits from late-year risk appetite, especially when halving narratives build.

For traders looking for amplified December exposure, Litecoin often delivers. Just remember the downside amplifies equally hard when sentiment sours.

Monero Quietly Outperforms During December Stress

Monero stands out for its defensive December characteristics. While other coins crashed hard in weak years, Monero held up remarkably well.

It rose about 15% in December 2020 and roughly 9% in December 2022 while many coins fell sharply. Monero also gained around 10% in December 2023, moving from the mid-$160s toward $180.

Most importantly, Monero avoided the extreme December crashes that hit other altcoins. Its drawdowns in weak years were relatively mild, likely reflecting steady transactional demand.

This resilience makes sense. Monero serves a specific use case focused on privacy and censorship resistance. When exchange fear or regulatory uncertainty rises, some traders rotate into Monero as a defensive crypto asset.

Across six years, Monero delivered consistent December strength without the wild swings of high-beta plays. That consistency makes it one of the more reliable late-year performers among mid-cap coins.

Santa Rallies Need the Right Conditions

The data shows these five cryptocurrencies can deliver strong December gains. But they don’t rally every year automatically.

Strong December performance clusters in bullish macro environments and recovery phases. When liquidity flows freely and confidence returns, these coins tend to catch bids. More defensive assets like Monero perform better during bear-market Decembers.

Bitcoin and Ethereum set the tone for the entire market. When they rally in December, altcoins typically follow with amplified moves. BNB and Litecoin often lead the charge higher during these periods.

But when macro conditions tighten or late-cycle stress hits, December turns ugly fast. The 2021 and 2022 data shows how quickly gains can evaporate when sentiment shifts.

For traders, the lesson is straightforward. Historical December strength exists, but current market conditions matter more than seasonal patterns. Each year’s macro backdrop and project-specific news ultimately decide whether Christmas turns green.

Watch liquidity conditions and overall risk appetite. Those factors drive December performance far more reliably than calendar dates alone.