MicroStrategy’s latest move sounds reassuring on paper. But look closer and it tells a different story entirely.

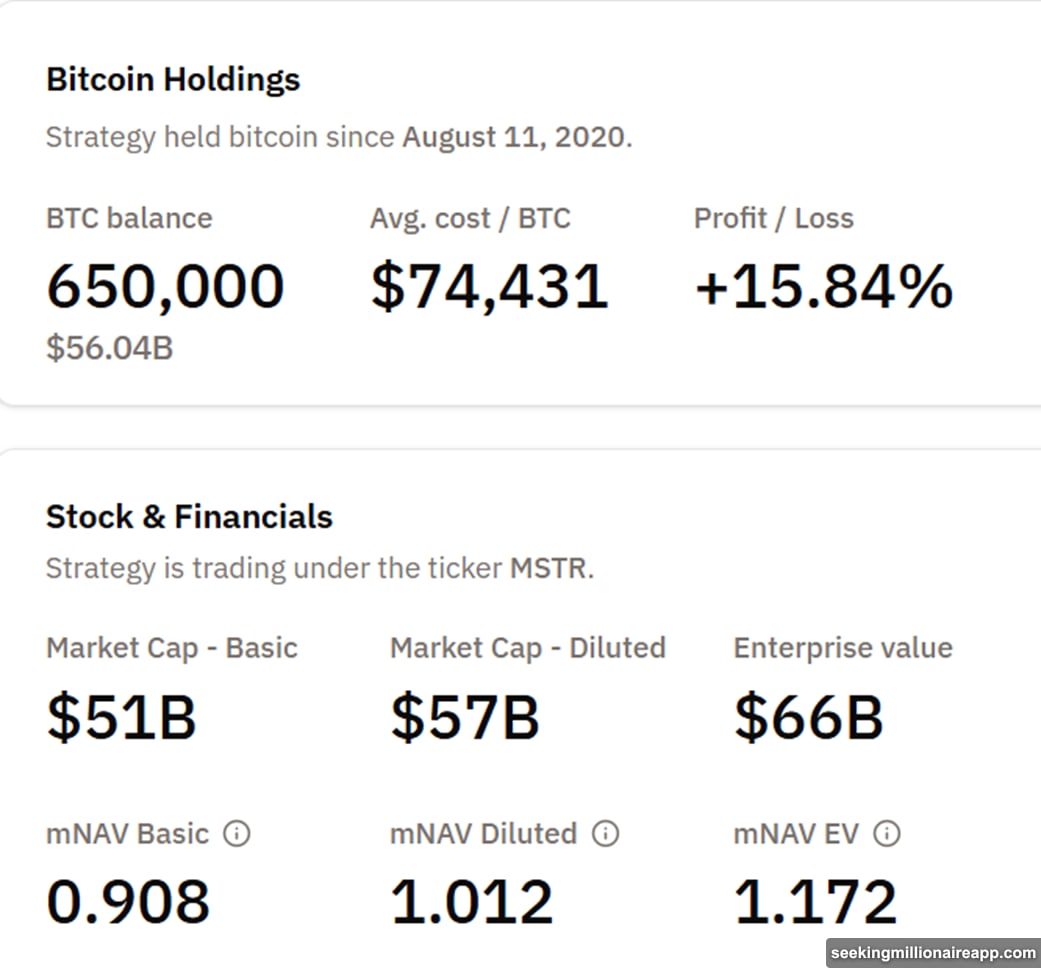

The company just announced a $1.44 billion USD reserve meant to cover dividends and interest for 21 months. CEO Michael Saylor framed it as the “next step in evolution.” Meanwhile, MicroStrategy added 130 BTC to its treasury, pushing total holdings to 650,000 Bitcoin.

So why are traders nervous instead of celebrating?

The “Green Dot” That Became a Red Flag

Markets spent days obsessing over Saylor’s cryptic “green dot” comments. Speculation ran wild about what it meant—another Bitcoin purchase, an MSTR buyback, or something else entirely.

