Meme coins just posted their best week since October. Market cap jumped 9.4% to $48.3 billion. Plus, several tokens started climbing before Bitcoin even hit $90,000.

Is this just another fake-out? Or are we looking at the start of meme coin season 2.0?

Three concrete signals suggest something bigger is brewing. Let’s break down what the data actually shows.

Meme Coins Outperformed Everything This Week

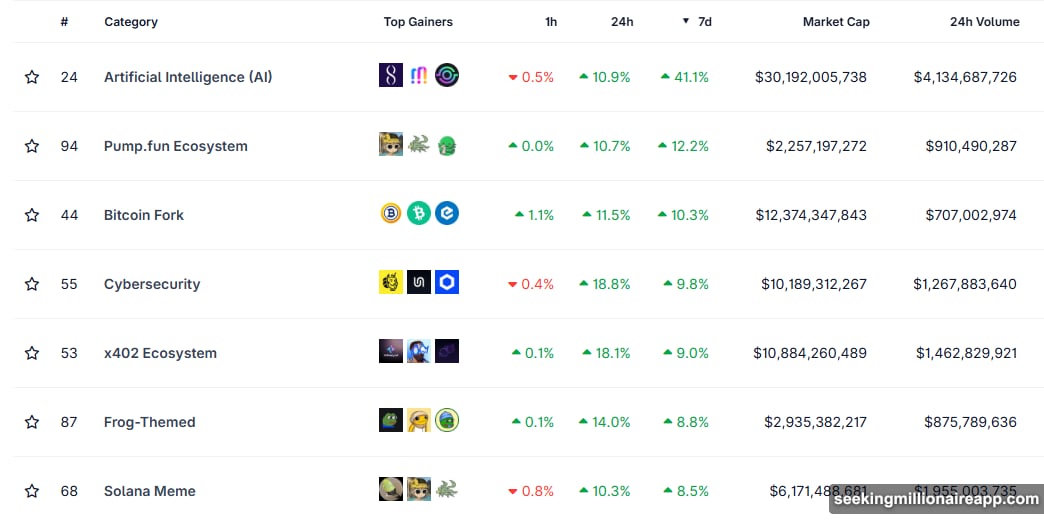

First, the performance numbers tell a clear story. While Bitcoin recovered and altcoins bounced, meme coins delivered stronger gains.

CoinGecko data reveals that Solana memes, Pump.fun ecosystem tokens, and frog-themed coins ranked among the seven best-performing crypto categories over the past seven days. The Pump.fun ecosystem group alone gained over 12%.

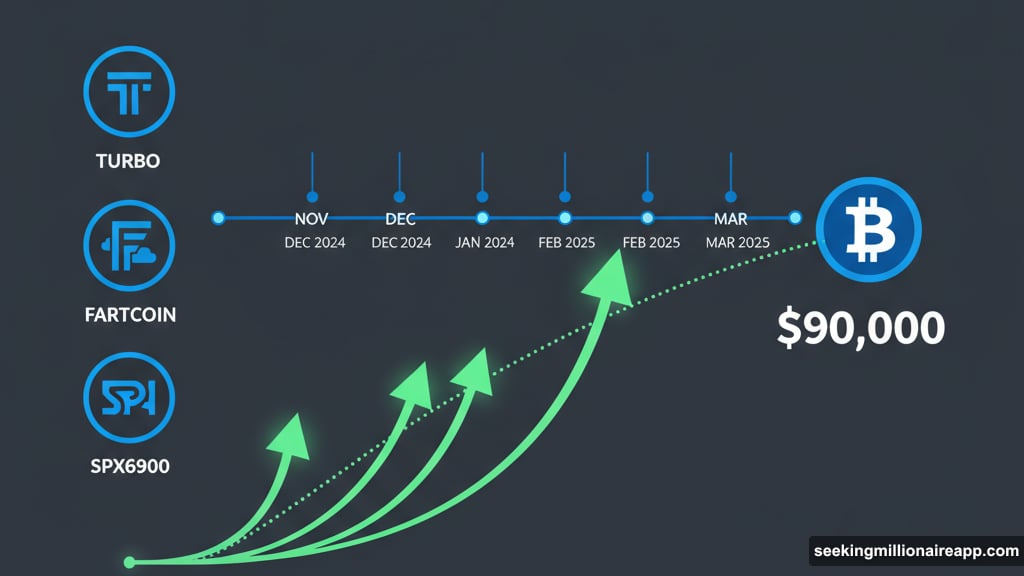

But here’s what makes this interesting. Some meme coins started rising before the broader market recovered. TURBO, FARTCOIN, PIPPIN, and SPX6900 all began climbing in late November—days before altcoins showed life.

