American banking giants are racing to offer crypto services. After years of watching from the sidelines, institutions like Bank of America and Morgan Stanley just made their moves official.

This isn’t cautious experimentation anymore. Banks are filing ETFs, advising clients, and building crypto infrastructure. The shift from skepticism to full-on participation happened fast.

Bank of America Tells Clients to Buy Bitcoin

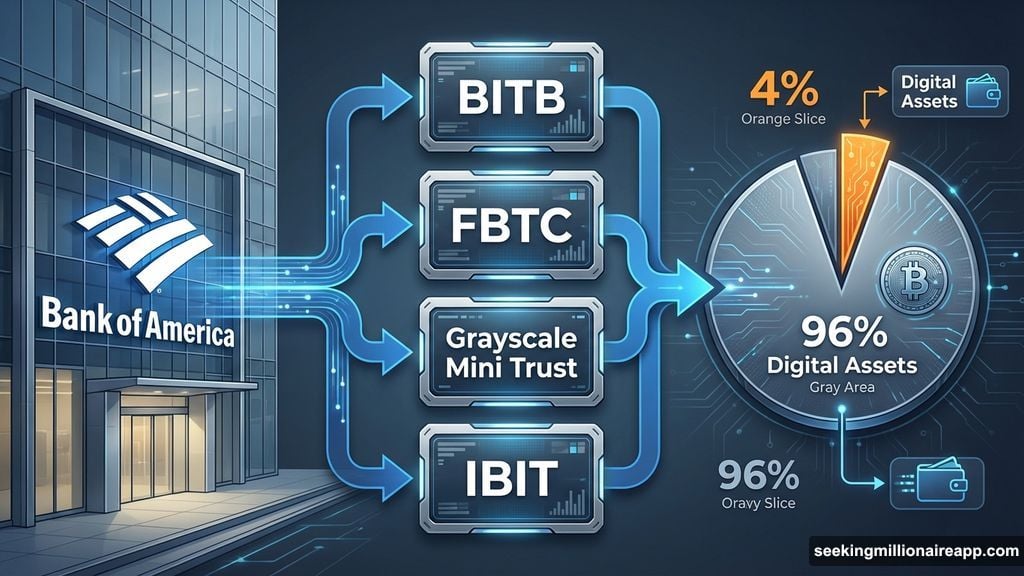

Bank of America just started recommending crypto to wealth management clients. Their guidance? Allocate up to 4% of portfolios to digital assets.

That’s a huge endorsement. BofA isn’t some crypto-native startup. They manage trillions in assets for traditional investors who trust conservative advice.

The bank covers four Bitcoin ETFs now: BITB, FBTC, Grayscale Mini Trust, and IBIT. These launched on January 5, 2026, giving clients direct access to regulated Bitcoin exposure.

Plus, this follows months of preparation. BeInCrypto first reported BofA’s plans back in December. So the announcement was expected. But seeing it happen still signals a major shift in how mainstream banks view crypto.

Morgan Stanley Files for Bitcoin and Solana ETFs

Morgan Stanley took things further. They filed an S-1 registration for both Bitcoin and Solana ETFs on January 6, 2026.

That’s significant for two reasons. First, Morgan Stanley manages $1.6 trillion in assets. Second, they’re including Solana alongside Bitcoin. Most banks stick to Bitcoin for regulatory safety. Adding Solana shows they’re willing to diversify beyond the largest crypto.

The filing means clients will soon trade both assets through regulated vehicles. No sketchy exchanges required. Just traditional brokerage accounts with familiar protections.

Meanwhile, American Bitcoin announced it jumped to the 19th largest public Bitcoin treasury. They accumulated roughly 5,427 BTC since their Nasdaq debut in September 2025. That represents a 105% BTC yield over four months.

These moves reflect competitive pressure. Banks fear missing out while clients demand crypto access elsewhere.

Other Banks Already Built Crypto Infrastructure

Morgan Stanley and BofA aren’t first movers. Several major institutions quietly built crypto services over the past few years.

JPMorgan Chase operates JPM Coin, a blockchain-based payment token. They also maintain broader digital asset infrastructure projects. Goldman Sachs runs crypto trading desks serving institutional clients. Citigroup explores custody and trading services, though still in early stages.

Charles Schwab plans to offer direct Bitcoin and Ethereum trading on client platforms. PNC Bank partnered with Coinbase to enable crypto trading through standard bank accounts. That partnership lets clients buy and sell without leaving their banking interface.

