Litecoin doesn’t get much hype anymore. Google searches dropped hard since 2021. Social media went quiet.

But here’s what nobody mentions. While everyone chased meme coins and new layer-1s, Litecoin just kept working. Over 13 years of uninterrupted uptime. Zero major security breaches. Consistent improvements under the hood.

That reliability matters more than most investors realize.

Bitcoin’s Boring Little Brother Actually Works Better

Charlie Lee launched Litecoin in October 2011 as a Bitcoin fork. His goal was simple. Make transactions faster and cheaper while keeping Bitcoin’s proven security model.

The network achieves blocks every 2.5 minutes instead of Bitcoin’s 10. So transactions confirm four times faster. Plus, fees average under 10 cents. That’s not theoretical math. Those are real costs people pay today.

Litecoin also sports 84 million total coins versus Bitcoin’s 21 million. More units means smaller price per coin. But the same scarcity economics apply since over 90% of supply already exists in circulation.

The “silver to Bitcoin’s gold” nickname stuck for good reason. Both use proof-of-work mining. Both halve rewards every four years. Both prioritize security over fancy features.

Yet Litecoin processes payments better than Bitcoin for everyday purchases. That’s not opinion. It’s measurable reality.

The Tech Upgrades Nobody Talks About

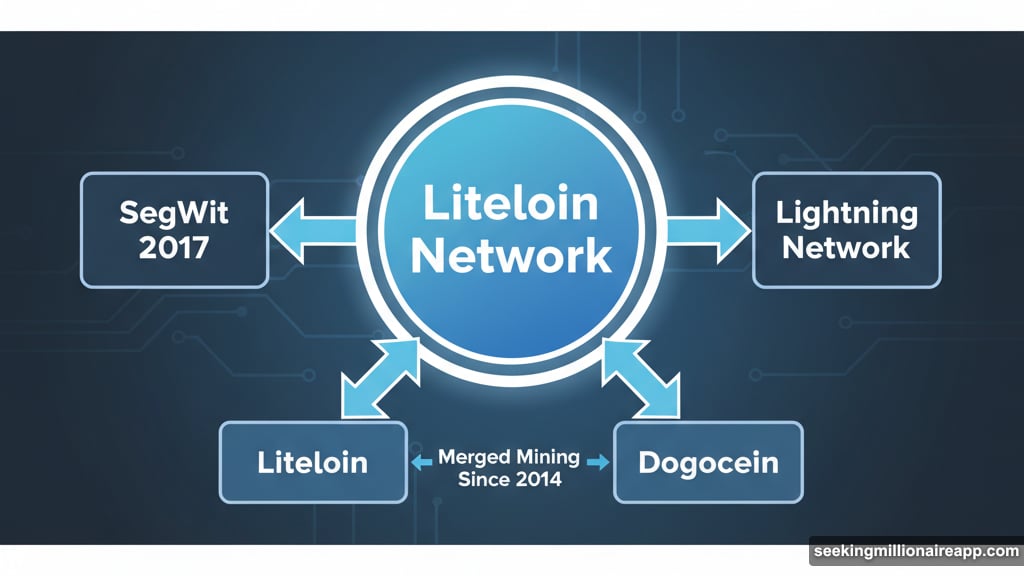

Litecoin became a testing ground for major blockchain innovations. Back in 2017, it activated Segregated Witness (SegWit) before Bitcoin did. That upgrade freed up block space and fixed transaction malleability bugs.

Then came Lightning Network support. This second-layer protocol enables instant payments with near-zero fees. Litecoin helped pioneer it. The first cross-chain Lightning transaction sent LTC to BTC successfully.

These weren’t marketing stunts. They were real technical achievements that improved the entire crypto ecosystem.

Security also got a boost through merged mining with Dogecoin since 2014. Both networks share computing power. So miners secure two blockchains simultaneously. That arrangement protects against 51% attacks way better than either network could manage alone.

Mining power has concentrated among major pools. But total hash rate keeps climbing thanks to more efficient Scrypt ASIC miners. The network has never been more secure.

Supply Crunch Coming in 2027

Here’s where things get interesting for long-term holders. Annual inflation sits under 2% right now. The next halving hits in July 2027. After that, new supply drops below 1% per year.

Compare that to traditional currencies. Central banks typically target 2% inflation minimum. Litecoin will soon deliver better scarcity than most fiat money or even gold.

Meanwhile, on-chain activity stays steady. Transaction counts spike whenever Bitcoin fees surge or Dogecoin demand explodes. Active addresses remain consistent despite market conditions changing constantly.

This pattern reveals actual utility. People use Litecoin for real transactions, not just speculation. That’s rare in crypto where most tokens serve no practical purpose.

Valuation Screams Opportunity

Two key metrics tell the story. Network value to transactions (NVT) ratio sits below Bitcoin’s and Dogecoin’s. That suggests Litecoin trades fairly compared to actual usage. Most crypto trades way above fair value. Litecoin doesn’t.

Market value to realized value (MVRV) ratio also sits well below bull market peaks. This metric compares current price to the average cost basis of all holders. Low MVRV means less speculative excess. Fewer weak hands ready to dump.

Google Trends confirms what everyone already knows. Retail enthusiasm disappeared. “Litecoin” searches cratered from 2021 highs.

But that’s actually bullish. Every previous cycle saw Litecoin bottom when nobody cared. Then it outperformed when attention returned. We’re in the “nobody cares” phase right now.

What Advisors Should Actually Consider

Financial advisors evaluating crypto face tough choices. Bitcoin dominates mindshare but carries massive volatility. Ethereum offers smart contracts but struggles with complexity and competing layer-2s.

Litecoin plays a different role. It’s the reliable workhorse that just functions. Block after block. Year after year. No drama. No protocol wars. No governance chaos.

For portfolio construction, that matters. Litecoin provides exposure to transaction-focused crypto without meme coin speculation. It offers lower correlation to Bitcoin’s narrative shifts. And it benefits from declining issuance heading into 2027’s halving.

Most importantly, it survived. So many projects from 2011 to 2013 died completely. Litecoin endured through multiple bear markets, technological shifts, and changing investor preferences.

That track record deserves respect even from skeptics.

Why Durability Beats Hype

The crypto market rewards novelty short-term. New protocols promise revolutionary features. Founders market aggressive roadmaps. Retail jumps from trend to trend chasing quick gains.

But long-term value comes from networks that simply work. Networks people trust to process transactions today, tomorrow, and five years from now. Networks that don’t break, don’t fork controversially, and don’t change fundamental economics on a whim.

Litecoin nails all three. Its value proposition hasn’t changed since 2011. Fast, cheap, reliable payments using proven proof-of-work security. No pivots. No rebrands. No desperate protocol overhauls.

In an industry obsessed with disruption, that consistency feels almost radical. Yet it’s exactly what serious users and institutions need.

The market will figure this out eventually. It always does. Usually right after most people stop paying attention.