CryptoQuant’s CEO just declared meme coins dead. Market data backs up his claim. But some traders see opportunity where others see collapse.

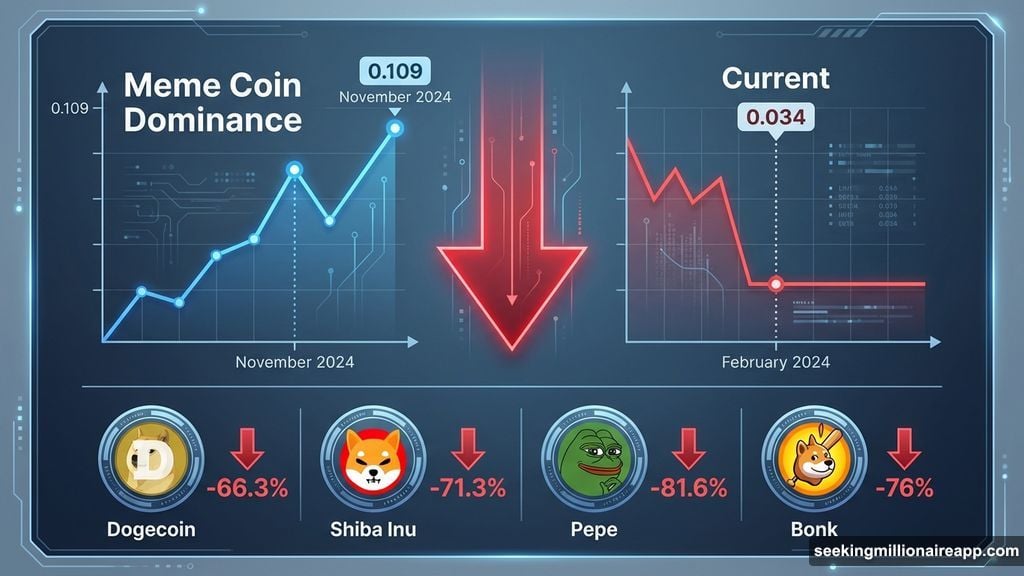

The numbers paint a brutal picture. Meme coin dominance in altcoin markets dropped to its lowest point since February 2024. Meanwhile, major tokens like Dogecoin and Shiba Inu bled out 65-70% of their value over the past year. So the question isn’t whether meme coins crashed. It’s whether they’ll ever recover.

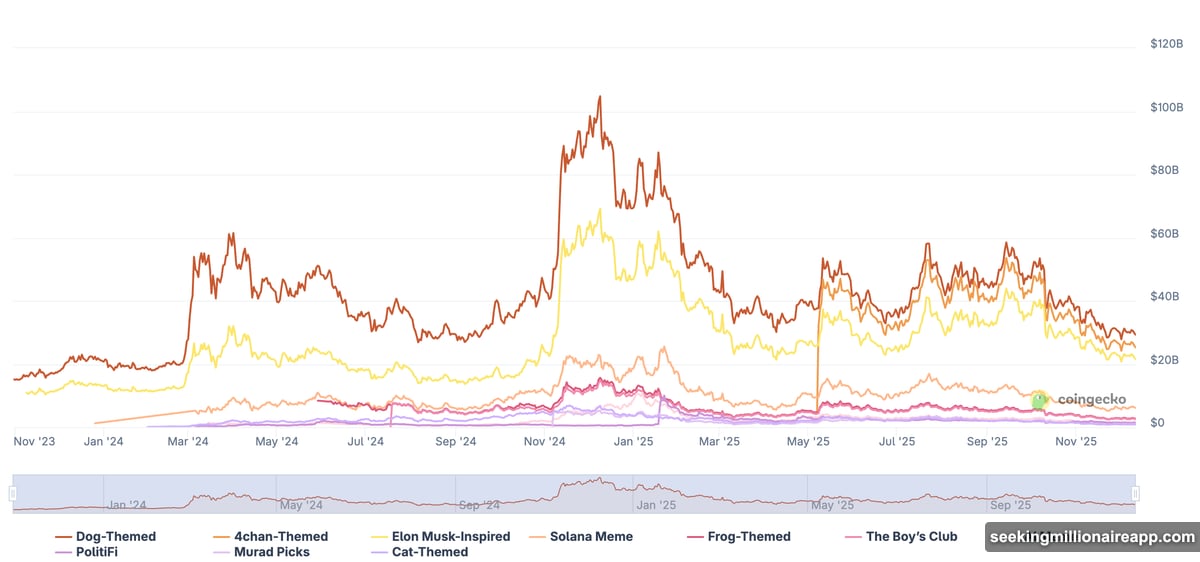

Dominance Hits Multi-Month Lows

CryptoQuant data shows meme coin dominance peaked at 0.109 in November 2024. Now it sits at 0.034. That matches the lowest levels from early 2024.

