Markets don’t usually crash in unison. But this week proved different.

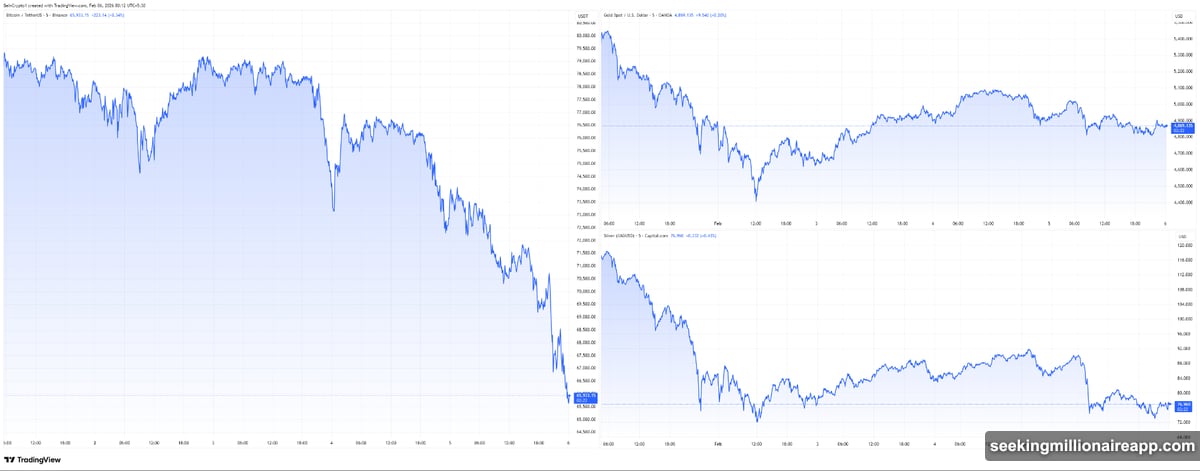

Bitcoin dropped alongside gold, silver, and equities in a synchronized sell-off that caught everyone off guard. The unusual correlation reveals something bigger than asset-specific weakness. Instead, it signals a liquidity crisis forcing traders to dump everything they can.

Everything Got Sold at Once

Normally, stress in crypto pushes money into gold or cash. Safe havens catch the overflow. That didn’t happen this time.

Investors sold Bitcoin, gold, silver, and stocks together. Why? Because they needed cash immediately. When margin calls hit, traders liquidate their most liquid holdings first. It’s mechanical, not strategic.

Bitcoin led the carnage among risk assets. But gold and silver posted their steepest weekly drops in months too. That’s the signature of forced deleveraging, not a calculated rotation out of crypto.

The pattern shows traders facing funding pressure, not making deliberate portfolio shifts. Markets sold off because participants had to raise cash fast, regardless of what they believed about Bitcoin’s long-term value.

Fed Actions Made Things Worse

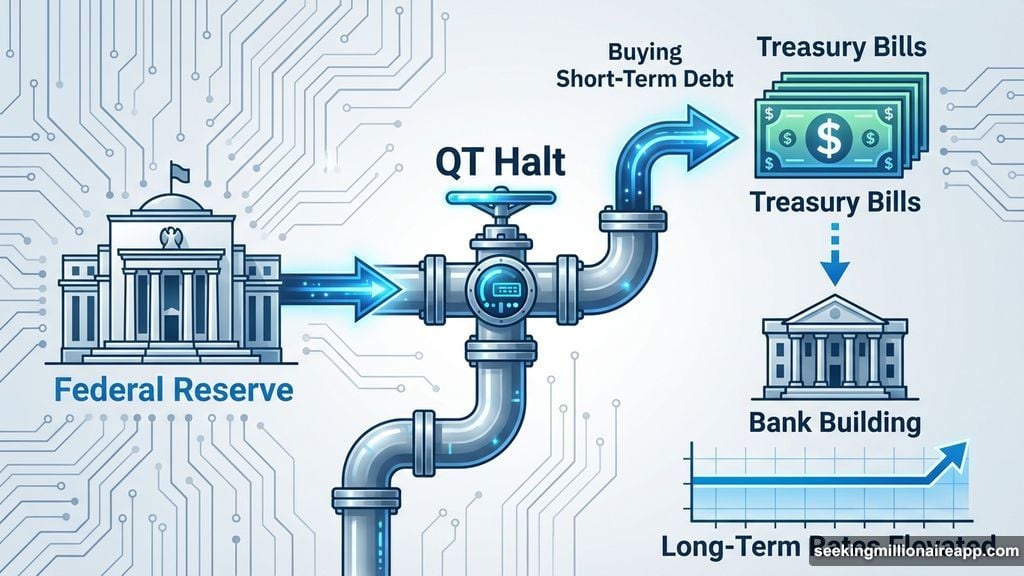

The Federal Reserve tried to help. It halted quantitative tightening in December and started buying short-dated Treasury bills.

