Crypto prices rarely cooperate. You wait for a breakout that never arrives. Instead, the price bounces between the same levels for weeks.

Most traders hate this. They take positions, close them early, then watch the price reverse again. Sound familiar?

But here’s the thing. That repetitive bounce isn’t random noise. It’s a pattern you can trade systematically. And grid trading does exactly that.

The Mechanic Behind Grid Trading

Grid trading places buy and sell orders at fixed intervals across a price range. Simple concept. When price drops to a buy level, you buy. When it rises to the next level, you sell.

No predictions required. No emotional decisions. Just predefined rules that execute automatically.

Here’s how it works in practice. You choose a price range where Bitcoin bounces repeatedly. Let’s say $90,000 to $100,000. Then you place orders at regular intervals throughout that range.

Price drops to $92,000? The system buys. Price rises back to $94,000? It sells. This cycle repeats endlessly as long as price stays inside your range.

The strategy accepts a simple truth. Crypto prices often go nowhere for extended periods. Instead of fighting that reality, grid trading profits from it.

Why Sideways Markets Break Traditional Strategies

Directional trades need follow-through. You buy expecting continuation. Or you short anticipating a breakdown. Both approaches fail when price refuses to commit.

Range-bound markets punish certainty. Price moves just enough to trigger your entry, then drifts back to the middle. Your stop loss hits. Then price reverses without you.

Grid trading takes a different approach. It expects price to revisit the same zones repeatedly. Every return to a familiar level creates another trade opportunity.

Think about how ranges actually behave. Price pushes up, pulls back, then repeats. Most traders see failed breakouts. Grid systems see expected behavior worth trading.

This rhythm matters. Because most people struggle to place the same trade repeatedly without second-guessing themselves.

Automation solves that problem. The system reacts identically every time price reaches a level. No hesitation. No fatigue. Just consistent execution.

