Japan’s bond market just cracked in ways most investors don’t understand yet. But the tremors could reach crypto faster than anyone expects.

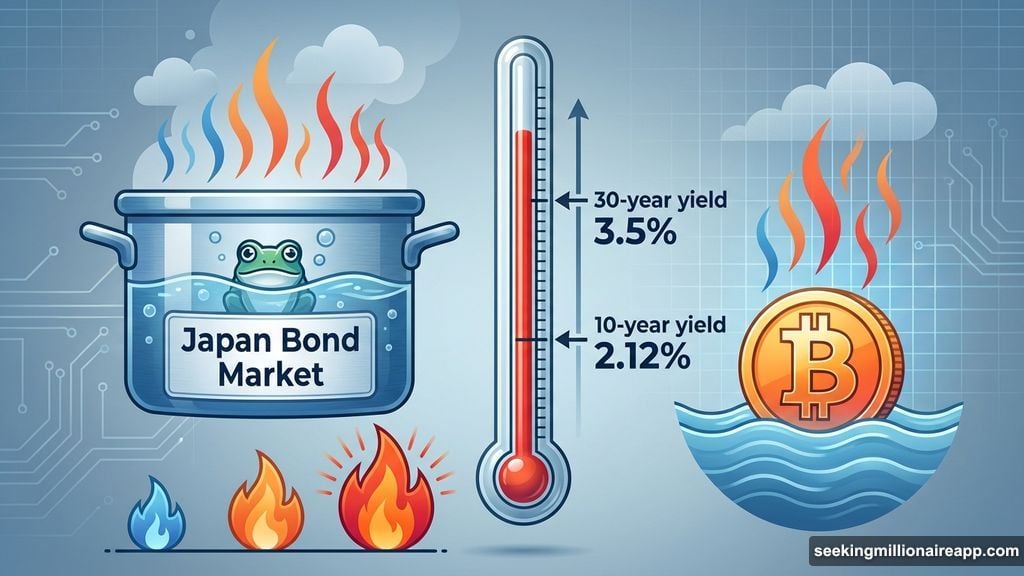

Government bond yields are spiking to levels Japan hasn’t seen in decades. The 10-year yield hit 2.12%, its highest since 1999. Meanwhile, the 30-year yield reached a record 3.5%. Both have jumped over 100 basis points in months.

This isn’t normal volatility. This is structural repricing after decades of ultra-low rates. And it threatens a massive source of global liquidity that crypto markets quietly depend on.

The Yen Carry Trade Built Modern Risk-Taking

For years, investors borrowed yen at rock-bottom rates. Then they invested that cheap money into higher-yielding assets worldwide. Stocks, emerging markets, and yes, Bitcoin all benefited from this flood of borrowed yen.

The math was simple. Borrow at near-zero in Japan. Invest elsewhere for real returns. Pocket the difference. Repeat until you’re managing billions.

But that math breaks when Japanese yields surge. Suddenly borrowing costs rise. The gap between what you pay and what you earn shrinks. Plus, the yen itself may strengthen, making it more expensive to repay those loans.

So the carry trade unwinds. Investors sell their positions to pay back yen loans. That drains liquidity from markets globally. Including crypto.

Japan’s Liquidity Is Actually Drying Up

Here’s the part that should worry you more. Japan’s monetary base dropped below ¥600 trillion for the first time since 2020. Cash in circulation fell 4.9% in 2025, the first decline in 18 years.

That’s real tightening. Not just talk from central bankers. Actual money supply contracting in an economy that ran on endless liquidity for decades.

The Bank of Japan spent years pumping money into markets. Now they’re pulling back. Government bond yields are surging because investors see massive deficit spending ahead. A record $780 billion budget for 2026 raises serious questions about fiscal sustainability.

Meanwhile, inflation pressures persist. The yen keeps weakening. So the BoJ faces impossible choices. Keep rates low and watch inflation climb? Or raise rates and risk crashing the bond market?

They’re choosing to let yields rise. Bond investors are pricing in higher risks. And that’s squeezing the entire carry trade structure.

The Boiling Frog Problem for Crypto

The danger isn’t a sudden crash. It’s a slow squeeze that nobody notices until it’s too late.

Analyst JustDario calls it “boiling frog syndrome.” The water heats up gradually. By the time you realize you’re in trouble, it’s too hot to escape. Japan’s financial stress is building slowly enough that most investors aren’t reacting yet.

But the foundation is weakening. The massive yen carry trade built on cheap Japanese borrowing? That’s the foundation. When it cracks, global risk assets feel it. Bitcoin included.

We saw this play out briefly in August 2024. Japanese yields spiked then too. Bitcoin dropped sharply as carry trade positions unwound. Markets stabilized when the BoJ intervened. But this time, the pressure looks more sustained.

Why Bitcoin Investors Should Care Now

Bitcoin’s correlation with traditional risk assets has strengthened. When global liquidity contracts, crypto typically feels it fast. The 2022 bear market partly reflected central banks draining liquidity worldwide.

Now Japan is doing the same thing. Except Japan’s liquidity has been propping up global markets for decades. The scale is different. The impact could be too.

Plus, crypto markets remain relatively small. A modest pullback in yen-funded positions could cause outsized volatility in Bitcoin. Especially if it triggers broader risk-off sentiment.

Some analysts argue Japan’s real interest rates are still negative despite rising nominal yields. That continues supporting risk assets. Capital Flows pointed out that Japanese equities are near all-time highs for this reason.

But negative real rates only work if inflation stays contained. If inflation keeps climbing while the BoJ stays behind the curve, those negative real rates won’t save you. Markets will reprice faster than policymakers can react.

What Happens Next

Japan’s bond market isn’t stable yet. Yields remain volatile. The government keeps spending while the central bank tries to exit stimulus. That’s a recipe for continued stress.

If the carry trade unwinds accelerate, Bitcoin could face sharp drawdowns. Not because of anything crypto-specific. Simply because a major source of global leverage is unwinding.

The risk is quiet and structural. No headlines screaming “crisis” yet. Just yields climbing, liquidity draining, and leverage slowly unwinding. By the time it makes front pages, the damage might already be done.

Bitcoin thrives on abundant liquidity. Cheap money flows into risk assets when central banks print. But when major economies like Japan tighten, that flow reverses. Crypto feels it hard and fast.

Watch Japanese bond yields closely. If the 10-year pushes much higher, or if the 30-year keeps breaking records, brace for volatility. The yen carry trade has funded global risk-taking for decades. Its unwind won’t be painless.

Japan’s bond market might seem distant from crypto. But the connections run deeper than most realize. And the reckoning could arrive sooner than markets expect.