Here’s what that means in practice. When the Fed stopped QT, it quit draining cash from the financial system. For banks, reserve levels stabilized. For everyone else, it reduced the risk of sudden funding stress.

By buying short-term government debt, the Fed ensures banks have enough cash for daily operations. Money markets keep functioning. The plumbing stays intact.

But these moves don’t lower borrowing costs for consumers. They don’t reduce mortgage rates or encourage risk-taking. Long-term interest rates remain elevated. Financial conditions stay tight.

So markets interpreted the Fed’s actions as a sign of underlying stress, not relief. The central bank was fixing pipes, not opening credit taps. That distinction matters enormously.

Jobs Data Trapped Everyone

US labor data deepened the confusion this week. Job openings continued falling. Hiring slowed. Layoffs rose. Consumer confidence dropped to its lowest level since 2014.

Yet unemployment remains relatively low. Plus, inflation hasn’t cooled enough to justify rapid rate cuts from the Fed.

That combination trapped markets between two bad options. Growth is slowing, but financial conditions stay restrictive. There’s no relief coming from monetary policy because inflation persists.

Investors wanted clarity. Instead, they got mixed signals that offer no obvious trading direction. When uncertainty reaches that level, selling becomes the default response.

Applications for unemployment benefits jumped by 22,000 to 231,000 in late January. That’s higher than forecasts predicted. More weakness ahead, but no policy response in sight.

Gold Fell Because It Could

Gold and silver declined despite rising uncertainty. That seems counterintuitive. Aren’t precious metals supposed to rally during stress?

Yes, but only when investors have spare cash or access to leverage. This time, they needed liquidity urgently. Both metals had rallied strongly earlier this year. That made them easy sources of cash.

Moreover, real yields remained elevated and the dollar strengthened during the sell-off. That combination removed short-term support for precious metals. Higher yields make non-yielding assets like gold less attractive.

So gold got sold not because it failed as a safe haven. It got sold because it worked as a liquid asset that traders could convert to cash quickly.

Cryptocurrencies fell harder because they sit at the bottom of the liquidity hierarchy. When leverage unwinds, crypto gets dumped first. Always.

Bitcoin Liquidations Accelerated Everything

Bitcoin dropped $56,700 over the past 120 days. From $126,000 at its peak to roughly $69,400 now. That’s a 45% crash in four months.

What drove it? Derivatives positioning. Long bets had built up in recent weeks. As prices dropped, liquidations accelerated. Forced selling created more forced selling.

Meanwhile, ETF inflows slowed at the same time. That reduced demand just when supply hit the market. The combination crushed prices faster than most expected.

There wasn’t one major event or news catalyst. Instead, it was a slow-motion unwind of leverage across the entire crypto market. Those hurt the most.

Markets Reset Expectations

The last two weeks reflect one clear theme. Markets priced in easier financial conditions too early. Liquidity didn’t expand fast enough to support those bets.

As a result, risk assets corrected together. Crypto, equities, and commodities all adjusted at once. The move reset positioning across multiple asset classes.

This wasn’t a failure of Bitcoin or gold as long-term hedges. It reflected short-term liquidity stress that typically appears before policy or macro clarity improves. Those phases hurt, but they pass.

For now, markets remain fragile. Volatility will persist until liquidity expectations stabilize or economic data decisively weakens enough to force Fed rate cuts.

What Actually Matters Here

This sell-off reveals how interconnected global markets have become. When liquidity tightens, everything moves together. Asset class diversification doesn’t protect you during a liquidity crisis.

The Fed’s actions support banking system stability, not asset prices. That’s an important distinction many investors missed. Technical fixes for financial plumbing don’t translate into rallies for Bitcoin or stocks.

Until the Fed cuts rates or significantly expands liquidity, risk assets face continued pressure. Labor market weakness without policy relief leaves markets trapped between slowing growth and restrictive conditions.

That’s a brutal combination for anyone holding leveraged positions. The smart play right now? Reduce leverage, hold cash, and wait for clearer signals. This environment punishes aggressive bets until conditions improve.