Spot Grids vs Futures Grids

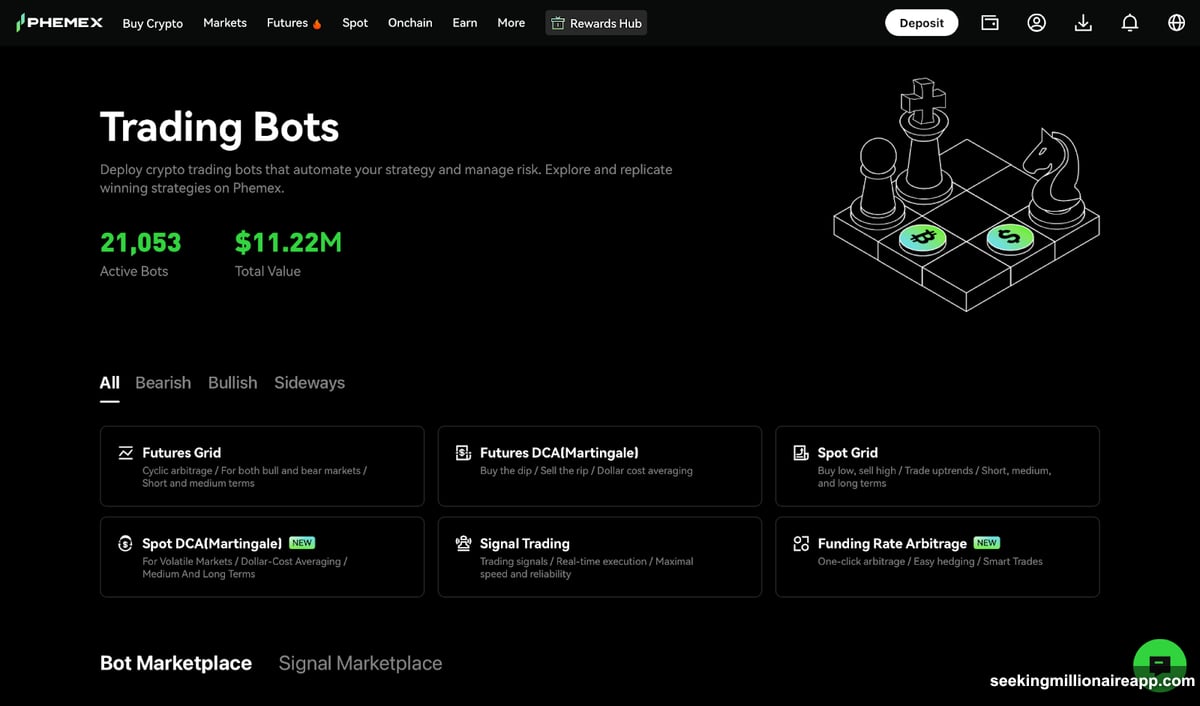

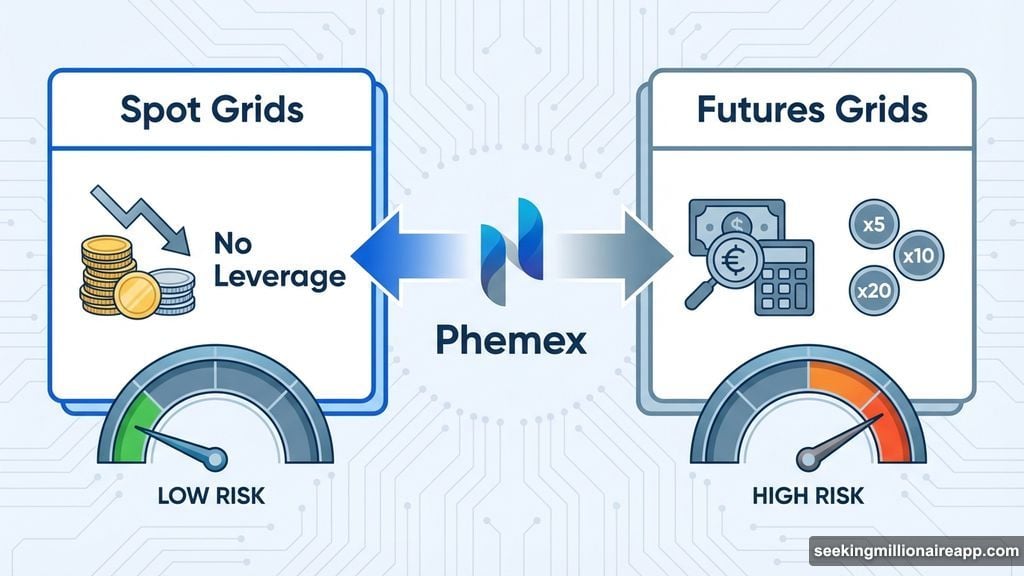

Phemex offers two ways to run grid strategies. Each serves different risk appetites.

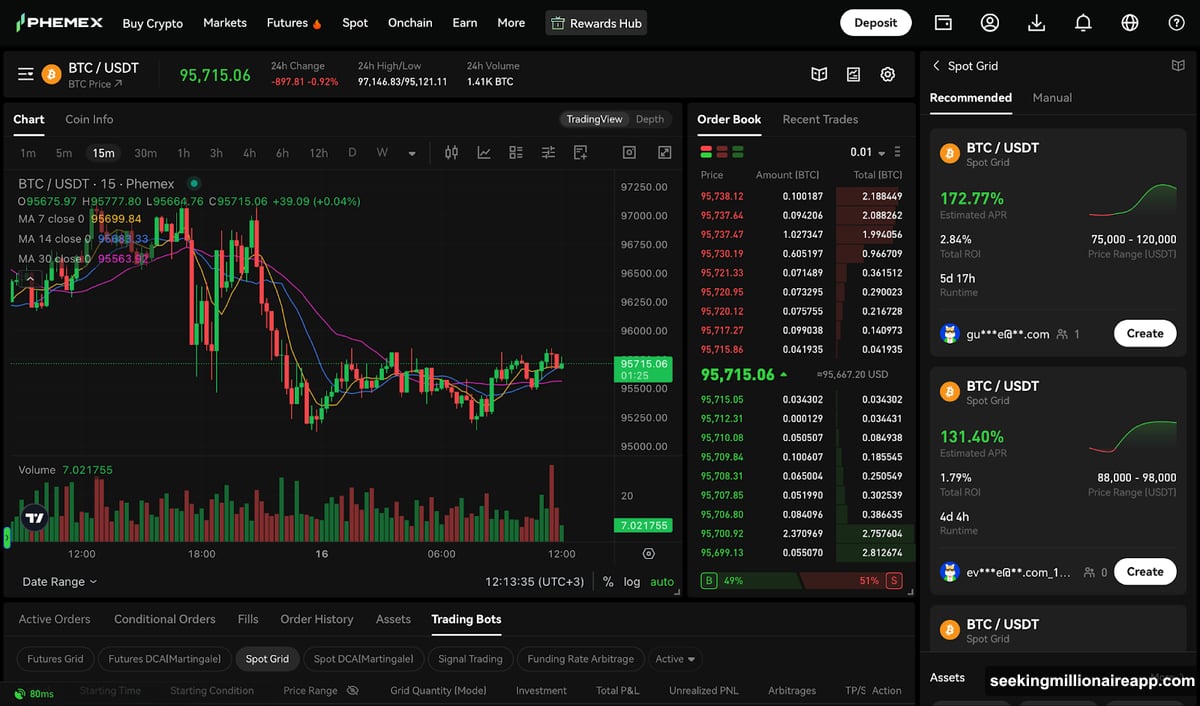

Spot grids stick to simple buy and sell orders using your own funds. No leverage. No margin math. No liquidation risk.

