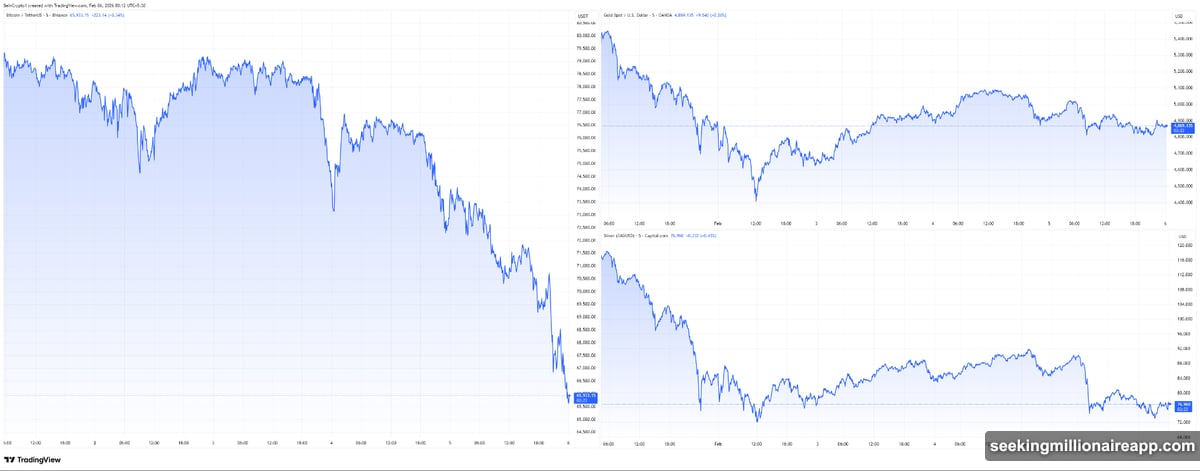

Markets don’t usually sell off like this. Crypto dropped. Gold fell. Silver tanked. Stocks cratered. All at once.

This wasn’t rotation into safer assets. This was panic liquidation driven by a liquidity crunch that nobody saw coming. And the Federal Reserve’s recent moves made things worse, not better.

Every Asset Got Hammered Together

Bitcoin led the carnage, plunging from $126,000 to $69,400 in just 120 days. That’s a brutal 45% crash with no single catalyst to explain it.

But here’s what’s really strange. Gold and silver fell hard too. These are supposed to be safe havens during market stress. Yet they posted their steepest weekly drops in months.

When everything sells off together, it signals forced deleveraging. Traders facing margin calls liquidate whatever they can sell fastest. Bitcoin goes first because it’s the most liquid. Gold and silver follow when cash needs get desperate.

This pattern reveals mechanical selling, not strategic portfolio shifts. Nobody chose to dump crypto for bonds. They had no choice but to sell everything.

Fed Moves Failed to Calm Anyone

The Federal Reserve halted quantitative tightening in December. They started buying short-term Treasury bills to stabilize bank reserves. Sounds helpful, right?

Markets saw it differently. These actions support the financial system’s plumbing without actually helping borrowers or risk assets. Banks get more reserves. But mortgage rates stay high. Business loans remain expensive. Consumer borrowing costs don’t budge.

Plus, the timing looked suspicious. Why stop draining liquidity now unless something’s breaking beneath the surface? Investors interpreted the Fed’s pivot as confirmation of hidden stress rather than relief.

Long-term interest rates remain elevated despite the policy shift. Financial conditions stay tight. That combination killed any hope for a near-term recovery in risk assets.

Jobs Data Made Everything Worse

US labor market data this week deepened the confusion. Job openings continued falling. Hiring slowed significantly. Layoffs ticked higher. Consumer confidence crashed to its lowest level since 2014.

Yet unemployment remains relatively low. Inflation hasn’t cooled enough to justify aggressive rate cuts. That left markets stuck between two bad scenarios.

Either growth slows enough to force Fed action, which means recession risk. Or conditions stay tight, which means more pain for leveraged positions. Neither outcome supports higher asset prices in the short term.

Unemployment claims jumped by 22,000 to 231,000 in late January, exceeding forecasts. That’s not catastrophic yet. But it’s trending the wrong direction while the Fed maintains restrictive policy.

Why Gold and Silver Fell with Crypto

Gold and silver dropping alongside crypto puzzles traditional investors. These metals usually rally during uncertainty and market stress.

But they fell because investors needed immediate liquidity. Both precious metals had rallied strongly earlier this year. That made them easy targets for raising cash quickly.

Real yields stayed elevated throughout the sell-off. The dollar strengthened at the same time. That combination removed short-term tailwinds for precious metals despite rising uncertainty about economic conditions.

Crypto suffered worse damage because it sits at the bottom of the liquidity hierarchy. When leverage unwinds system-wide, crypto gets sold first and hardest.

Bitcoin derivatives data showed long positioning had built up significantly in recent weeks. As prices dropped, cascading liquidations accelerated the decline. Meanwhile, ETF inflows slowed dramatically, removing a key demand source.

Forced Deleveraging Across Markets

The synchronized crash reveals what happens when markets price in easier conditions too early. Traders bet on Fed rate cuts and expanding liquidity. Instead, they got tight financial conditions and slowing growth.

Leverage had built up across multiple asset classes during the earlier rally. When the first cracks appeared, forced selling created a feedback loop. Lower prices triggered margin calls. Margin calls forced more selling. More selling pushed prices lower.

This process reset positioning across crypto, equities, and commodities simultaneously. The market structure essentially broke down for a period as everyone rushed for the exits at once.

Bitcoin dropped $56,700 in 120 days with no single major event explaining the decline. That’s $14,000 per month for four straight months. The steady bleeding points to systematic deleveraging rather than news-driven panic.

Markets Mispriced Liquidity Expectations

The core issue wasn’t crypto-specific weakness or loss of confidence in Bitcoin. It was a fundamental mispricing of how quickly liquidity would expand.

Fed actions support financial stability without directly injecting liquidity into markets. That distinction matters enormously. Bank reserves stabilize. But asset prices don’t automatically rise.

Markets expected the Fed’s pivot to fuel another rally. Instead, it revealed underlying fragility in the financial system that required immediate intervention just to prevent worse outcomes.

The gap between expectations and reality forced a violent repricing. Bitcoin bore the brunt because crypto remains the most speculative, leveraged segment of financial markets.

What Happens Next

This sell-off doesn’t invalidate Bitcoin’s long-term value proposition. It doesn’t mean gold and silver lost their safe-haven status. It reflects a painful but necessary reset after positioning got too aggressive.

Short-term liquidity stress phases typically precede either policy clarity or decisive economic data. Right now, we have neither. That keeps volatility elevated and recovery uncertain.

Markets remain fragile until liquidity expectations stabilize or economic data weakens enough to force Fed rate cuts. Until then, expect continued choppiness across all risk assets.

The Fed painted itself into a corner. Tight policy threatens growth. But premature easing risks reigniting inflation. That uncertainty keeps markets on edge and vulnerable to sudden moves.

Bitcoin may offer long-term upside versus gold, as some analysts suggest. But that thesis requires patient capital, not leveraged speculation. For now, survival beats optimization.