Ki Young Ju, CryptoQuant’s CEO, put it bluntly on X: “Memecoin markets are dead.” His statement sparked immediate debate across crypto communities. Some agreed. Others argued he’s calling the bottom too early.

CoinGecko data reinforces the decline. Market capitalization across meme coin categories surged into late 2024, then entered sustained decline. Plus, the yearly performance numbers are equally grim.

Dogecoin dropped 66.3%. Shiba Inu fell 71.3%. Pepe crashed 81.6%, while Bonk shed 76%. Overall, the entire meme coin market declined 65.9%, according to Artemis data.

Solana’s Meme Sector Hit Hardest

Solana-based meme coins suffered the worst damage. Joao Wedson, CEO of Alphractal, observed that meme coins and altcoins in the Solana ecosystem reached their worst phase. For many, they’re simply dead.

However, he noted payment-focused altcoins remain resilient. That reveals a clear divide between utility tokens and pure speculation plays.

Notably, the collapse wasn’t limited to obscure tokens. Even established meme coins with large communities lost significant value. So the issue goes beyond individual project failures.

Why Trust Evaporated

Several factors killed meme coin markets. First, ultra-cheap token launches destroyed trust. Platforms like Pump.fun let anyone create tokens for under $1, with zero protection against rug pulls.

Research by Solidus Labs found that 98.7% of tokens launched on Pump.fun showed signs of pump-and-dump schemes. Moreover, approximately 93% of liquidity pools on Raydium displayed indicators of soft rug pulls. That’s roughly 361,000 pools.

One trader, DeFiApe, explained the problem clearly: “Nobody has faith, everyone just extracts.” The constant rug pulls eroded community and long-term holding behavior. Instead, participants focused purely on short-term extraction.

Second, the market became oversaturated. Analyst Mikko Ohtamaa pointed out that the world doesn’t have attention for 25 million meme coins. Plus, even winners often lost investors money.

“You don’t buy memecoins because you invest in them,” Ohtamaa wrote. “You buy memecoins because you think it will pump, and you hope to sell at the top.” That mentality created a toxic cycle of speculation without substance.

Third, liquidity problems intensified. Trader Wazz noted that meme coins used to offer great liquidity providing opportunities. Now they’re massive liquidity sinks with eight-figure pools and zero volume.

The Case for Recovery

Despite overwhelming negativity, some analysts see opportunity. They argue the dominance decline signals a potential bottom. When everyone declares an asset class dead, contrarians often profit.

Gordon, a prominent crypto commentator, defended meme coins aggressively. He called critics “incredibly short sighted and low IQ.” His reasoning? Meme coins drove crypto attention and volume throughout the recent cycle.

“The only reason there’s any attention on crypto is meme coins,” Gordon claimed. “Meme coins aren’t going anywhere and they will lead the next bull run.” He predicts a resurgence once market conditions improve.

Some traders agreed. User Mel00nee suggested it’s “time to buy the cockroaches and HODL.” That perspective reflects classic contrarian thinking. Buy when blood runs in the streets.

Furthermore, historical patterns support cautious optimism. Meme coins crashed before in 2021 and 2022. Yet they recovered during the next market cycle. So precedent exists for rebounds from extreme lows.

What Decides the Future

Three factors will determine whether meme coins recover or fade permanently.

First, broader market conditions matter. If Bitcoin and Ethereum enter sustained bull runs, speculative capital typically flows back into meme tokens. But if crypto markets remain weak, meme coins will struggle.

Second, regulatory clarity plays a role. Increased oversight could eliminate scam projects and restore trust. Alternatively, harsh regulations might kill the sector entirely.

Third, legitimate projects need to differentiate themselves. Meme coins that build real communities and utility might survive. Those that exist purely for speculation will likely disappear.

Platform improvements could help too. If launch platforms implement better protections against rug pulls, trust might gradually return. But that requires industry-wide changes, not isolated fixes.

The Verdict Isn’t Final

Meme coin markets stand at a crossroads. Dominance metrics hit multi-month lows. Major tokens lost 65-80% of their value. Scams proliferated. Trust evaporated.

Yet some see these conditions as capitulation signals. They argue that when everyone declares an asset dead, bottoms form. Historical cycles suggest they might be right.

For now, meme coins remain deeply unpopular. Most traders abandoned the sector entirely. But markets rarely stay dead forever. Whether recovery happens in months or years depends on factors beyond anyone’s control.

The skeptics might be correct that meme coins are finished. Or the contrarians might profit enormously from buying at the bottom. Only time will tell which group made the right call.