State Street went deeper. They’re developing stablecoins and tokenized assets, including bonds and money market shares. So banks aren’t just facilitating crypto trading. They’re creating crypto-native financial products.

US Bank (US Bancorp) resumed Bitcoin custody for institutional managers in 2025. They now handle Bitcoin ETF custody, providing full-service solutions for asset managers.

BNY Mellon became an early adopter. They safeguard BTC and ETH holdings through dedicated custody platforms. That infrastructure supports institutional clients who need secure storage for large crypto positions.

Specialized Crypto Banks Fill Gaps

Traditional banks aren’t alone. Specialized institutions emerged to serve crypto markets directly.

Cross River Bank, which is FDIC-insured, partners with Coinbase to facilitate crypto transactions via APIs. That lets Coinbase offer banking services without becoming a bank itself.

Anchorage Digital became the first federally chartered crypto bank in the US. They focus on institutional custody and blockchain services with full regulatory approval.

Custodia Bank operates under a Wyoming charter. They offer crypto-specialized services designed specifically for digital assets. Wyoming created a unique regulatory framework that makes crypto banking easier than most states.

These specialized players handle functions traditional banks hesitate to touch. They bridge the gap between crypto markets and regulated finance.

Regulatory Clarity Drove the Shift

Banks didn’t suddenly embrace crypto out of nowhere. Regulatory changes made it safe to participate.

Updated guidance from the Federal Reserve, Office of the Comptroller of the Currency (OCC), and FDIC now permits banks to custody crypto assets. They can facilitate trades and offer digital asset services legally.

That clarity removed major risks. Banks spent years worried about regulatory backlash. Now they have official permission to operate in crypto markets.

Plus, Bitcoin ETF approvals from the SEC opened floodgates. Regulated investment vehicles gave banks a safe way to offer crypto exposure without direct holdings.

The combination of custody permissions and ETF approvals created a tipping point. Banks that waited for certainty now feel confident moving forward.

Three Waves of Bank Crypto Adoption

The adoption pattern follows a clear sequence.

First came custody and institutional products. Banks started holding crypto for large clients who needed secure storage. That required minimal market risk while generating fee revenue.

Next arrived wealth management and ETFs. Once custody proved viable, banks began recommending crypto allocations to individual investors. ETFs made this simple and regulatory-compliant.

Third came exchange partnerships. Rather than building full infrastructure in-house, banks partnered with Coinbase and other platforms. This let them offer crypto services quickly without massive development costs.

Each wave reduced barriers for the next. Custody built trust. ETFs created access. Partnerships scaled services rapidly.

Bitcoin ETFs See Massive Inflows

Bitcoin ETFs recorded their biggest inflows in three months recently. BlackRock’s entry signaled crypto’s structural shift from fringe asset to mainstream investment.

That matters because institutional money moves slowly but steadily. Once major asset managers commit, others follow to avoid falling behind.

Meanwhile, MicroStrategy continues accumulating Bitcoin aggressively. Their strategy raised questions about sustainability. Can capital markets keep funding their purchases without a premium cushion?

Some analysts worry MicroStrategy’s approach depends on continuously rising Bitcoin prices. If momentum stalls, their financing model faces pressure.

Crypto Markets Show Mixed Signals

Bitcoin whales accelerated exchange activity in early 2026. That suggests major holders are repositioning amid fragile liquidity conditions.

Large transactions can move prices significantly when liquidity is thin. So whale activity often precedes volatility.

Arbitrage bots dominate Polymarket with millions in profits. Human traders struggle to compete with algorithmic strategies that execute instantly.

Plus, crypto oversight strengthened in India. Forty-nine exchanges registered with the Financial Intelligence Unit (FIU). That regulatory compliance shows global crypto adoption spreading beyond Western markets.

Banks Transformed Crypto’s Status

Five years ago, major banks called Bitcoin a scam. Jamie Dimon famously trashed it publicly.

Today, JPMorgan operates blockchain infrastructure. Goldman runs trading desks. Bank of America recommends 4% allocations.

That transformation happened because banks follow money. Client demand for crypto exposure became impossible to ignore. Regulatory clarity removed legal barriers. Competitive pressure forced action.

So crypto shifted from niche experiment to accepted asset class. Banks that resisted risk losing clients to competitors who offer crypto services.

The FOMO is real. Not among retail investors this time. Among trillion-dollar institutions racing to catch up.