Why does early movement matter? Meme coins typically have shallow liquidity compared to major altcoins. So when smart money positions early, price swings get amplified fast. That early positioning often predicts larger market moves.

Today’s top gainers list included TURBO, BRETT, PENGU, and USELESS. Meanwhile, Solana remains the primary battleground for meme coin action. Trading activity dropped sharply in recent weeks. However, as analyst Stalkchain noted, “Memes aren’t dead, but they’re taking a breather.”

Translation? The infrastructure still exists. Volume can explode again with minimal catalyst.

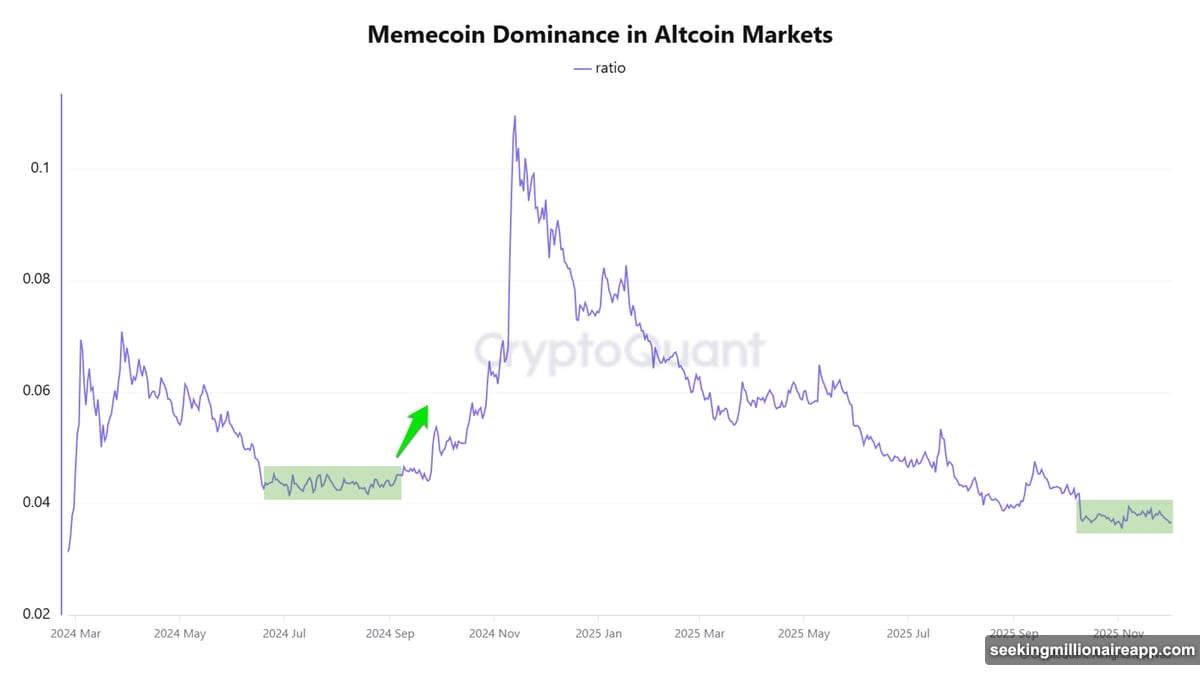

Dominance Charts Show Capitulation May Be Over

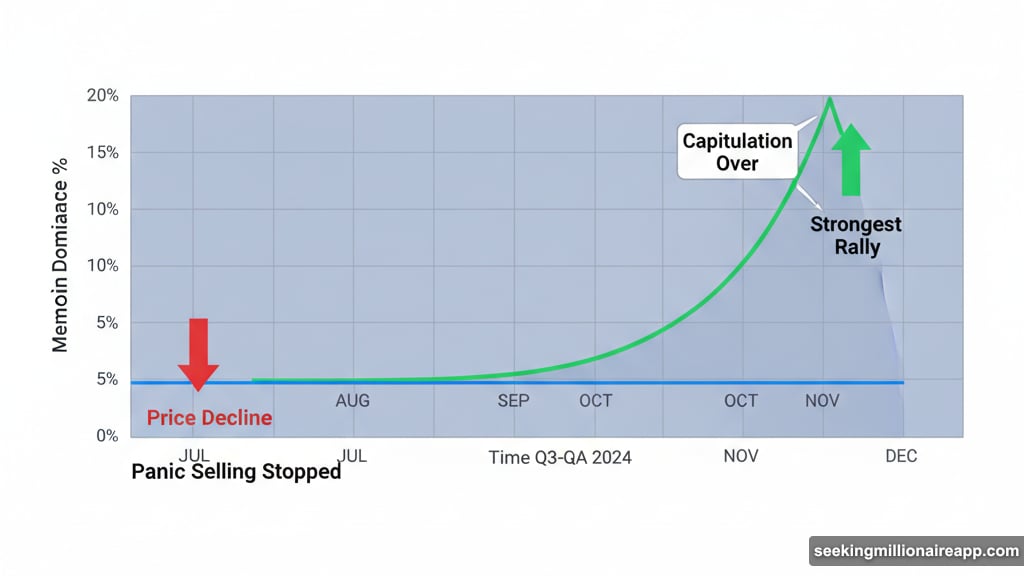

Next, look at meme coin dominance—the percentage of total altcoin market cap held by meme tokens. CryptoQuant data shows dominance has traded sideways for nearly two months.

Flat dominance during a price decline signals something important. It means panic selling has stopped, even if prices haven’t bottomed yet. Sellers exhausted themselves. Buyers haven’t shown up in force. But the bleeding slowed.

This pattern appeared before. In Q3 2024, meme coin dominance went sideways for three months. Then meme coins entered their strongest rally in market history. Not saying history repeats exactly. But similar setups often produce similar outcomes.

Moreover, sideways dominance during Bitcoin strength is bullish. It suggests meme coin holders aren’t rotating into safer assets despite volatility. They’re holding positions and waiting for the next leg up.

Technical Indicators Flash Bullish Divergence

Third, the daily RSI for total meme coin market cap shows a classic bullish divergence pattern. Market cap printed a lower low. But RSI printed a higher low.

What does that mean in plain English? Selling pressure is weakening. Each drop produces less downside momentum than the previous one. That’s how bottoms form in real time.

Plus, RSI bounced from the oversold zone near 30. When RSI climbs from oversold levels while showing divergence, reversals tend to follow. Not guaranteed, obviously. But the setup carries strong statistical odds.

Technical analysis works better when multiple timeframes align. Right now, the daily chart shows divergence. The weekly chart shows potential base-building. And price action shows early strength while the broader market still struggles.

All three elements point the same direction.

The Solana Factor Still Matters Most

Solana continues to dominate meme coin trading. Most new tokens launch on Pump.fun. Most volume happens on Raydium. Most attention focuses on Solana-based projects.

