Three altcoins are making headlines this weekend, but for very different reasons. One is riding a massive surge, while two others face critical tests that could determine their short-term direction.

The broader crypto market is watching Bitcoin nervously as it hovers near $100,000. But these three tokens are moving based on their own catalysts rather than just following BTC’s lead.

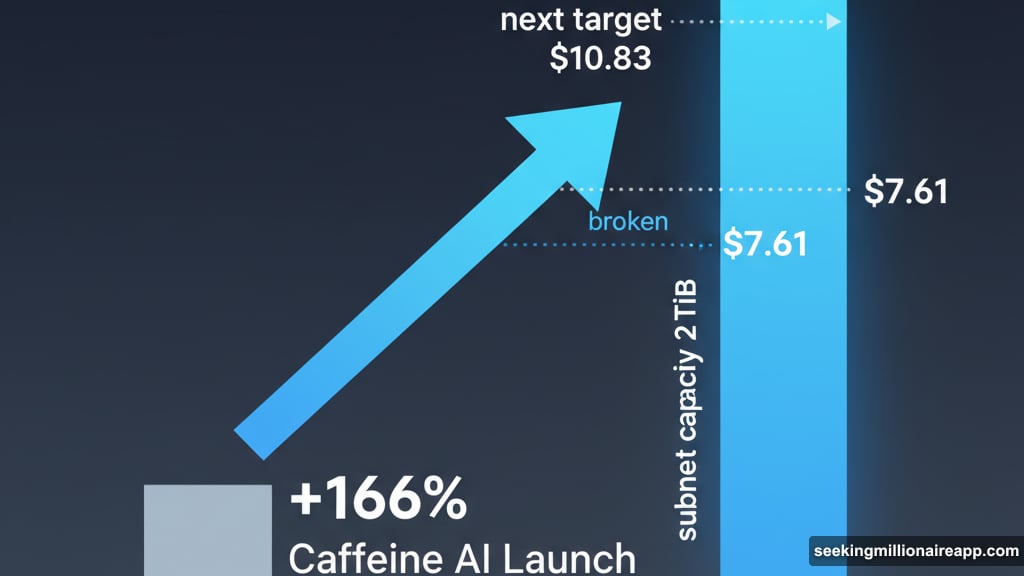

Internet Computer Explodes After AI Launch

Internet Computer (ICP) just became the week’s breakout star. The token rocketed 166% to $7.80 after Dfinity launched its AI tool called Caffeine.

This isn’t just marketing hype. The upgrade doubled Internet Computer’s subnet capacity to 2 TiB. Plus, it enhanced performance for HIPAA-compliant decentralized applications. Healthcare apps need serious security, and ICP just became much more attractive for that use case.

The price action confirms investor enthusiasm. ICP broke past $7.61 resistance and hit a 10-month high. If momentum continues, the token could push toward $10.83 this weekend.

But here’s the catch. After a 166% rally, profit-taking becomes tempting. If sellers emerge, ICP could drop back to $6.05 or even $4.67. That would erase much of the recent gains and invalidate the bullish setup.

Movement Faces Token Unlock Pressure

Movement (MOVE) is heading into a more challenging weekend. The project will unlock 50 million tokens worth over $2.90 million in the next two days.

Token unlocks often spell trouble. Sudden supply increases without matching demand typically trigger selling pressure. And Movement is already in a month-long downtrend.

The situation gets trickier because MOVE shows a strong 0.86 correlation with Bitcoin. If BTC drops below $100,000, MOVE will likely follow. The token could fall below its $0.0525 support level and potentially slip under $0.0461.

However, renewed buying interest could flip the script. If investors step in, MOVE might break its downtrend and push past $0.0669 resistance. Breaking through $0.0741 would confirm a trend reversal and invalidate the bearish outlook.

The next 48 hours will reveal whether buyers show up or the unlock triggers a selloff.

Axie Infinity Eyes Breakout Despite Unlock

Axie Infinity (AXS) is also facing a token unlock this weekend. But unlike Movement, this one seems less threatening.

The unlock is worth just $854,780. That’s small enough that it shouldn’t trigger major selling pressure. The limited supply increase helps maintain price stability in the short term.

More interesting is what’s happening technically. AXS has been stuck in a month-long downtrend, but that might be ending. The MACD indicator is approaching a bullish crossover, which often signals momentum reversal.

If sentiment improves, AXS could break above its downtrend line. The next resistance sits at $1.39, followed by $1.51. Reaching those levels would represent a solid recovery for the gaming token.

On the flip side, continued bearish conditions could push AXS below $1.18 support. A drop under $1.15 would open the door to retesting $1.00. That outcome would extend losses and disappoint bulls hoping for a turnaround.

Different Catalysts, Shared Uncertainty

These three tokens illustrate how diverse the altcoin market has become. Internet Computer is riding genuine technical innovation. Movement and Axie Infinity are navigating tokenomics challenges while trying to maintain price stability.

The weekend will reveal which narratives win. Strong fundamentals might protect ICP’s gains. Token unlocks could pressure MOVE and AXS, or buyers might see them as opportunities.

Bitcoin’s movements still matter. But increasingly, altcoins are proving they can move independently based on their own developments. That’s a sign of market maturation, even if it makes predicting outcomes harder.

Watch these three closely. The next few days could set the tone for their performance through the rest of November.