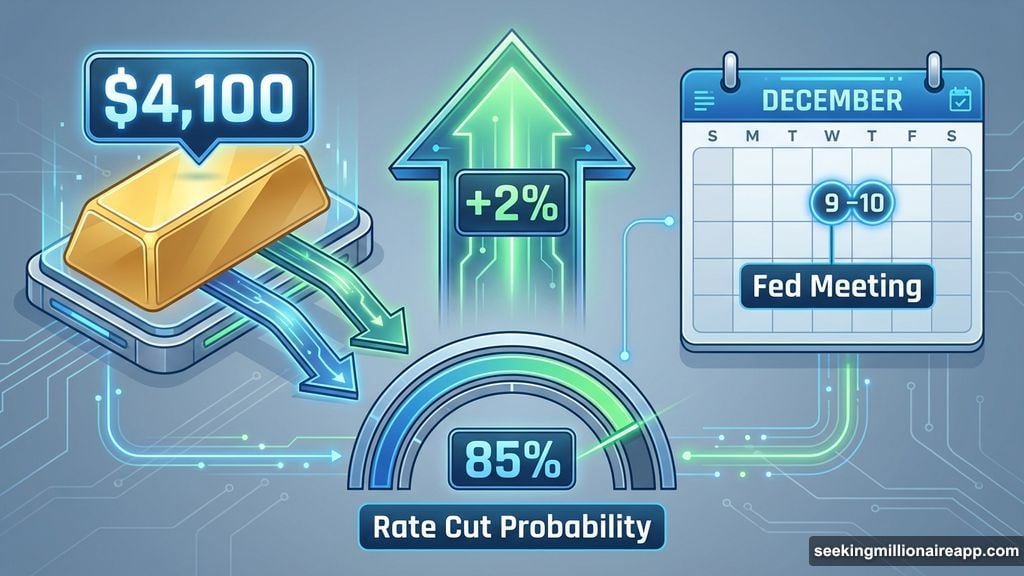

Gold just climbed over 2% this week. The reason? Markets now bet heavily on a December rate cut.

Traders pushed gold past $4,100 as Federal Reserve officials signaled they’re ready to ease. Plus, the blackout period starts Saturday, so incoming US data will drive the next move. Here’s what actually matters for gold investors right now.

Fed Officials Flip Dovish Fast

The tone shift happened quickly. Fed Governor Stephen Miran said he’d support a 25-basis-point cut if his vote mattered. That’s a complete reversal from his earlier push for 50 bps in previous meetings.

New York Fed President John Williams added fuel. He called current policy “modestly restrictive” and said there’s room to adjust soon. So gold responded immediately, jumping 1.5% on Monday alone.

Markets now price in an 85% chance of a December cut. That’s up from around 60% just weeks ago. The CME FedWatch Tool shows traders are almost certain the Fed will move. Yet data still needs to cooperate for that outcome.

Holiday Week Kept Trading Thin

Wednesday’s economic data came in mixed. Initial jobless claims dropped to 216,000 for the week ending November 22. That’s 6,000 fewer than the prior period. Meanwhile, durable goods orders rose 0.5%, beating the 0.3% forecast.

Neither release changed Fed expectations. Gold held firm above $4,100 heading into Thanksgiving. Friday saw minimal volume, but the metal stayed near weekly highs around $4,125.

The ADP report revealed something concerning though. Private employers shed an average of 13,500 jobs weekly through November 8. That layoff trend matters more than single-week jobless claims. In fact, sustained job losses could accelerate Fed action.