That concentration creates both opportunity and risk. When Solana memes run, they run hard. When they crash, they take everything with them. So Solana network health directly impacts meme coin season prospects.

Recent data shows Solana DEX volume stabilizing after sharp declines. Not growing yet. But stable volume during market weakness suggests a base is forming. If Solana network activity picks up, meme coins will amplify those gains.

However, one concern remains. Retail interest in meme coins hasn’t fully returned. Social media mentions and search volume stay below September peaks. That could mean this rally lacks the fuel for sustained moves.

Or it could mean we’re early. Before the crowd arrives. Before the next wave of retail FOMO kicks in.

What This Means for Your Portfolio

Meme coins remain extremely risky. They rise fast but crash faster. Adding exposure requires strict position sizing and clear exit plans.

That said, ignoring the signals isn’t smart either. The data shows weakening downside momentum, stabilizing dominance, and early outperformance. Those conditions often precede larger moves.

So what’s the smart play? Consider small positions in established meme coins with proven communities. TURBO, BRETT, and other survivors from the last rally already demonstrated staying power. They’re more likely to lead if another leg up materializes.

Avoid chasing new launches unless you understand the risks. Most new tokens die quickly. The few survivors deliver massive gains. But picking winners before the fact is nearly impossible.

Finally, watch Solana network metrics closely. If DEX volume surges and new wallet creation accelerates, meme coins will likely follow. If Solana stays flat, meme coin strength probably remains temporary.

The December Wildcard

December brings unique market dynamics. Thin liquidity from holidays. Year-end tax selling. Plus potential year-end bonuses flowing into crypto.

These factors create volatility in both directions. Sharp moves become more common. That environment suits meme coins perfectly—they thrive in chaos.

But don’t confuse a December pump with sustainable trend change. Real meme coin seasons last months, not weeks. They require sustained retail interest, fresh capital inflows, and constant new narratives.

We’re seeing early signs. Not confirmation yet. The difference matters.

So yes, meme coins could get wild in December. The setup exists. The signals are flashing. The infrastructure remains intact.

But wild doesn’t mean sustainable. Position accordingly.