The meme coin party looks like it’s winding down. What started as a roaring phenomenon has dropped to a whisper—at least according to the data.

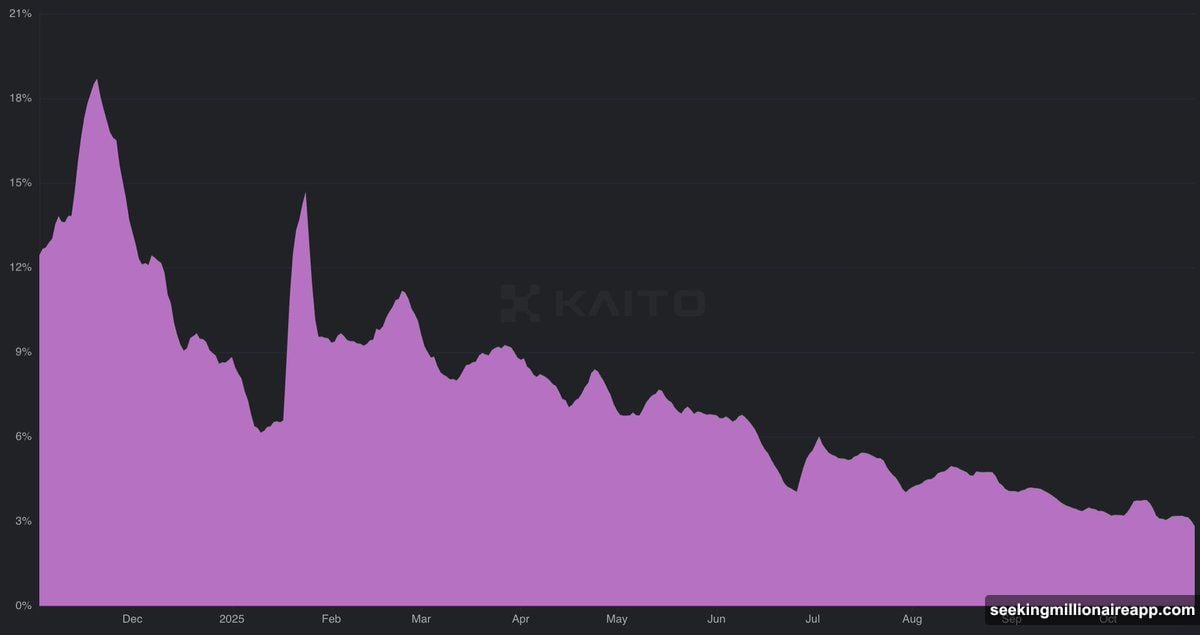

Meme coin mindshare collapsed from 20% in late 2024 to just 2.5% by October 2025. That’s nearly a 90% drop in attention. Plus, trading volumes, new token launches, and even Google searches all paint the same picture: fewer people care about dog-themed coins than they did a year ago.

But here’s where it gets interesting. Some analysts call this a “generational bottom”—the lowest point before a massive comeback. Others think meme coins peaked for good. So who’s right?

The Numbers Tell a Sobering Story

Let’s start with what actually happened. Data from KAITO shows meme coin mindshare fell off a cliff. In late 2024, roughly one in five crypto conversations involved meme coins. By October 2025, that dropped to one in forty.

Google Trends backs this up. Search interest for “meme coins” hit a perfect score of 100 at the start of 2025. By October, it crashed to just 7. That’s not a correction. That’s people moving on.

Blockchain activity mirrors the trend. Early 2025 saw meme coins dominate Solana’s decentralized exchange volume—about 60% of all trades, according to Galaxy Research. By October, that figure halved to roughly 30%.

Meanwhile, price action during the recent bull run told its own story. Bitcoin and Ethereum smashed through to new all-time highs. But Dogecoin and Shiba Inu? They couldn’t even revisit their previous peaks.

New Launches Slowed to a Crawl

Token creation used to be frantic. More than 13 million meme coins launched over the past year. Yet September saw 56% fewer launches compared to January.

And most new tokens died quietly. In early October, tokens launched via Pump.fun collectively held a fully diluted market cap of $4.8 billion. But just 12 of those tokens—less than 0.0001% of all launches—accounted for 55% of that value.

Translation: most meme coin projects fail spectacularly. Only a tiny handful gain any real traction. The rest vanish into irrelevance within days or weeks.

AI and DeFi Stole the Spotlight

So where did all that attention go? AI agent tokens and decentralized finance platforms absorbed most of the energy.

According to a16z’s latest report, sound policy and bipartisan legislation cleared the way for more productive blockchain use cases. Suddenly, building actual utility looked more attractive than launching the next PEPE clone.

Tokens within the x402 ecosystem posted triple-digit gains. Perpetual DEXs exploded in popularity this year. These aren’t memes—they’re projects with functions, revenue models, and developer activity.

Plus, investors learned some expensive lessons. Meme coins delivered massive gains for early entrants. But latecomers often watched their positions evaporate. After enough people got burned, enthusiasm cooled.

Community Can’t Agree on What Happens Next

Ask ten crypto traders about meme coins’ future, and you’ll get ten different answers.

One analyst insists meme coins will “NEVER die.” Another called the current downturn a “generational bottom”—suggesting interest fell so low that the only direction left is up. A third reminded investors that “memes are like this. The risks are high. The rewards are higher (at times).”

But skeptics aren’t buying the comeback narrative. They argue the sharp decline reflects fundamental exhaustion. The meme coin era peaked, played out, and now investors want something different.

History offers mixed signals. Previous crypto cycles saw similar patterns. Assets that seemed finished suddenly roared back months or years later. But some trends really do end for good. Distinguishing between a pause and a permanent shift is nearly impossible in real time.

What This Means for Investors

Meme coins remain deeply speculative. They always were. But now the speculative premium seems smaller.

If you’re holding DOGE or SHIB long-term, the data doesn’t look encouraging. These tokens haven’t reclaimed previous highs despite favorable market conditions. Plus, mindshare continues declining month after month.

On the other hand, contrarians see opportunity. When interest drops this dramatically, assets sometimes become oversold. A single catalyst—a celebrity tweet, a viral moment, renewed retail interest—could spark another run.

But betting on that catalyst requires high risk tolerance. Most new meme coins fail. Most established ones underperform Bitcoin and Ethereum. The exceptions make headlines. The failures fade quietly.

The Bigger Picture

Meme coins captured something unique in crypto culture. They weren’t about technology or utility. They were about community, humor, and shared speculation. At their peak, they represented pure crypto chaos—no pretense, no business model, just vibes and volatility.

Now, that energy seems depleted. Crypto markets matured slightly. Regulations clarified. Investors got more sophisticated. Meme coins still exist, but they’ve lost cultural dominance.

Whether this marks the end or just another cycle remains unclear. But one thing’s certain: the meme coin era of 2024 isn’t coming back unchanged. The market moved on. Only time will tell if meme coins can reinvent themselves or fade into digital history.