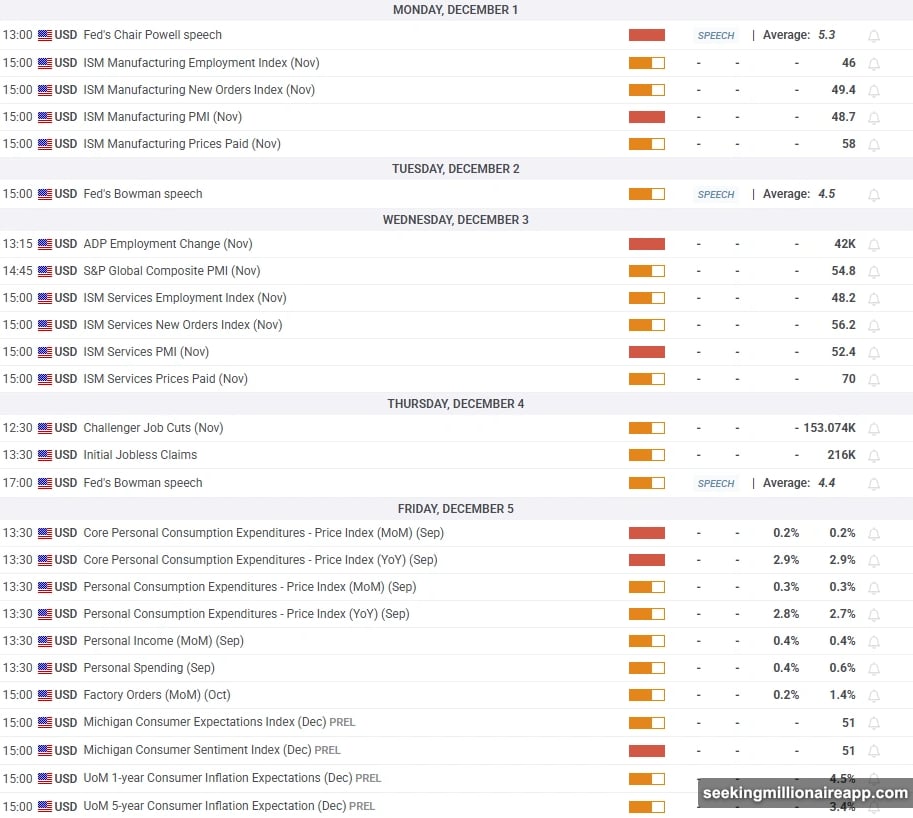

US Data Takes Center Stage

Fed officials can’t comment until the December 9-10 meeting. So investors must rely entirely on economic releases to gauge rate cut timing.

Monday brings ISM Manufacturing PMI. A strong employment index reading above 50 would support the dollar and pressure gold. Wednesday’s ISM Services PMI matters even more. A drop below 50 signals contraction and could boost gold prices.

Thursday’s Challenger Job Cuts report deserves attention. October layoffs hit 153,074, the highest in 22 years. A sharp decline would ease labor market worries and might strengthen the dollar against gold.

Friday’s PCE Price Index covers September due to earlier delays. This lagging data probably won’t move markets much. Still, watch for any surprises that shift inflation expectations.

Technical Setup Looks Constructive

Gold trades comfortably above key support levels. The 20-day simple moving average sits at $4,085, while the 50-day SMA holds at $4,030. The 23.6% Fibonacci retracement from the August-October rally provides additional support at $4,125.

The RSI hovers near 60 on the daily chart. That shows bullish momentum without being overbought. However, the indicator has moved sideways recently, suggesting consolidation rather than acceleration.

Support levels stack up below current prices. First comes $4,125, then $4,085, followed by $4,030 and $3,970. On the upside, resistance sits at $4,245, with further barriers at $4,300 and $4,380.

The gold-to-silver ratio broke down through 14-year rising support. Immediate support now comes at 72. With gold at $4,500 and that ratio, silver could reach $62. Some analysts think that could happen as soon as next week.

What Drives Gold From Here

Three factors will determine gold’s path through December. First, incoming US economic data must stay weak enough to justify a rate cut. Second, the Fed needs to actually deliver that 25 bps cut at the December meeting. Third, any surprises in labor market data could shift expectations fast.

The blackout period removes Fed commentary from the equation. That makes data releases the sole driver of market pricing. Strong manufacturing or services PMI readings would reduce rate cut odds and pressure gold. Weak readings would do the opposite.

Technical momentum supports higher prices short-term. Yet gold needs fresh catalysts to break above $4,245 resistance. The December Fed meeting will provide that catalyst, either through a cut or unexpectedly hawkish guidance.

Current positioning suggests traders believe the cut is coming. They’re betting on lower rates supporting gold prices. Whether that bet pays off depends entirely on what US data reveals about economic health before the Fed decides.

Watch those PMI releases on Monday and Wednesday. They’ll set the tone for gold’s final push into the December Fed meeting.