You pick a trading pair, define upper and lower price boundaries, and choose how many grid levels sit inside that range. The platform shows you exactly where orders will land before anything goes live.

Once active, the bot places buy orders below current price and sell orders above it. Then it repeats that cycle automatically. If price drops hard, the bot keeps working inside your defined range. If price exits the range, execution pauses.

The simplicity appeals to cautious traders. You know exactly what happens in every scenario.

Futures grids add directional bias and optional leverage. Same grid logic, but with three operating modes:

Long mode starts with a bullish position and trades the grid around that stance. Short mode does the opposite with a bearish tilt. Neutral mode takes no directional position initially, just buys low and sells high across your range.

The mechanics stay familiar. But futures grids involve margin requirements and liquidation risk. Getting the range and leverage right matters significantly more here.

Three Parameters That Control Grid Performance

Most grid failures trace back to mismatched settings. Three inputs matter more than everything else.

Price range selection defines where the bot operates. Set it too tight and price exits frequently, leaving the bot idle. Set it too wide and trades happen rarely while capital spreads thin.

Look at recent price action. Where did price pause or reverse over the past week or month? Place your grid where price already spends time. You’re not predicting the next move. You’re working with established zones.

Grid count controls trade frequency. More grids mean smaller gaps between orders and more frequent trades. Fewer grids create wider gaps and larger profit per fill.

Neither option wins by default. Tight grids suit calm ranges with steady oscillation. Wider grids handle choppier ranges with sharper swings better.

Fees matter here. Each trade costs money. So the gap between buy and sell levels must exceed that cost for the strategy to profit.

Grid spacing type determines how distance between orders is calculated. You’ll typically choose between arithmetic or geometric spacing.

Arithmetic spacing uses equal price gaps. If your range runs from $90,000 to $100,000, each grid step uses the same dollar distance. This works when price moves calmly inside a tight band.

Geometric spacing uses equal percentage gaps instead. Lower prices get tighter spacing. Higher prices spread out. Since crypto moves in percentages rather than fixed amounts, this option often behaves more naturally during volatile ranges.

Setting Up Your First Grid Bot

The actual setup process on platforms like Phemex feels straightforward. Nothing goes live until you confirm the full layout.

Start by choosing a trading pair that shows clear range behavior. Avoid assets that move sharply on news or suffer from thin liquidity.

Define your price range using levels where price bounced before. This range tells the bot where to work and where to pause.

Select the number of grids based on your trade frequency preference. Fewer grids create wider gaps. More grids increase activity.

Choose your spacing type. Pick arithmetic for tight, stable ranges. Use geometric for percentage-based movement across wider ranges.

Allocate only capital you’re comfortable committing to this single strategy. The bot uses only this balance, nothing more.

For spot grids, decide whether to add a stop price. For futures grids, set leverage carefully and define stop conditions before launch.

Review the visual layout. You should clearly see where buy and sell orders will sit across the range. Then confirm and activate.

Once running, the focus shifts from constant decision-making to periodic supervision. Watch for range breaks or volatility shifts that change market character.

Common Grid Trading Mistakes

Grid trading looks calm on the surface. That’s exactly why small mistakes slip through unnoticed.

Setting the range too tight causes the bot to stop working whenever price breaks out slightly. A range reflecting recent highs and lows usually performs better than one squeezed around current price.

Spreading the range too wide creates the opposite problem. Trades trigger rarely and capital stays underused. The grid exists but doesn’t participate enough to matter.

Grid count causes trouble when pushed to extremes. Too many grids create frequent trades with tiny profits that fees quietly erase. Too few grids miss swings happening inside the range.

Futures grids add their own risks. High leverage leaves little room for error when price moves sharply. Modest leverage and wider ranges typically survive longer than aggressive settings.

Many traders leave bots running after conditions change. A grid fits a range. Stop it when the range disappears. Continuing during a strong trend just creates growing exposure in the wrong direction.

When Grid Trading Fits Your Strategy

Grid trading works when markets move sideways without clear direction. It thrives when prices oscillate repeatedly and you prefer rules over constant judgment calls.

If you enjoy active decision-making or rely on strong trends, grids will feel restrictive. The strategy removes discretion by design.

Consider grid trading when you value consistency, automation, and clearly defined risk. It replaces impulse with a systematic process.

But remember this. Grid trading manages execution, not market risk. Automation doesn’t remove the inherent risks of crypto market participation. It just changes how you interact with them.

The strategy turns choppy, directionless markets into structured opportunities. Whether that fits your approach depends on how you view trading itself.