Two corporate giants just made moves that reveal where institutional crypto money is really flowing. MicroStrategy grabbed another $835 million in Bitcoin. Meanwhile, Tom Lee’s BitMine quietly became the world’s largest Ethereum holder.

These aren’t routine purchases. The scale and timing suggest something bigger is building beneath the surface.

MicroStrategy Buys $835M in Bitcoin Despite Market Doubts

MicroStrategy scooped up 8,178 BTC last week at an average price of $102,171 per coin. That brings their total stash to 649,870 BTC, worth roughly $48.37 billion at an average cost of $74,433.

Michael Saylor announced the purchase on X. He also confirmed Strategy’s Bitcoin yield hit 27.8% year-to-date. Plus, the company now controls 3.1% of the entire Bitcoin network.

But here’s where it gets interesting. The announcement sparked immediate controversy.

Lookonchain verified MicroStrategy sits on $12.88 billion in unrealized profit, a 27% gain. However, MSTR stock fell 3% in pre-market trading despite the bullish purchase. Some observers called the rollout “amateurish” after Strategy posted, then deleted the announcement within minutes.

The Strategy Debate Gets Heated

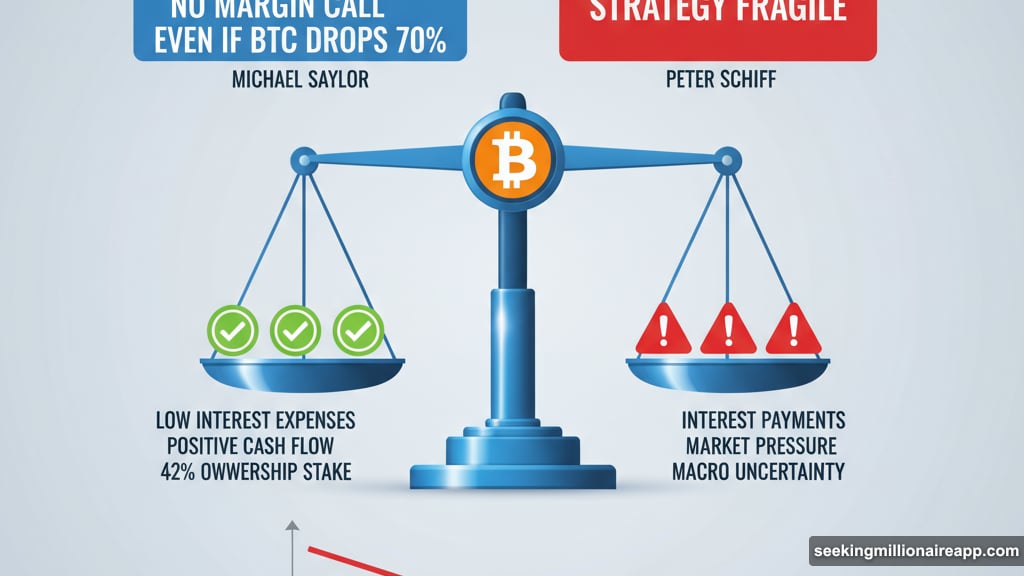

Market analysts remain split on whether MicroStrategy’s approach is brilliant or reckless.

Miles Deutscher argues the structure is solid. “Even if BTC drops 70%, Saylor won’t have to sell. There’s no margin call.” Jeff Dorman backed this view, noting low interest expenses, positive cash flow, and Saylor’s 42% ownership stake that blocks activist intervention.

On the flip side, critics like Peter Schiff call the strategy fragile. Dom Kwok went further, claiming “MSTR will be forced to sell its BTC to make interest payments. It’s sell bitcoin or bust.”

The truth likely sits somewhere in the middle. MicroStrategy’s structure provides breathing room. But massive Bitcoin drops would still create pressure, even without technical liquidation triggers.

BitMine Now Holds 2.9% of All Ethereum

While everyone watches MicroStrategy, Tom Lee’s BitMine executed an even larger move on Ethereum.

BitMine now controls 3,559,879 ETH tokens. That represents 2.9% of the total supply. The firm added 54,156 ETH in a single week, according to its November update.

At current prices, BitMine holds $11.8 billion in combined crypto assets. That includes their massive ETH position, 192 BTC, and $607 million in cash. StrategicETHReserve.xyz data confirms BitMine is the world’s leading Ethereum treasury holder and the second-largest crypto treasury overall behind MicroStrategy.

The stock market noticed. BitMine trades $1.4 billion daily, ranking 48th among US stocks. That puts it ahead of DoorDash in trading volume.

Tom Lee Says the Peak Is Years Away

In his November message, Lee broke from traditional crypto cycle thinking. He predicts the peak won’t arrive for another 12 to 36 months, not the standard four-year timeline.

Lee attributes recent weakness to a market maker suffering balance sheet stress. He calls it a temporary form of “quantitative tightening” for crypto. “The lingering weakness has the hallmarks of a market maker with a crippled balance sheet,” his announcement read.

Moreover, Lee views Ethereum tokenization as a “major unlock.” He compared current regulatory developments, like the GENIUS Act and SEC’s Project Crypto, to the 1971 end of Bretton Woods.

That’s a bold comparison. If accurate, it suggests structural changes that could dwarf previous bull runs.

Corporate Treasuries Are the New Battlefield

Together, these moves reveal a clear trend. Crypto is becoming a corporate treasury weapon.

MicroStrategy targets deeper Bitcoin control. BitMine pushes toward its “Alchemy of 5%” goal for Ethereum holdings. Both strategies bet on long-duration conviction over short-term trading.

This marks a shift from retail-driven cycles. Instead, balance sheets, liquidity channels, and institutional conviction now drive major price action.

The market may be entering its first true multi-chain corporate accumulation era. Retail traders aren’t leading anymore. Corporate treasuries are.

However, risks remain significant. Market maker stress, regulatory uncertainty, and sudden Bitcoin or Ethereum drops could force difficult decisions. Critics rightfully point out that leverage and debt obligations create vulnerabilities.

What Happens Next Matters

MicroStrategy and BitMine are making massive bets. So far, both strategies show unrealized profits. But markets can turn quickly.

Watch for three signals. First, whether MicroStrategy continues weekly purchases even if Bitcoin drops. Second, if BitMine maintains its ETH accumulation pace. Third, how traditional finance responds as crypto becomes a standard balance sheet asset.

These corporate players are reshaping crypto markets. Their success or failure will define institutional adoption for the next decade.

The mania Tom Lee predicts might already be building. It just looks different this time. Instead of retail FOMO, it’s corporate balance sheets going all-in.