Turns out, it was a cash reserve. That might seem boring compared to Bitcoin accumulation. But the timing reveals mounting pressure beneath MicroStrategy’s diamond-handed exterior.

Plus, this announcement came right after the company admitted something once considered unthinkable. For the first time, MicroStrategy’s CEO confirmed specific conditions under which the firm would sell Bitcoin.

That admission changed everything.

The Sell Trigger Nobody Wanted to Hear

CEO Phong Le outlined two conditions that would force MicroStrategy to liquidate Bitcoin:

First, MSTR stock trades below 1.0x mNAV. That means the company’s market value drops below the Bitcoin it owns. Right now, mNAV sits comfortably above 1x, pulling away from the dangerous 0.9x threshold.

Second, the firm can’t raise capital through equity or debt. If capital markets freeze up while MSTR trades underwater, Bitcoin sales become the only option to fund dividend obligations.

Le called this the “kill switch.” Indeed, that’s exactly what it is—a measurable tripwire where Saylor’s “never sell” doctrine collapses.

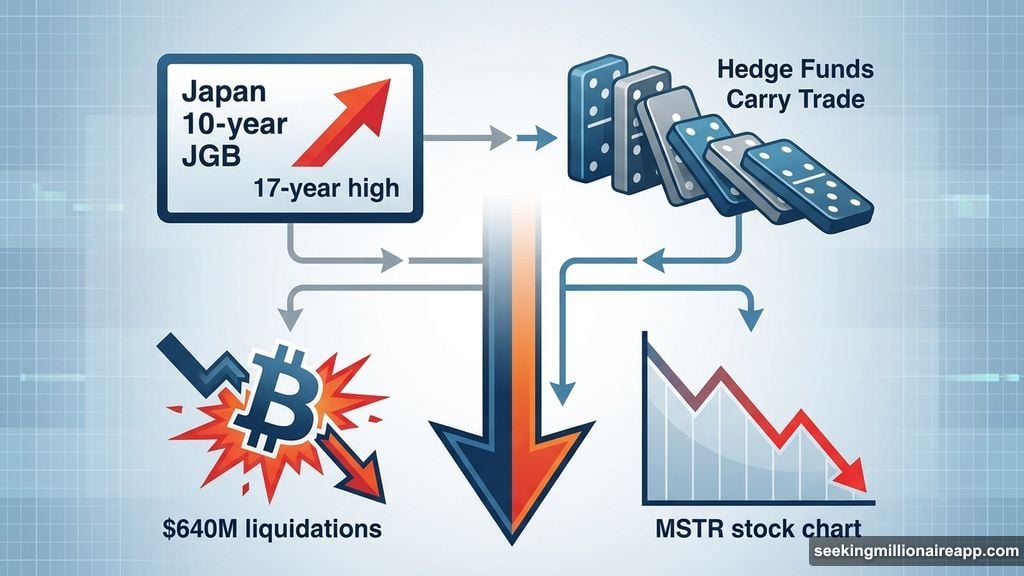

Global Liquidity Is Tightening Fast

Markets already feel fragile. Japan’s 10-year JGB yields hit 17-year highs, triggering $640 million in crypto liquidations. That bond shock sent shockwaves through leveraged positions worldwide.

Moreover, hedge funds face mounting stress from unwinding carry trades. Jim Cramer recently warned that declines in MSTR and Bitcoin now look like anticipation of hedge fund blowups tied to the Japan carry trade.

“Strategy and Bitcoin at this level are almost the same thing,” Cramer wrote. That line captures the structural reality: MicroStrategy functions as a leveraged Bitcoin ETF with a software business attached.

So when liquidity dries up, MicroStrategy compresses violently. The firm insists it faces no forced liquidation risk. But the existence of a sell trigger proves otherwise.

A Cash Reserve Isn’t as Safe as It Sounds

The $1.44 billion reserve covers 21 months of dividends at current rates. That sounds like plenty of breathing room. But consider what happens if Bitcoin crashes while capital markets tighten simultaneously.

MicroStrategy can’t refinance debt or issue new stock if no buyers exist. That leaves the Bitcoin treasury as the only source of liquidity. And if mNAV drops below 0.9x, selling Bitcoin to pay dividends becomes the least-bad option.

Furthermore, the company’s strategy works spectacularly when Bitcoin rallies. But it compresses brutally when markets reverse. The cash wall might delay the decision, but it doesn’t eliminate the trigger condition.

Bitcoin’s next move won’t just shape market sentiment. It may decide whether MicroStrategy remains the face of corporate accumulation or becomes the first high-profile test of strategy limits.

Bitcoin Holdings Keep Growing Anyway

Despite the tension, MicroStrategy added 130 BTC at roughly $89,960 per coin. Total holdings now reach 650,000 BTC—about 3.1% of all Bitcoin that will ever exist.

That aggressive accumulation continues even as risk warnings multiply. The firm acquired those 650,000 coins for $48.38 billion at an average price of $74,436 per Bitcoin.

So the company sits on substantial unrealized gains if current prices hold. But that cushion disappears fast if Bitcoin drops toward the mid-$60,000 range while stock valuations compress simultaneously.

Markets already price in Bitcoin volatility. Now they’re also pricing in MicroStrategy’s structural fragility as a leveraged Bitcoin vehicle.

What Changed This Week

MicroStrategy’s announcement marks a turning point. The firm once represented pure conviction—holding Bitcoin no matter what happened. That narrative attracted billions in investment.

But the admission of a sell condition, combined with a $1.44 billion defensive cash position, signals something shifted. The strategy evolved from “never sell” to “never sell unless forced to by capital markets and valuation metrics.”

That’s a meaningful difference. Markets now have a measurable tripwire: 0.9x mNAV under stress conditions. Traders will watch that metric obsessively going forward.

Meanwhile, crypto equities opened sharply lower. MSTR dropped 5.12% in pre-market trading. Coinbase fell 4.50%. MARA Holdings declined 6.35%. The broader crypto equity space mirrored Bitcoin’s weakness.

The Bigger Picture Nobody Wants to Discuss

MicroStrategy’s position represents the extreme end of corporate Bitcoin adoption. The firm leveraged its balance sheet aggressively to accumulate coins. That worked brilliantly during Bitcoin’s rally from $20,000 to nearly $100,000.

But leverage cuts both ways. The same structure that amplified gains on the way up will amplify losses on the way down. And the existence of a sell trigger confirms that MicroStrategy’s strategy has limits.

For Bitcoin bulls, the concern isn’t just one company. It’s what happens if other corporate treasuries face similar pressure. If MicroStrategy becomes forced to sell under stress, it validates bears’ warnings about structural fragility in leveraged Bitcoin positions.

That doesn’t mean Bitcoin crashes tomorrow. But it means the risk profile just changed. The market now knows that even the most committed corporate holder has conditions under which they’d liquidate.

Markets Are Watching One Number Now

The key metric going forward: mNAV relative to 1.0x. As long as that stays comfortably above parity, MicroStrategy avoids its sell trigger. But if Bitcoin weakens while MSTR stock compresses, that cushion evaporates quickly.

Traders will also watch capital markets closely. Can MicroStrategy continue raising equity or debt to fund operations and Bitcoin purchases? If those markets freeze during a downturn, the pressure intensifies dramatically.

So far, the company maintains it faces no immediate risk. The $1.44 billion reserve provides runway. Bitcoin holdings carry substantial unrealized gains at current prices. And mNAV sits safely above danger levels.

But “so far” is doing a lot of work in that sentence. Bitcoin’s next move determines whether MicroStrategy’s cash wall holds or becomes the first line of defense before something breaks.

The market just got a lot more nervous about finding out which scenario plays out.